Hello!

A couple of earnings of note after the close yesterday. Salesforce is higher by about 6.5% this morning, slightly more than the expected move. CrowdStrike is up slightly, well inside the expected move. Check out this video preview of CRWD that detailed a process for analyzing neutral earnings trades, selling the move, and give the new Orbit Youtube Channel a follow:

CrowdStrike Earnings – Condor and Flies

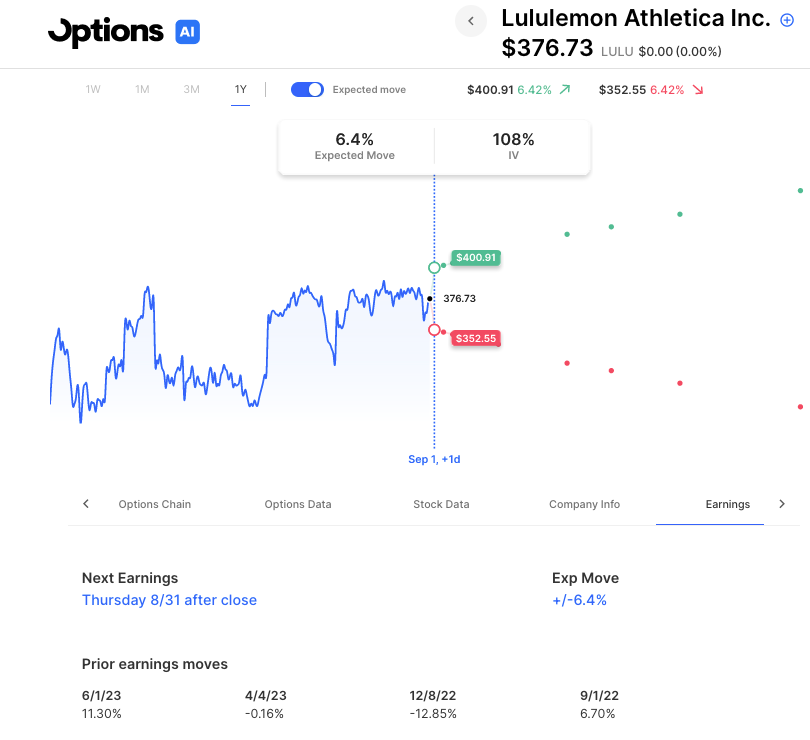

Dollar General reported this morning and is getting hammered, down 18%. Retailer volatility has been one of the themes of this earnings season. This afternoon we get another retailer in LuluLemon as well as Broadcom and MongoDB.

Here’s a look at LULU’s set-up. Options are pricing about a 6.5% move. That compares to the last 4 moves of +11%, 0%, -13% and +7%. So splitting the difference but more like a mean than a median as 3 of the last 4 moves have been larger than what’s expected this event:

Trending and Moving:

- Palantir Technologies Inc Cl A (PLTR) -2.94%

- Allarity Therapeutics Inc (ALLR) +29.56%

- Dollar General Corp (DG) -15.76%

- Shopify Inc (SHOP) +8.30%

- Chewy Inc (CHWY) -5.23%

- Vinfast Auto Ltd (VFS) +6.61%

- Salesforce Inc (CRM) +6.40%

Today’s Earnings:

- Broadcom Inc. (AVGO) Expected Move: 3.90%

- Lululemon Athletica Inc. (LULU) Expected Move: 6.39%

- Dell Technologies Inc. (DELL) Expected Move: 4.72%

- MongoDB, Inc. (MDB) Expected Move: 9.54%

- Nutanix, Inc. (NTNX) Expected Move: 8.96%

- SentinelOne, Inc. (S) Expected Move: 9.45%

Economic Calendar:

- At 09:00 AM (EST) Fed Collins Speech Impact: Medium

Trade Scanner:

- Overbought (RSI): HZNP (87), UBS (82), SGEN (82), PR (79), SPLK (78)

- Oversold (RSI): M (21), JWN (22), DLTR (23), FTCH (25)

- High IV: VMW (+186%), CHWY (+140%), ORCL (+128%), UBS (+124%)

- Unusual Options Volume: AMC (+1299%), PEP (+935%), CHWY (+845%), DG (+798%), CRWD (+661%), UBS (+564%), MCD (+541%)

Full lists here: Options AI Free Tools.

The Options AI Team

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.