Good morning!

Options AI mobile is now available in the Apple app store! Go find it here.

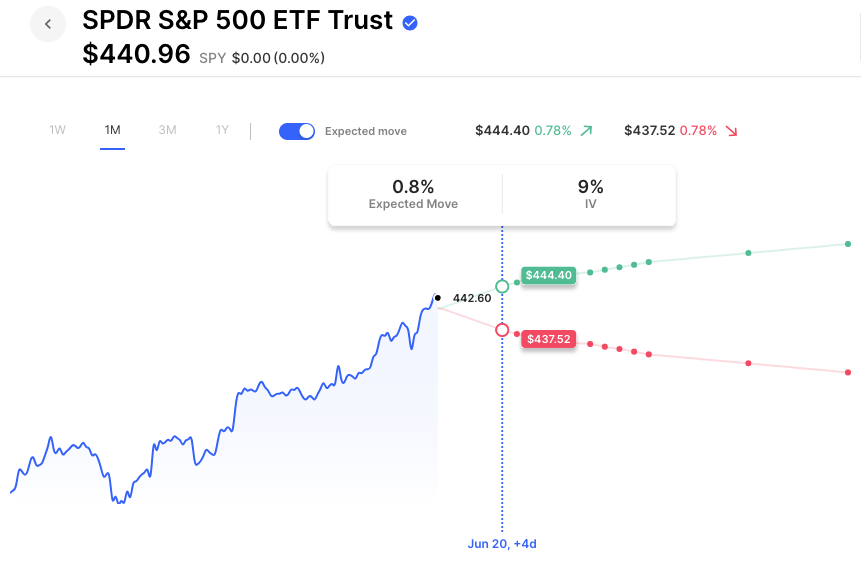

Stocks opened higher this morning, potentially capping off a great week for stocks. With this morning’s action, SPY is up nearly 3% on the week. With QQQ up nearly 5%. The week started with a cooler-than-expected CPI, had a bit of a news shock with a slightly more hawkish Fed, but quickly shook that off and headed higher into the three-day weekend. In fact, the shakeout post-Fed may have helped the rally as it likely put some traders offsides needing to then chase higher.

IV remains low, with the VIX 14.30, and SPY at the money vol on Monday just 9, the first time we’ve seen single digits in some time (that is also a reflection of traders not wanting to get plugged with long option premium for the long weekend). SPY vol for the rest of the week is 10-11 and just 12 a few weeks out.

Pre-Market Movers:

- Innovative Eyewear Inc (LUCY) +24.66%

- Vci Global Limited Ordinary Share (VCIG) +34.63%

- Nio Inc ADR (NIO) -2.98%

- Dragonfly Energy Hldgs Corp (DFLI) -22.22%

- Dice Therapeutics Inc (DICE) +37.67%

- Xpeng Inc ADR (XPEV) -4.39%

- Grab Holdings Ltd Cl A (GRAB) +5.26%

- Jd.com Inc ADR (JD) -4.07%

Today’s Earnings Highlights:

- FedEx Corporation (FDX) Expected Move: 5.55%

- La-Z-Boy Incorporated (LZB) Expected Move: 10.65%

Full list here: Options AI Earnings Calendar.

Economic Calendar:

- At 08:30 AM (EST) Housing Starts MoM (May) Estimates: -1.2, Prior: 2.2

- At 08:30 AM (EST) Building Permits MoM (May) Estimates: 0.6, Prior: -1.4

- At 08:30 AM (EST) Housing Starts (May) Estimates: 1.4, Prior: 1.401

- At 08:30 AM (EST) Building Permits (May) Estimates: 1.42, Prior: 1.417

Options AI Scanner Highlights:

- Overbought (RSI): TSLA (86), ORCL (84), DAL (84), ADBE (82), JETS (80)

- Oversold (RSI): CGC (6), SQQQ (26), SPXS (27), ZIM (34), UNH (35)

- High IV: NKLA (+239%), SPCE (+176%), AMC (+162%), UVXY (+145%), BYND (+140%)

- Unusual Options Volume: ASHR (+1627%), SPCE (+1449%), FXI (+985%), GLW (+772%), FFIE (+688%), ADBE (+656%), RBLX (+506%), FDX (+500%)

Full lists here: Options AI Free Tools.

Chart of the Day:

FedEx options are pricing in about a 5.5% move for earnings.

That’s all for now. Have a great day!

The Options AI Team

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.