Good morning!

Options AI mobile is now available in the Apple app store! Go find it here.

Futures are lower for a 3rd straight day as the market waits for Fed Chair Powell’s testimony in front of Congress. Some of his prepared remarks were released before the bell. The 3 day losing streak hasn’t added up to much of a sell-off as of yet. The SPY is lower by about 1.5% since an intra-week high last Thursday. Nor has it affected vol much, the VIX is even lower than it was during that Thursday high in stocks.

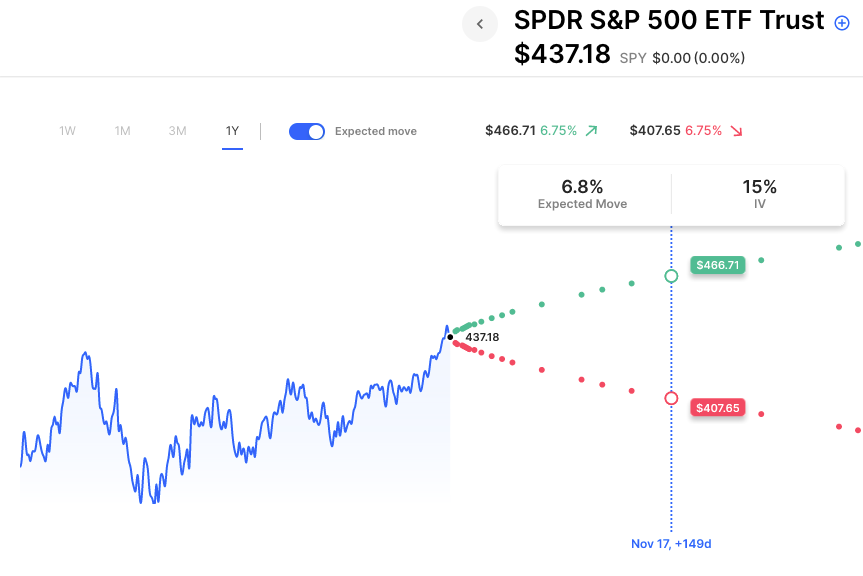

As mentioned alot recently, yes vol is low, but the moves in the market are also very muted. The realized vol in SPY over the past month now sits at 12. Options in SPY are about 11 vol for the upcoming few weeks. In other words, IV is currently reflective of how the market is moving. Therefore option buyers are still having to get direction correct and be very nimble, despite how “cheap” vol is. Short-term option trading is basically a battle between implied vol, and realized vol. The mean reversion of IV (buying low IV, selling high IV) typically needs more time to play out. Speaking of that, when vol is this low for this long it’s sometimes helpful to begin to look out a few months and see how low IV has been dragged down by what’s happening recently. A look at SPY vol out in November and December shows at-the-money vol around 15-16. To put that in perspective, that’s both below historical averages for IV, but it’s also much lower than the realized vol if SPY over the past year, which is around 20, even with the slow grind of the past few months.

Pre-Market Action:

- Tesla Inc (TSLA) +0.54%

- Marathon Digital Hldgs Inc (MARA) +5.38%

- Riot Platforms Inc (RIOT) +3.82%

- Rivian Automotive Inc Cl A (RIVN) +0.96%

- Nvidia Corp (NVDA) -0.66%

- Coinbase Global Inc Cl A (COIN) +2.89%

- Opendoor Technologies Inc (OPEN) +4.23%

- Alibaba Group Holding ADR (BABA) -0.65%

- Amazon.com Inc (AMZN) +0.24%

- Apple Inc (AAPL) -0.33%

- Carvana Company Cl A (CVNA) +0.55%

- Li Auto Inc ADR (LI) +3.14%

- C3.Ai Inc Cl A (AI) -0.76%

Today’s Earnings Highlights:

- KB Home (KBH) Expected Move: 7.97%

- Winnebago Industries, Inc. (WGO) Expected Move: 10.56%

- Steelcase Inc. (SCS) Expected Move: 11.40%

Economic Calendar:

- At 10:00 AM (EST) Fed Jefferson Testimony Impact: Medium

- At 10:00 AM (EST) Fed Cook Testimony Impact: Medium

- At 12:25 PM (EST) Fed Goolsbee Speech Impact: Medium

- At 10:00 AM (EST) Fed Chair Powell Testimony Impact: High

- At 04:30 PM (EST) Fed Barkin Speech Impact: Medium

Scanner

Overbought (RSI): TSLA (89), CCL (81), DAL (81), META (79), JETS (78), LUV (77), NVDA (77)

Oversold (RSI): CGC (6), TGT (39), PENN (40), DOCU (40), DIS (41)

High IV: FGEN (+568%), VMW (+175%), BYND (+128%), RIVN (+116%), TSLA (+109%), AZN (+106%), IBM (+106%), NKE (+106%), FDX (+104%), PLTR (+100%)

Unusual Options Volume: FDX (+1484%), SPCE (+1172%), MARA (+1041%), MSTR (+859%), SOUN (+850%), AVGO (+751%), ABT (+725%), RIOT (+686%)

Chart of the Day:

SPY vol is just 15 in November:

That’s all for now. Have a great day!

The Options AI Team

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.