The Broader Markets

Last Week – SPY was more or less unchanged on the week, up just 0.3%. Options had priced about a 1% move. SPY has remained range-bound between about $466 and just above $470 for the past 2 weeks. Since breaking out above $460 to start November it has been in a range of about $462 and $470.

This Week – SPY options are pricing about a 0.8% move (about $4 in either direction) for the upcoming (Holiday shortened 4 day) week. With the SPY about $469, that corresponds to just above $473 on the upside and around $465 on the downside.

Implied Volatility – The VIX ended Friday around 18, slightly higher on the week. That puts it just under its historical average.

Expected Moves for This Week (Via Options AI)

- SPY 0.8%

- QQQ 1.2%

- IWM 1.8%

- DIA 1.0%

In the News

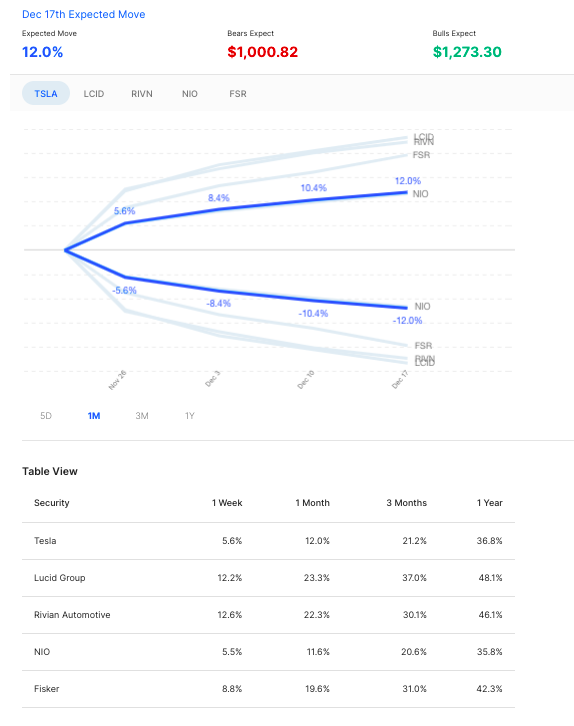

EV automotive stocks were once again in the news the past two weeks as Rivian went public, Lucid’s first car won Motortrend car of the year and Elon Musk sold Tesla stock. Here’s a comparison of expected moves in some of the more popular EV stocks. Options in Chinese carmaker NIO are pricing similar moves to Tesla but options in RIVN and LCID are pricing much larger moves. From Options AI expected move comparison with TSLA’s 12% expected move for Dec 17th expiry highlighted vs NIO, LCID, RIVN and FSR:

Expected Moves for Companies Reporting Earnings

Options AI puts the expected move at the heart of its trading experience. Traders are able to quickly generate credit and debit trades based on the Expected Move, or to their own targets in context of the Expected Move. More education on Expected Moves and options trading can be found at Learn / Options AI.

The expected moves link to the Options AI Calendar. Recent moves on prior earnings start with the prior quarter.

Monday

Zoom ZM / Expected Move: 9.5% / Recent moves: -17%, 0%, -9%

Tuesday

Dick’s DKS / Expected Move: 3.3% / Recent moves: +13%, +17%, -6%

Best Buy BBY / Expected Move: 5.7% / Recent moves: +8.3%, +1%, -9%

XPeng XPEV / Expected Move: 5% / Recent moves: -1%, -5%, -4%

Autodesk ADSK / Expected Move: 5.4% / Recent moves: -9%, 0%, -3%

Nordstrom JWN / Expected Move: 10.3% / Recent moves: -18%, -6%, -3%

Vmware VMW / Expected Move: 5.3% / Recent moves: -7%, -2%, -4%

Gap GPS / Expected Move: 9.8% / Recent moves: +1%, -5%, +8%

Wednesday

John Deere DE / Expected Move: 4% / Recent moves: -2%, +1%, +10%

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC a registered broker-dealer.