Good morning!

Pepsi followed other consumer companies with an earnings beat that was based almost entirely on higher prices, with virtually no volume growth. This is something to track as it A: shows inflation is sticky and for now is helping companies B: with companies beating lowered expectations on higher product prices, folks trying to gauge what’s going on in the economy via earnings season need to be careful not to just read the headline, as it’s complicated. McDonalds is also higher pre-market.

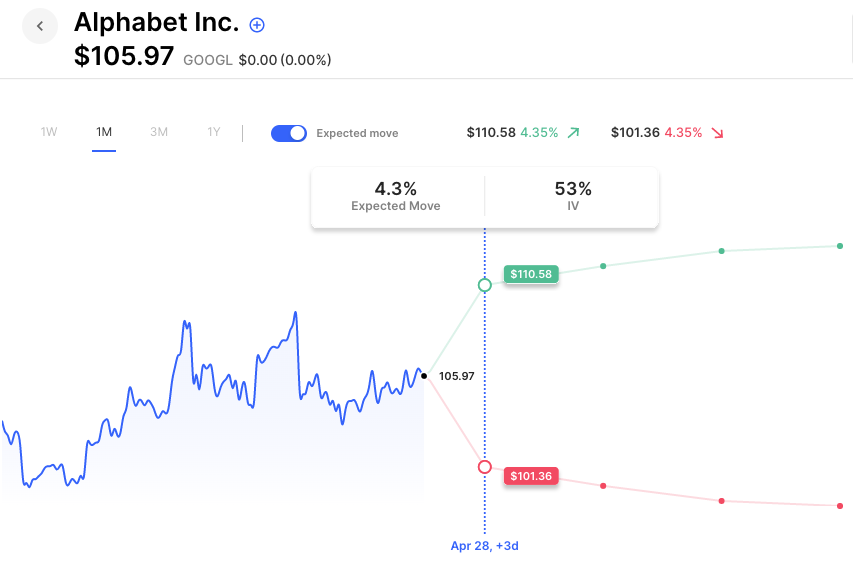

On the flipside, UPS met estimates but reported a drop in volume, also something to watch for those looking for signs on the economy. The stock is lower. After the close we get reports from mega-cap peers, and new bitter AI rivals Microsoft and Alphabet. Microsft options are pricing in about a 3.6% move, with Alphabet 4.3%.

Pre-Market Movers:

- Cisco Systems Inc (CSCO) -0.17%

- Baudax Bio Inc (BXRX) +57.96%

- First Republic Bank (FRC) -21.75%

- Intel Corp (INTC) -0.44%

- Microsoft Corp (MSFT) -0.44%

- Alphabet Cl A (GOOGL) -0.31%

- Amazon.com Inc (AMZN) -0.62%

- Abbott Laboratories (ABT) -0.57%

- Tesla Inc (TSLA) -1.23%

- Coca-Cola Company (KO) +0.20%

- McDonald’s Corp (MCD) +0.78%

- Meta Platforms Inc (META) -0.14%

Today’s Earnings Highlights:

- Microsoft Corporation (MSFT) Expected Move: 3.66%

- Alphabet Inc. (GOOGL) Expected Move: 4.37%

- Visa Inc. (V) Expected Move: 2.83%

- PepsiCo, Inc. (PEP) Expected Move: 1.73%

- McDonald’s Corporation (MCD) Expected Move: 2.22%

- United Parcel Service, Inc. (UPS) Expected Move: 5.00%

- Texas Instruments Incorporated (TXN) Expected Move: 3.51%

- Verizon Communications Inc. (VZ) Expected Move: 3.55%

- 3M Company (MMM) Expected Move: 3.44%

- Chipotle Mexican Grill, Inc. (CMG) Expected Move: 4.80%

- General Motors Company (GM) Expected Move: 4.46%

- Spotify Technology S.A. (SPOT) Expected Move: 7.80%

Full list here: Options AI Earnings Calendar.

Economic Calendar:

- At 04:30 PM (EST) API Crude Oil Stock Change (Apr/21) Impact: Medium

- At 10:00 AM (EST) New Home Sales (Mar) Estimates: 0.63%, Prior: 0.64%

- At 09:00 AM (EST) S&P/Case-Shiller Home Price YoY (Feb) Estimates: 0%, Prior: 2.5%

Options AI Scanner Highlights:

Based on the prior day’s trading action.

- Unusual Options Volume: SPOT (+1750%), UPS (+1747%), RLX (+1628%), ABEV (+1557%), ZM (+1495%), MCD (+1312%), KO (+1295%), MMM (+1285%), FRC (+1282%), COIN (+1022%)

Full lists here: Options AI Free Tools.

Chart of the Day:

GOOGL options are pricing a 4.3% move. Alphabet and Microsoft have been at the center of the AI wars and go head to head on earnings this afternoon.

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.