Hello!

Alphabet and Microsoft highlight a busy earnings day, both reporting after the close.

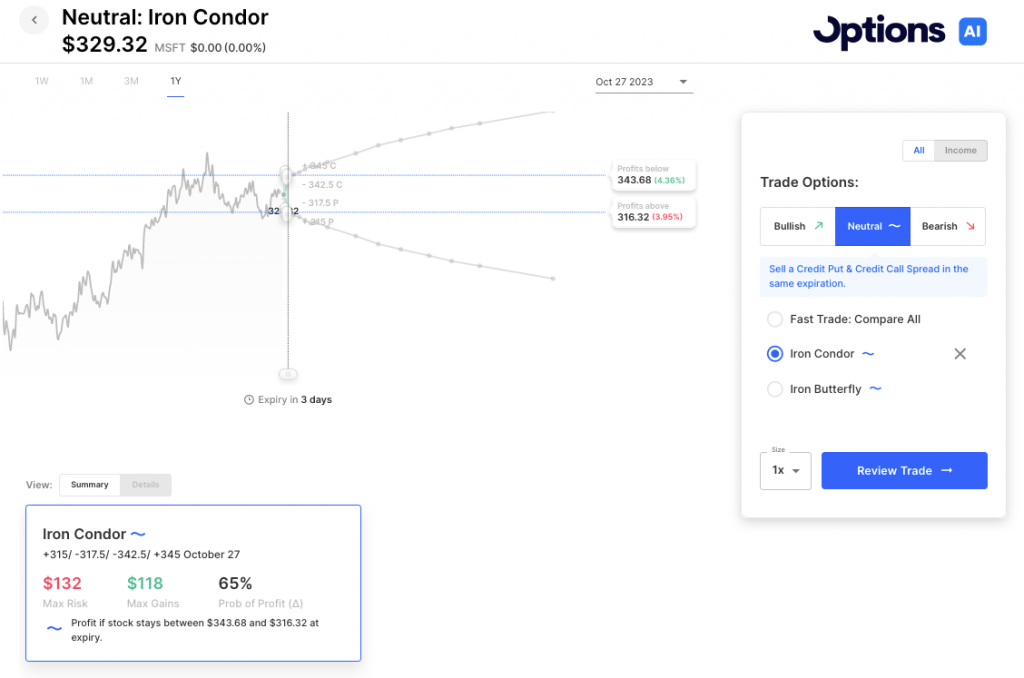

Microsoft options are pricing about a 4% move. Prior earnings saw actual moves of -4%, +7%, -1%, -8%. At 60 IV, the options expiring this week are about twice the 30-day IV. The stock itself has not been that volatile into the event, having essentially flatlined since the first week of October. 30 day realized vol (how much the stock has been actually moving) is just 20, compared to its realized vol over the past year of 29. Sometimes it’s interesting to look at trade breakevens zoomed really far out, here’s an Iron Condor with strikes based on the expected move, expiring this Friday, on the one-year chart. The levels are pretty closely aligned with the highs and lows over the past 2 and a half months or so:

Alphabet options are pricing about a 4.5% move. Recent earnings have seen moves of +6%, 0%, -3% and -9%. Like MSFT the stock has been flatlining the past few weeks (albeit like everything in the market it’s been moving intraday and day to day, just not ending up anywhere new). It’s realized vol of 22 over the past 30 days compares to the stock’s 34 vol over the past year. Its weekly expiry IV of 70 is about twice its 30 day of 35, a similar 2x to MSFT.

Early Movers:

- Coca-Cola Company (KO) +3.01%

- Spotify Technology S.A. (SPOT) +3.03%

- Verizon Communications Inc (VZ) +4.11%

- Alphabet Cl A (GOOGL) +1.21%

Earnings After the Bell:

- Microsoft Corporation (MSFT) Expected Move: 3.89%

- Alphabet Inc. (GOOGL) Expected Move: 4.41%

- Visa Inc. (V) Expected Move: 3.23%

- Texas Instruments Incorporated (TXN) Expected Move: 3.97%

- Chubb Limited (CB) Expected Move: 5.72%

- Snap Inc. (SNAP) Expected Move: 16.38%

- F5, Inc. (FFIV) Expected Move: 6.40%

- Matador Resources Company (MTDR) Expected Move: 8.50%

- Boyd Gaming Corporation (BYD) Expected Move: 6.16%

- Teladoc Health, Inc. (TDOC) Expected Move: 11.97%

Full list here: Options AI Earnings Calendar

Economic Calendar

- At 09:45 AM (EST) S&P Global Composite PMI (Oct) Impact: Medium

- At 09:45 AM (EST) S&P Global Services PMI (Oct) Estimates: 49.8, Prior: 50.1

- At 09:45 AM (EST) S&P Global Manufacturing PMI (Oct) Estimates: 49.5, Prior: 49.8

Unusual Options Volume

SPOT (+1225%), OKTA (+1054%), TTWO (+1003%), MSTR (+976%), COIN (+695%), MARA (+616%), RIOT (+593%), TSLA (+544%), JETS (+502%), NFLX (+476%)

Follow The Orbit on Twitter and Youtube

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC