Good morning!

Another sideways day yesterday following several sideways weeks (albeit with some intra-week volatility last week). So far this earnings season we’ve seen typical moves higher and lower by individual companies but the broader market has refused to make any grand conclusions about what it all means. Things may change a bit this week with the FOMC meeting, but with the VIX now 16, and a significant amount of companies having already reported, if the FOMC does not spook markets IV could compress even more, or at least continue to act as a long gamma dampener on market moves. The next significant event on the economic front following the FOMC announcement is the CPI release on the 10th. Options are showing a slight uptick in vol for that week but we’re talking IV at 13 or 14. So gone are the days of options pricing in 26 IV for a CPI day. On the earnings front today we had Uber report before the bell and AMD, Ford and Starbucks after.

Pre-Market Movers:

- Uber Technologies Inc (UBER) +8.43%

- Sofi Technologies Inc (SOFI) -2.93%

- Tesla Inc (TSLA) -0.60%

- Lyft Inc Cl A (LYFT) +2.93%

- Amazon.com Inc (AMZN) -0.42%

- Pfizer Inc (PFE) +1.30%

- BP Plc ADR (BP) -5.25%

- Adv Micro Devices (AMD) -0.19%

- Nvidia Corp (NVDA) -0.59%

- AMC Entertainment Holdings (AMC) +1.24%

- Apple Inc (AAPL) +0.12%

Today’s Earnings Highlights:

- Pfizer Inc. (PFE) Expected Move: 2.84%

- Starbucks Corporation (SBUX) Expected Move: 4.32%

- Uber Technologies, Inc. (UBER) Expected Move: 8.66%

- Ford Motor Company (F) Expected Move: 5.00%

- Cheniere Energy, Inc. (LNG) Expected Move: 3.11%

- Paycom Software, Inc. (PAYC) Expected Move: 7.40%

- Match Group, Inc. (MTCH) Expected Move: 9.90%

- Caesars Entertainment, Inc. (CZR) Expected Move: 6.48%

Full list here: Options AI Earnings Calendar.

Economic Calendar:

- At 10:00 AM (EST) Factory Orders MoM (Mar) Estimates: 1.1%, Prior: -0.7%

- At 10:00 AM (EST) JOLTs Job Openings (Mar) Estimates: 9.775m, Prior: 9.931m

- At 04:30 PM (EST) API Crude Oil Stock Change (Apr/28) Estimates: -1m, Prior: -6.083m

Options AI Scanner Highlights:

- Overbought (RSI): SBUX (90), PEP (88), MO (82)

- Oversold (RSI): HOOD (3), COIN (5), NET (7), TWLO (7), CVNA (14), MRNA (17), AMGN (19), BABA (21)

- High IV: AMC (+1362%), UPST (+1279%), TWLO (+1073%), HOOD (+1073%), BYND (+1069%), GRAB (+1021%), IBM (+985%), DOCU (+961%), LYFT (+960%), QCOM (+950%), CVNA (+945%), PTON (+935%), SBUX (+913%), PLTR (+911%)

- Unusual Options Volume: UPST (+1357%), MTCH (+1330%), UBER (+1073%), SOFI (+1064%), EXPE (+948%), NVDA (+948%), PTON (+888%), SNAP (+709%)

Full lists here: Options AI Free Tools.

Chart of the Day:

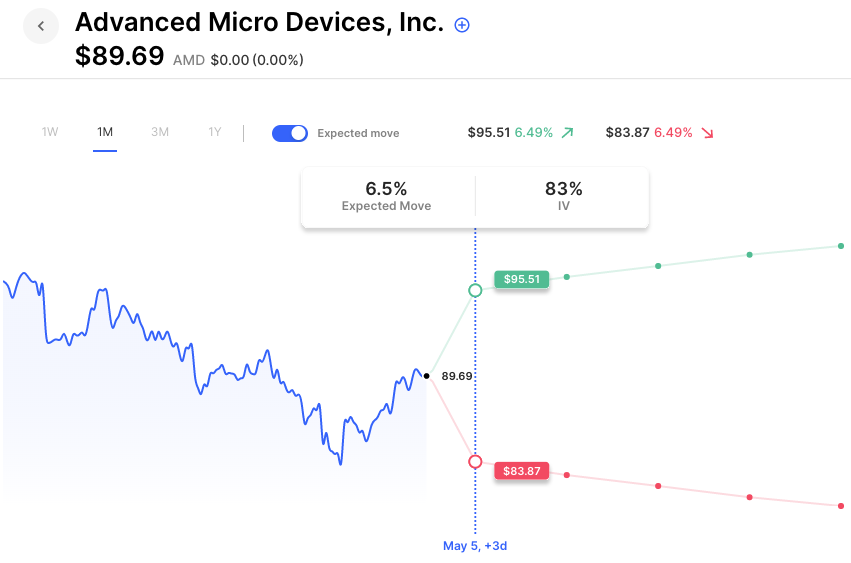

AMD options are pricing in a 6.6% move for earnings.

That’s all for now. Have a great day!

The Options AI Team

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.