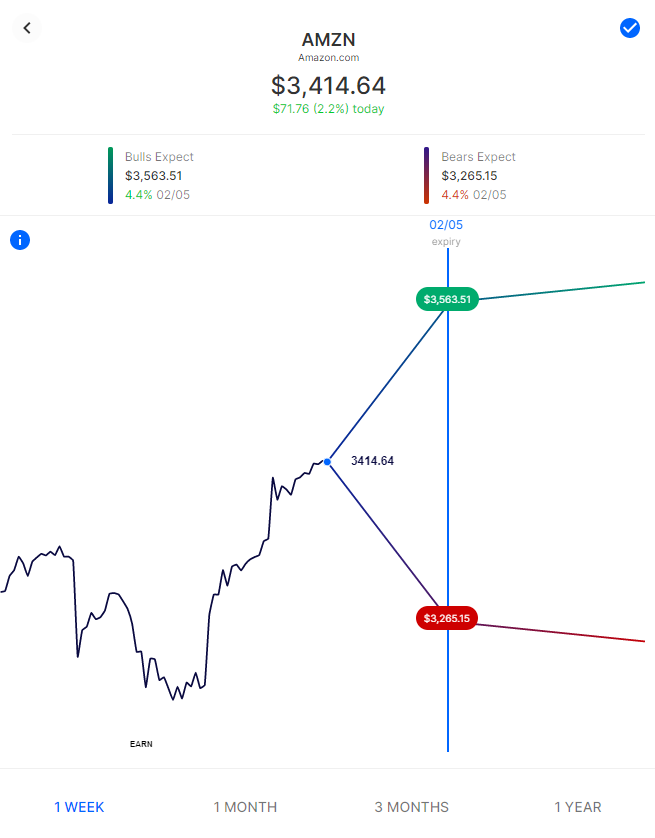

Earnings season continues today with Amazon and Alphabet reporting results after the close. Via Options AI, with Amazon (AMZN) trading about $3400, the options market is pricing an expected move into Friday of about 4.5%, corresponding to about $3550 on the upside and $3250 on the downside. With Alphabet (GOOGL) trading near $1925 Options are pricing about a 4% expected move for Alphabet (GOOGL) corresponding to about $2000 on the $1850 on the downside.

Whatever your trading view, with high-priced stocks like these, we can look at how option spreads might be used to reduce capital outlay and potentially improve probability of profits (versus buying an outright calls or puts). We’ll also see how the expected move itself can help guide strike selection through this process.

Please note, all trade strategies are for informational purposes only and pricing is approximate at the time of writing. They represent just a few of the many potential ways that options might be used to express a view.

Credit Spreads: ‘Selling to the Bulls’ and/or ‘Selling to the Bears’

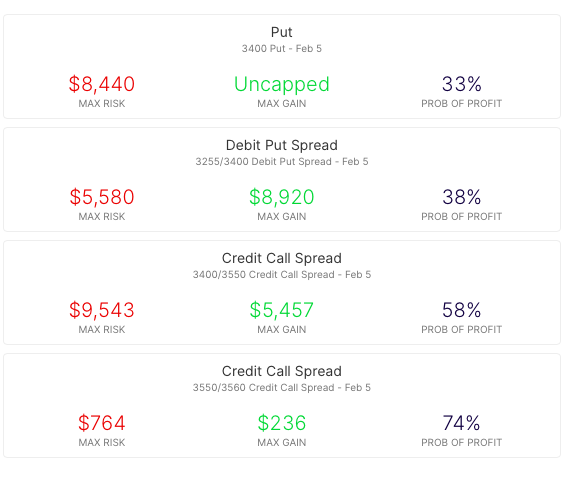

Let’s take AMZN as an example. With the stock price around $ 3,400 buying a single at-the-money Call can cost (or risk) approx. $ 8,000 in premium. Even a further out-the-money Call can involve high premium and therefore a high break-even (meaning lower probability of profit). So, we’ll look at how Credit Spreads, focused on the expected move, can offer a way to express any trading view while risking less capital (and offer a relatively high probability of profit). The important thing to remember with options, is that there are always trade-offs. When it comes to Credit Spreads, one key trade-off for risking less and having increased probability of profit, is a relatively poor risk to reward ratio.

With this in mind, let look at the expected move of AMZN on Options AI:

Seeing the expected move chart, we’re going to look at three Credit Spread strategies that might be used to express each of the following views:

1. Bull Credit Put Spread – taking a view that the stock will be above the bearish expected move at expiry

2. Bear Credit Call Spread – taking a view that the stock will be above the bearish expected move at expiry

3. Iron Condor (Credit Call + Credit Put Spread) – taking a view that the stock will stay between the bullish and bearish expected move at expiry

Rather than buying options and incurring a premium debit (cost), each of the above strategies instead ‘sells’ to either the bulls or bear (or in the case of the Iron Condor, to both), receiving a premium credit (income) upfront.

Let’s look at each in more detail:

Bullish – Credit Put Spreads

Firstly, lets look at how a $5 wide Credit Spread with its short strike out-the-money at the Bearish expected move level (in this example at 3250). The chart below shows how by ‘selling to the bears’ the premium collected from the trade is kept if the stock ends up at any level above the breakeven.

Here’s a closer look at the strikes involved:

Selling that put spread at a 1.25 credit risks about $375 to make up to $125 if the stock is above $3250 at expiry.

Bearish – Credit Call Spreads

Here is the same comparison, with a bearish price target to the expected move:

And focusing on the out-the-money credit call spread, as a bearish, or simply “not bullish” position, in this example 10 dollars wide:

Spreads to ‘Sell to both the Bulls and the Bears’

Finally, let’s consider the scenario where you believe that the options market is overpricing the move and believe that a stock like BABA will stay within the expected move on a given timeframe. Rather than “not bearish” or “not bullish” this is a trade that ‘sells the move’ to both the bulls and the bears – the Iron Condor:

Note the range created on the chart around the expected move. The Iron condor, which involves simultaneously selling an out-the-money Credit Call Spread, and a Credit Put Spread seeks to collect the premium (income) received if Amazon stays within the expected move.

Summary

Remember, the above are just examples of the many ways a trader might express a view using options. They are intended solely to demonstrate how the expected move can help provide actionable insight to consider before making any trade, particularly into an uncertain event and how it might be used for more informed strike selection. Learn / Options AI has a couple of free tools as well as education on expected moves and spread trading. The concepts shown in Amazon or Alphabet can apply to any stock and it are simply used here for illustrative purposes.