Options AI mobile is now available in the Apple app store! Go find it here.

Good morning!

Stock futures are lower this morning, a slight pullback following the past week’s gains. The FOMC minutes (from the June meeting) highlight the economic calendar. The market is pricing a more than 80% chance of a rate hike at the upcoming (July 25-26) meeting. There are also expectations of another hike before year-end. These minutes are closely followed by a jobs number on Friday, and a CPI release next week so some clarity on future hikes may be realized in the next week. Meanwhile, option prices are likely to see a bit of a pop this morning, both out of the quasi long holiday weekend, but also with stock futures pointing lower. The VIX printed below 13 on Friday, its lowest level in years, but it is already higher this morning, around 14.50. Again, around 19 is the historical mean so anything in this current range is historically low. However, as has been mentioned in this space before, the realized, or actual volatility of the market is in fact even lower historically. The SPY realized vol for the past 30 days is 10. That compares to realized vol in SPY over the past year of 19. So the low IV has been justified and will remain until something either spooks the market lower or a FOMO situation develops to the upside. SPY IV is about 10 for the rest of the week (as of Friday’s close) but could tick up into the NFP jobs number on Friday.

The earnings calendar remains light today but does begin to pick up after next week, when we’re smack dab in earnings season again.

Pre-Market Movers:

Rivian Automotive Inc Cl A (RIVN) +6.29%

Tesla Inc (TSLA) -0.79%

Marathon Digital Hldgs Inc (MARA) -3.13%

Riot Platforms Inc (RIOT) -3.75%

Xpeng Inc ADR (XPEV) -1.93%

Coinbase Global Inc Cl A (COIN) -2.84%

Astrazeneca Plc ADR (AZN) +2.57%

Wolfspeed Inc (WOLF) +18.06%

Mp Materials Corp (MP) +9.24%

Transocean Inc (RIG) +4.30%

Advanced Health Intelligence Ltd ADR (AHI) -8.77%

Hut 8 Mining Corp (HUT) -1.42%

Today’s Earnings Highlights:

none

Economic Calendar:

At 10:00 AM (EST) Factory Orders MoM (May) Estimates: 0.8%, Prior: 0.4%

At 02:00 PM (EST) FOMC Minutes Impact: High

At 04:00 PM (EST) Fed Williams Speech Impact: Medium

Options AI Scanner Highlights:

Overbought (RSI): DAL (87), LUV (83), AAL (82), JBLU (80), JETS (80), HUT (80)

Oversold (RSI): AZN (24), PFE (38), MU (43), MRNA (43), PENN (44), SBUX (44)

High IV: NKLA (+257%), RAD (+242%), LUMN (+156%), LCID (+109%), HOOD (+106%), PENN (+102%), PFE (+101%), GE (+101%), SPOT (+101%)

Unusual Options Volume: HOOD (+632%), CGC (+610%), RIOT (+589%), AZN (+552%), JPM (+540%), MSTR (+513%), CSCO (+500%), COIN (+461%), XPEV (+460%)

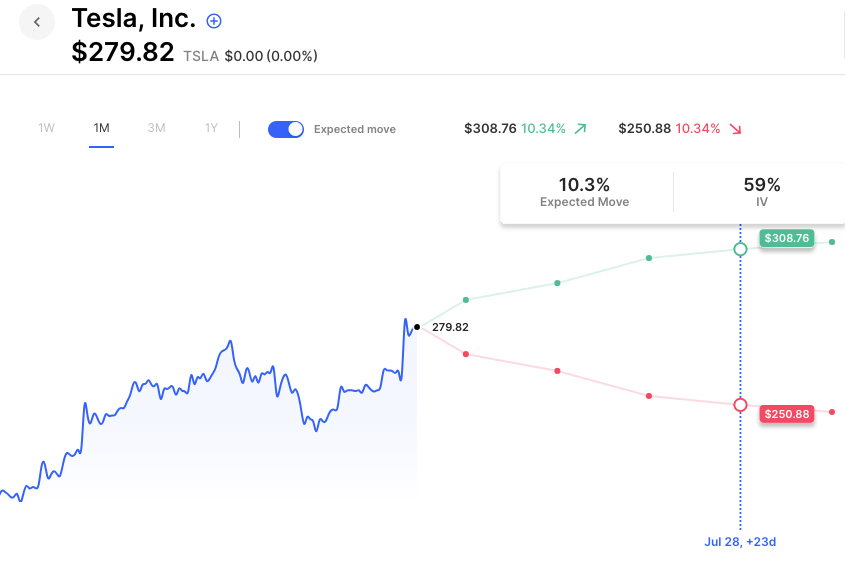

Chart of the Day:

Tesla stock is up 18% in July (one trading day) and options are pricing about a 10% move for the rest of the month.

That’s all for now. Have a great day!

The Options AI Team

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.