Good morning!

JP Morgan has agreed to take over the assets of First Republic Bank after an FDIC seizure over the weekend. Unlike the SVB collapse which happened in about 48 hours, the First Republic collapse was more of a slow-moving wreck that seemed inevitable but took over a month to play out. Futures are flat to down slightly as the FRC news was not surprising and had been pretty much assumed by last Thursday or Friday.

Speaking of last week. The SPY was higher by about 0.8%, inside what options were pricing. HOWEVER, it was not the same type of sideways trading we’d become accustomed to over the past month or so. The SPY was very weak most of the week, before rallying nearly 3% from its intra-week lows. It remains to be seen if that was a true shift in realized vol. The VIX was unphased and finished the week near 16, near its lowest levels of the past 3 years.

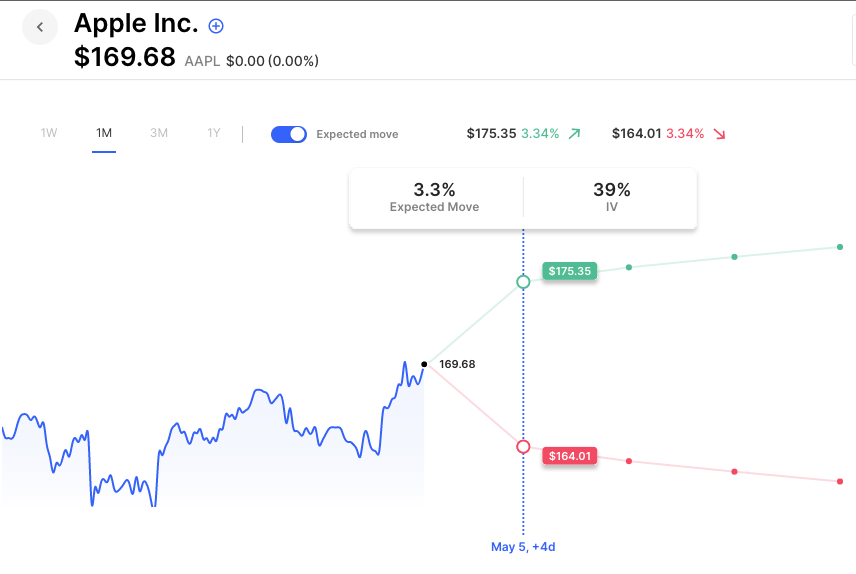

This week sees the Fed Policy announcement and expectations are for another .25 increase, but perhaps its last. Short term treasury yields have been creeping up as the market assumes a rate hike end/pause but is not assuming any rate cuts anytime soon. The big earnings report this week is Apple, but the rest of the days are also filled, so keep an eye on the Options AI earnings calendar for expected moves.

Pre-Market Movers:

- First Republic Bank (FRC) -34.47%

- Sofi Technologies Inc (SOFI) +4.82%

- Pacwest Bancorp (PACW) -4.93%

- Tesla Inc (TSLA) -0.36%

- JP Morgan Chase & Company (JPM) +4.28%

- Marathon Digital Hldgs Inc (MARA) -3.08%

- Carvana Company Cl A (CVNA) +2.74%

- Amazon.com Inc (AMZN) -0.86%

- Nio Inc ADR (NIO) +0.38%

- Adv Micro Devices (AMD) +1.45%

- Carnival Corp (CCL) +0.98%

- Snap Inc (SNAP) +1.03%

- Apple Inc (AAPL) -0.35%

- Uber Technologies Inc (UBER) +2.58%

- General Motors Company (GM) +2.60%

- Bank of America Corp (BAC) +0.68%

- Palantir Technologies Inc Cl A (PLTR) +0.39%

- Nvidia Corp (NVDA) +0.52%

Today’s Earnings Highlights:

- MGM Resorts International (MGM) Expected Move: 5.09%

- Check Point Software Technologies Ltd. (CHKP) Expected Move: 7.30%

- SoFi Technologies, Inc. (SOFI) Expected Move: 12.03%

- MicroStrategy Incorporated (MSTR) Expected Move: 7.51%

Full list here: Options AI Earnings Calendar.

Economic Calendar:

- At 10:00 AM (EST) ISM Manufacturing PMI (Apr) Estimates: 46.8%, Prior: 46.3%

Options AI Scanner Highlights:

- Overbought (RSI): SBUX (90), PEP (86), EBAY (77), META (77), MSFT (75), KO (74), MCD (74)

- Oversold (RSI): VLO (2), HOOD (3), COIN (7), TWLO (8), RBLX (9), PLTR (10), PINS (13), CVNA (14), MRNA (14)

- High IV: XELA (+3114%), WMT (+1248%), ETSY (+1136%), TWLO (+1089%), BYND (+1081%), HOOD (+1075%), LYFT (+1024%)

- Unusual Options Volume: NET (+1622%), FSLR (+1133%), PINS (+1067%), SOFI (+808%), FRC (+766%), TLT (+728%), AMZN (+721%), CRWD (+645%), ORCL (+619%), PACW (+610%), WYNN (+587%), PANW (+567%)

Full lists here: Options AI Free Tools.

Chart of the Day:

Options are pricing about a 3.3% move for Apple earnings.

That’s all for now. Have a great day!

The Options AI Team

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.