Hello!

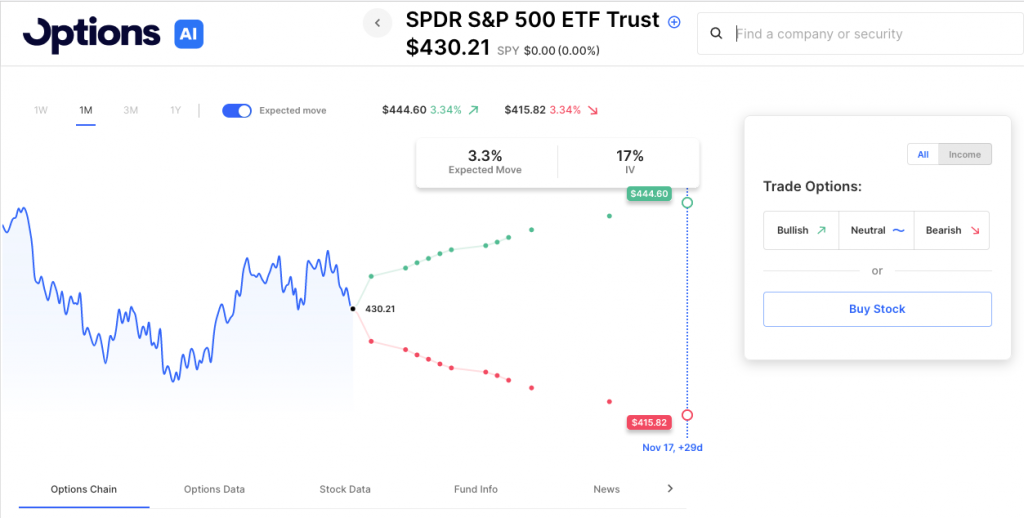

With the futures slightly higher this morning SPY is unchanged on the week and up about 1% in October. It doesn’t feel like it, right? The intraday swings have been swift and it hasn’t been uncommon for the morning to look completely different from the afternoon. In fact, on Tuesday, the SPY hit the 0DTE expected move in both directions before ending up exactly unched. Sometimes it’s helpful to get your bearings during two-way movement in the market. For instance, here’s the SPY expected move chart for the next month or so. There’s not a ton of panic yet in stocks and the expected move over the next month is just 3.5% or so:

If we were to see real panic of an acceleration of selling set in look for that expected move to get closer to 5%. Also, the focus is now on idiosyncratic moves in individual stocks, like the NFLX and TSLA moves in either direction overnight. Not every stock will be going i the same direction over earnings season.

The big macro news of the day is Fed Chair Powell will speak at noon (eastern) at the Economic Club of New York which will possibly be market-moving. 0DTe expected moves have been higher recently, with QQQ often around 1%. Here’s today’s:

0DTE Expected Move

- SPY 0.7% (roughly $427-434)

- QQQ 1.0% (roughly $360-$367)

Earnings After the Close:

- Intuitive Surgical, Inc. (ISRG) Expected Move: 5.70%

- CSX Corporation (CSX) Expected Move: 3.34%

- Western Alliance Bancorporation (WAL) Expected Move: 5.50%

- Bank OZK (OZK) Expected Move: 5.73%

- WD-40 Company (WDFC) Expected Move: 6.00%

Full list here: Options AI Earnings Calendar

Economic Calendar:

- At 09:00 AM (EST) Fed Jefferson Speech Impact: Medium

- At 10:00 AM (EST) Existing Home Sales MoM (Sep) Impact: Medium

- At 12:00 PM (EST) Fed Chair Powell Speech Impact: High

- At 01:20 PM (EST) Fed Goolsbee Speech Impact: Medium

- At 04:00 PM (EST) Fed Bostic Speech Impact: Medium

- At 05:30 PM (EST) Fed Harker Speech Impact: Medium

Unusual Options Volume (the day’s volume vs 30d avg)

PG (+971%), MS (+873%), ABT (+703%), BIDU (+699%), UAL (+646%), NFLX (+561%), GS (+551%), ASML (+526%), MRNA (+484%), JNJ (+439%), TSLA (+400%), PEP (+378%), SHOP (+368%), TXN (+366%), LULU (+364%)

Earnings before the open Friday

- AXP American Express Company 3.3%

- SLB Schlumberger Limited 2.8%

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC