Good morning!

Futures are down slightly. On the earnings front, Coca-Cola (KO) reported this morning and is higher on the news. KO beat estimates while crediting higher prices. That’s certainly something to keep an eye as more companies report. Higher prices not necessarily demand has been a common refrain, particularly from consumer product companies. For those looking to read the tea leaves on earnings season and apply it to the broader economy, it’s worth paying attention to pricing vs demand and the after effects of inflation.

On the economic front we have Dallas manufacturing after the open, Of course this week will be dominated by the mega-cap tech earnings. We see reports from Microsoft and Alphabet on Tuesday (after the close), Meta Wednesday (after) and Amazon Thursday (after). But that’s not all, companies like UPS, Intel, Snap, and Boeing also report. So the headlines will be coming in fast and furious. We will see some idiosyncratic stock moves each day, and on the mega-caps days, broader market moves.

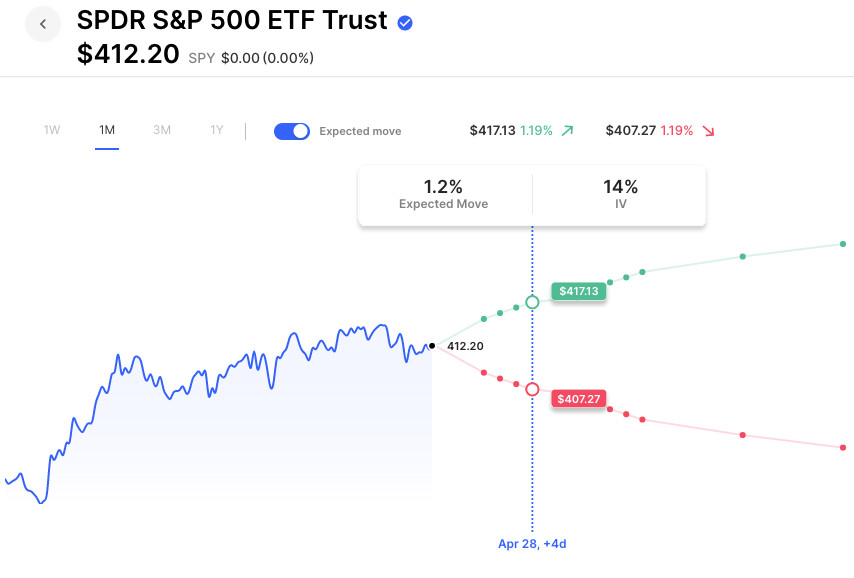

Last week we discussed the sometimes self-fulfilling lack of actual volatility in the market following a sharp decline in implied volatility. Last week sure felt like that. The market finished the week unchanged (with options having priced just a 1.1% move for the week). A lot of that gamma from Friday cleared on expiry, so it will be interesting to see how much of that effect remains stacked behind Friday’s expiry.

Spy options are pricing about a 1.2% move for this week. The VIX sits at about 17.50, lower than historical averages and quite low based on recent history but not at an extreme low by any historical measures.

Pre-Market Movers:

- Tesla Inc (TSLA) -0.93%

- Marathon Digital Hldgs Inc (MARA) +2.46%

- Amazon.com Inc (AMZN) +0.62%

- Coca-Cola Company (KO) +1.75%

- Apple Inc (AAPL) -0.19%

- Riot Platforms Inc (RIOT) +1.52%

- Sofi Technologies Inc (SOFI) -0.34%

- Microsoft Corp (MSFT) -0.69%

- Nvidia Corp (NVDA) -0.25%

- Pacwest Bancorp (PACW) +2.56%

- Coinbase Global Inc Cl A (COIN) +0.53%

Today’s Earnings Highlights:

- The Coca-Cola Company (KO) Expected Move: 1.92%

- First Republic Bank (FRC) Expected Move: 22.86%

Economic Calendar:

- At 10:30 AM (EST) Dallas Fed Manufacturing Index (Apr) Estimates: -14.6%, Prior: -15.7%

- At 08:30 AM (EST) Chicago Fed National Activity Index (Mar) Estimates: -0.02%, Prior: -0.19%

Options AI Scanner Highlights:

Based on the prior day’s trading action.

Unusual Options Volume: TRIP, LYFT, JBLU, TXN, ADBE, COIN

Chart of the Day:

SPY options are pricing just a 1.2% move for mega-cap earnings week. (Apple typically reports this week but is next week in this instance)

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.