Good morning!

Options AI mobile is now available in the Apple app store! Go find it here.

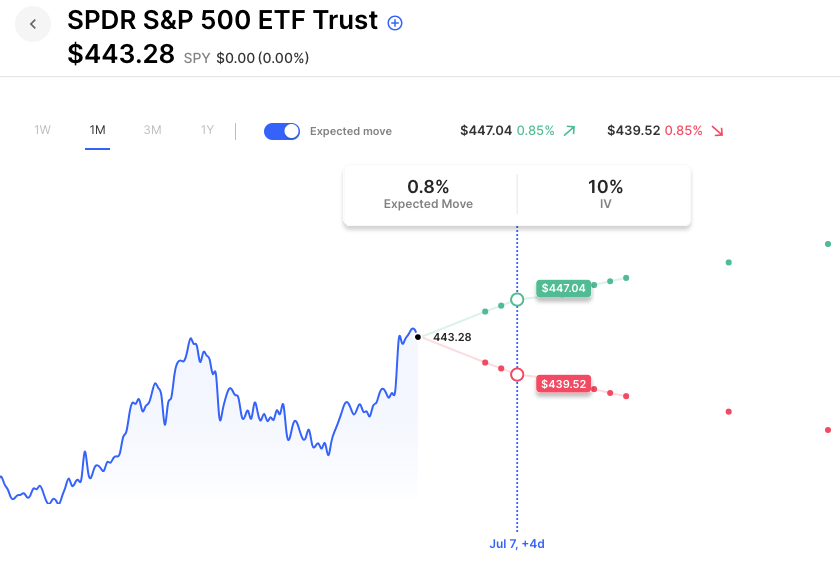

Futures are basically flat this morning into a holiday-shortened session. On the economic data front, the ISM PMI number will drop shortly after the open. Earnings reports are super light this week with nothing really of note today. Last week was a very positive one for stocks with the SPY up 2.3% on the week, a move more than double what options were pricing. With the move higher, IV was even lower, with the VIX actually putting in an intraday print below 13 on Friday. Once again, that’s low levels of IV that the market hasn’t seen since Covid dropped. Considering this is a holiday-shortened week those low levels are likely warranted, or at least understandable as traders do not want to be sitting on long premium during the dog days of Summer trading. But as has been mentioned in this space, it doesn’t take much for stocks to move beyond those small expected moves, particularly on weeks like last week where there’s a persistent bid in the market on a slow grind higher. Traders should be very very aware of both the risk of long premium, but also of how tight the breakeven levels of short premium trades can be with IV this low. Active trade management with small-win mentalities is how many traders approach these conditions.

For this week, SPY options are pricing just under a 1% move for what amounts to a 3-and-a-half-day week. That could change coming out of the holiday for the final 3 days as traders may re-adjust to more regular market hours. That’s particularly true this week as the economic calendar picks up on Wednesday with FOMC minutes, then Thursday ISM services PMI, ADP jobs, and of course the non-farm payrolls on Friday. The earnings calendar is light this week but picks up in the second half of the month with banks and airlines beginning to report mid-month with big tech rolling in late month.

Today’s expected move (0DTE)

- SPY 0.4%

- QQQ 0.5%

Pre-Market:

- Tesla Inc (TSLA) +6.13%

- Nio Inc ADR (NIO) +4.44%

- Micron Technology (MU) +0.19%

- Xpeng Inc ADR (XPEV) +7.53%

- Lucid Group Inc (LCID) +1.60%

- Alphabet Cl C (GOOG) -0.32%

- Rivian Automotive Inc Cl A (RIVN) +2.16%

- Apple Inc (AAPL) -0.32%

- Unitedhealth Group Inc (UNH) -0.48%

- Astrazeneca Plc ADR (AZN) -6.62%

- Li Auto Inc ADR (LI) +5.84%

- Zhong Yang Financial Group Limited (TOP) -5.22%

Today’s Earnings Highlights:

none of note

Full list here: Options AI Earnings Calendar

Economic Calendar:

- At 09:45 AM (EST) S&P Global Manufacturing PMI (Jun) Estimates: 46.3, Prior: 48.4

- At 10:00 AM (EST) ISM Manufacturing PMI (Jun) Estimates: 47, Prior: 46.9

- At 10:00 AM (EST) ISM Manufacturing Employment (Jun) Estimates: 50.5, Prior: 51.4

Scanner Highlights:

Based on the prior day’s trading action.

- Overbought (RSI): DAL (87), AAL (81), LUV (80), OSTK (80), JBLU (79), JETS (78), AAPL (78), OPEN (77), SNAP (74)

- Oversold (RSI): OKTA (39), ETSY (39), MU (40), KO (40), TGT (40), ABBV (40), DOCU (41), GLD (41), JD (41)

- High IV: NKLA (+211%), AMC (+206%), MANU (+172%), AZN (+136%), OSTK (+116%), SOFI (+114%), BUD (+113%), AMGN (+102%), RIVN (+102%), MRK (+101%), SPOT (+100%)

- Unusual Options Volume: CMCSA (+1401%), BITO (+657%), XLI (+561%), RIG (+556%), OSTK (+531%), NKE (+486%), MSTR (+475%), CCL (+473%), AAPL (+450%), JPM (+440%), UPS (+398%)

Full lists here: Options AI Free Tools.

Chart of the Day:

SPY options are pricing less than a 1% move for the week but that could change out of the holiday.

That’s all for now. Have a great day!

The Options AI Team

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.