Hello!

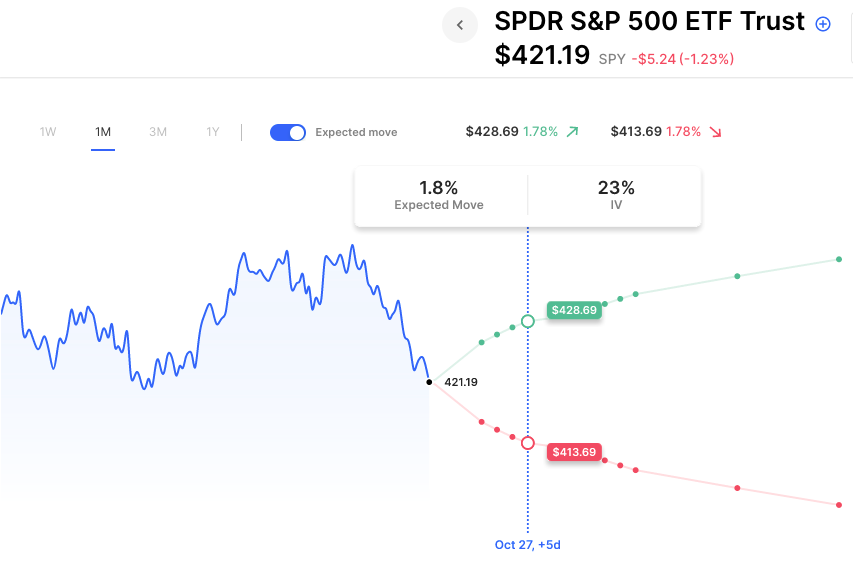

SPY was down 2.5% last week, more than the 1.8% move options were pricing. Despite the day-to-day volatility, it is only down about 1.6% on the month. Speaking of the day-to-day volatility, intraday volatility has been even more extreme, adding to the feeling of a wild market even though it hasn’t necessarily cracked or seen panic selling overall. However, certain sectors have seen steep declines recently, and the VIX is now near 22, its highest level since March. As was the case with September expiry, this week begins a new vol/gamma regime where some of the strikes that may have been acting as support or even magnets over the past week or so have expired. Keep an eye not only on the VIX this week but also the 0DTE expected moves. Currently, SPY 0DTe expected moves are approaching 1% and QQQ is now over 1% each day. Several days last week the markets moved that amount in both directions, multiple times in a day.

Expected Moves for the Week

- SPY1.8% (roughly $413-$429)

- QQQ2.3% (roughly $346-$363)

- IWM2.4% (roughly $162-$171)

- TLT 2.1% (roughly $81-$85)

- USO 3.5% (roughly $77-$84)

Economic Calendar

Tuesday

- 9:45am – SP Global PMI

Wednesday

- 10am – New Home Sales

Thursday

- 8:15am – ECB Monetary Policy Announcement

- 8:30am – GDP

Friday

- 8:30am – Core PCE

Earnings Calendar with Expected Moves

Tuesday

- MSFT Microsoft Corporation 4.2%

- GOOGL Alphabet Inc. 4.9%

- V Visa Inc. 3.5%

- KO The Coca-Cola Company 2.3%

- NVS Novartis AG 3.4%

- TXN Texas Instruments Incorporated 4.3%

- GE General Electric Company 5.3%

- RTX Raytheon Technologies Corporation 4.1%

- SNAP Snap 17.5%

Wednesday

- META Meta Platforms, Inc. 7.8%

- TMO Thermo Fisher Scientific Inc. 4 .5%

- TMUS T-Mobile US, Inc. 3.9%

- IBM International Business Machines Corporation 4.0%

- NOW ServiceNow, Inc. 6.0%

- BA The Boeing Company 4.9%

- KLAC KLA Corporation 4.9%

- PXD Pioneer Natural Resources Company 2.8%

- ORLY O’Reilly Automotive, Inc. 5.5%

Thursday

- AMZN Amazon.com, Inc. 6.2%

- MA Mastercard Incorporated 3.8%

- MRK Merck & Co., Inc. 3.3%

- UPS United Parcel Service, Inc. 4.8%

- HON Honeywell International Inc. 3.3%

- BMY Bristol-Myers Squibb Company 3.1%

- MO Altria Group, Inc. 2.0%

- NOC Northrop Grumman Corporation 3.0%

- BSX Boston Scientific Corporation 3.5%

- VALE Vale S.A. 4.0%

- CMG Chipotle Mexican Grill, Inc. 6.4%

- VLO Valero Energy Corporation 3.8%

- F Ford Motor Company 5.0%

Friday

- CVX Chevron Corporation 2.7%

- XOM Exxon Mobile 3.0%

- ABBV AbbVie Inc. 3.8%

Follow The Orbit on Twitter and Youtube

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC