Hello!

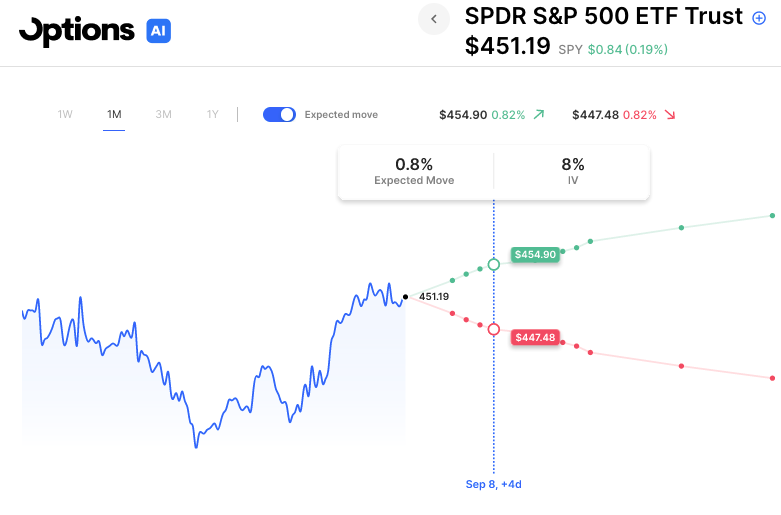

Option vol got slammed last week into the 3 day weekend. The VIX closed at 13, down from 18 on August 18th while the SPY rallied 4% during that time. Weekly SPY vol really got crushed into the long weekend with at-the-money options in SPY for this next week in single digits. That should pick on the open as market makers reset for the new week. 0DTE options in SPY which had been pricing in 0.6-.07% daily moves were back below 0.5%. Keep an eye on those if IV ticks up from 7 to 10 just after the long weekend.

Despite the uptick in realized vol in the market from the very low levels of the spring grind higher, the SPY has basically remained in about a 6% range since June. The past week’s rally put it near the top of that range.

The economic calendar perhaps has bigger news overseas this week than domestically, so those are included below. The earnings calendar is winding down over the next two weeks but this week sees reports from Zscaler and Docusign. Below are this week’s expected moves, they are smaller both because it’s a 4 day week but also as vol got crushed into the long weekend. Those may tick higher on the open:

- SPY Expected Move: 0.8%

- QQQ Expected Move: 1.3%

US Economic Calendar

- Tuesday: 10am – Factory orders

- Wednesday: 10am ISM Services PMI, 2pm – Fed Beige Book

International: Tuesday – ECB Lagarde speech, Wednesday – Euro GDP, Thursday – Japan GDP, Friday – China CPI

Earnings of Note with Expected Moves

Tuesday

- ZS ZScaler 8.2%

- GTLB GitLab Inc. 14.7%

- HQY HealthEquity, Inc. 7.2%

Wednesday

- AI C3 12.3%

- PATH UiPath Inc. 10.3%

- CNM Core & Main, Inc. 16.6%

- GME GameStop Corp. 12.4%

Thursday

- TTC The Toro Company 3.7%

- DOCU DocuSign, Inc. 9.1%

- GWRE Guidewire Software, Inc. 6.7%

- RH RH 6.9%

Friday

- KR Kroger 4.0%

Full lists here: Options AI Free Tools.

The Options AI Team

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.