Good morning!

Yesterday saw the first bit of market concern in weeks and resulted in a move lower of more than 1.6% in the SPY. That was more than the expected move for the entire week and therefore woke up option prices a bit as well, with the VIX nearly touching 20 intraday before closing just below 19. The worries yesterday were twofold, renewed concern about the regional/mid-sized banks following First Republic’s earnings and some indications from other companies on earnings that the economy may be slowing. Those worries will likely remain the backdrop for a bit. FRC is lower again this morning. However, the regional bank index ETF is not, it’s slightly in the green as it tries to recover a bit of yesterday’s move.

And earnings continue against this backdrop and last night we got some big ones. Microsoft and Alphabet are both higher pre-market, although it’s Microsoft (up +8% pre-market) that’s powering the QQQ futures higher. Both company’s earnings calls heavily featured talk of AI and as has been the case lately, the assumption is that MSFT is a bit ahead of GOOGL in the game thus far. The stocks’ moves this morning may be a proxy battle on that front.

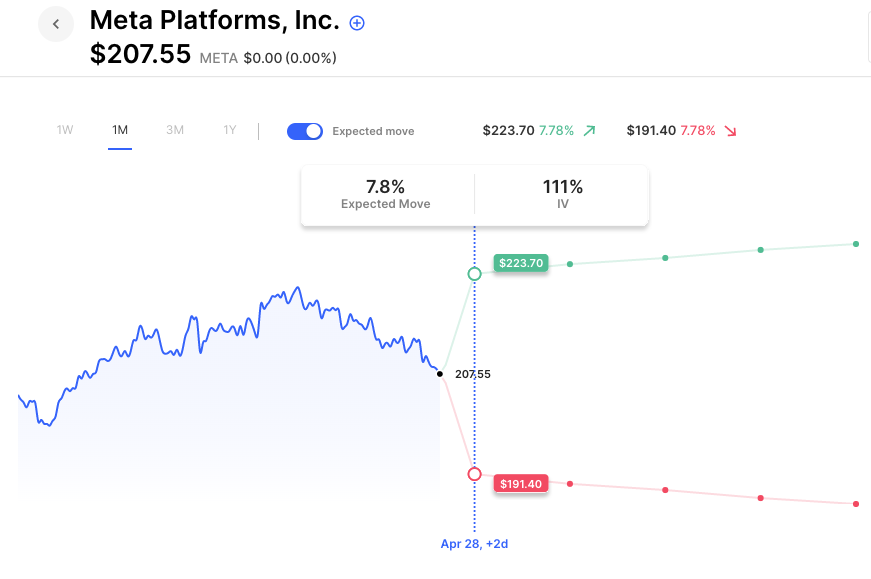

Boeing (BA) is also higher on earnings. META is up next after the close, with options pricing about an 8% move.

Pre-Market Movers:

- First Republic Bank (FRC) -14.81%

- Marathon Digital Hldgs Inc (MARA) +13.68%

- Microsoft Corp (MSFT) +8.34%

- Pacwest Bancorp (PACW) +12.90%

- Tesla Inc (TSLA) +0.37%

- Alphabet Cl A (GOOGL) +1.00%

- Amazon.com Inc (AMZN) +2.80%

- Doordash Inc Cl A (DASH) +1.55%

- Alphabet Cl C (GOOG) +0.76%

- Apple Inc (AAPL) +0.04%

- Adv Micro Devices (AMD) +2.48%

- Snap Inc (SNAP) +1.87%

- Nvidia Corp (NVDA) +2.51%

- Meta Platforms Inc (META) +1.88%

- Paypal Holdings (PYPL) +0.58%

Today’s Earnings Highlights:

- Meta Platforms, Inc. (META) Expected Move: 7.81%

- The Boeing Company (BA) Expected Move: 3.88%

- ServiceNow, Inc. (NOW) Expected Move: 6.10%

Full list here: Options AI Earnings Calendar.

Economic Calendar:

- At 08:30 AM (EST) Durable Goods Orders MoM (Mar) Estimates: 0.7%, Prior: -1.2%

- At 07:00 AM (EST) MBA 30-Year Mortgage Rate (Apr/21) Impact: Medium

Options AI Scanner Highlights:

Based on the prior day’s trading action.

- Overbought (RSI): PEP (99)

- Oversold (RSI): DOCU (0)

- Unusual Options Volume: INVZ (+2355%), FRC (+1600%), UPS (+1361%), RIO (+1358%), SPOT (+1333%), TXN (+1131%), CRWD (+1084%), MSFT (+1032%), SNOW (+983%), ABBV (+959%), GSK (+947%), XLV (+946%), GOOGL (+933%), SBUX (+882%), KSS (+790%), ADBE (+746%), VXX (+743%), UVXY (+729%), JWN (+682%), NVDA (+654%)

Full lists here: Options AI Free Tools.

Chart of the Day:

META options are pricing about a 7.8% move, it’s last report saw a move of 23%.

That’s all for now. Have a great day!

The Options AI Team

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.