Options AI mobile is now available in the Apple app store! Go find it here.

Good morning!

Stock futures are lower for the second straight day. It’s a big two days for economic data, following yesterday’s Fed minutes. This morning, ADP reported ~500k private sector jobs added, doubling expectations. That sent futures lower as it’s yet another sign the FOMC is likely to keep interest rates higher for longer and potentially be more aggressive with raises. The US 2-year treasury yield is above 5% near this year’s high, but more importantly, nearing levels it hasn’t seen since 2006. Stocks have absorbed higher interest rate assumptions over the past 2 months quite well, rising with the rising yields. That played out mainly due to lessening fears of a recession (and the AI hype driving tech stocks higher). If the jobs number comes in hot tomorrow it will be just the latest data point pointing to a persistently strong economy, driving yields higher, and assumptions of a more hawkish Fed for the balance of 2023. There are signs elsewhere in the economic data of an economy that’s cooling off in certain sectors, but jobs and hiring has remained strong, and we’ll find out more on the front tomorrow. This 2-day pullback in stocks is breathing a little life into option vol. The VIX is now ~15.30, up from 13 just a few trading days ago.

As was mentioned in this space, vol got about as low as you’d ever see over the past two weeks. That didn’t mean it would immediately go higher, but it was unlikely to go much lower. A 15.30 VIX is still historically low but it does show a little appetite for traders to buy options. Something we haven’t seen much of over the past several weeks. Skew is near the highest levels of the past few years, meaning downside put strikes were already more expensive than upside call strikes. That is largely reflective of a low IV environment where the percentage differences get magnified, but keep an eye on that skew number as the VIX rises, if it remains high, it would be showing continued demand for puts even at higher vol, and therefore be a good indication of any fear in the market.

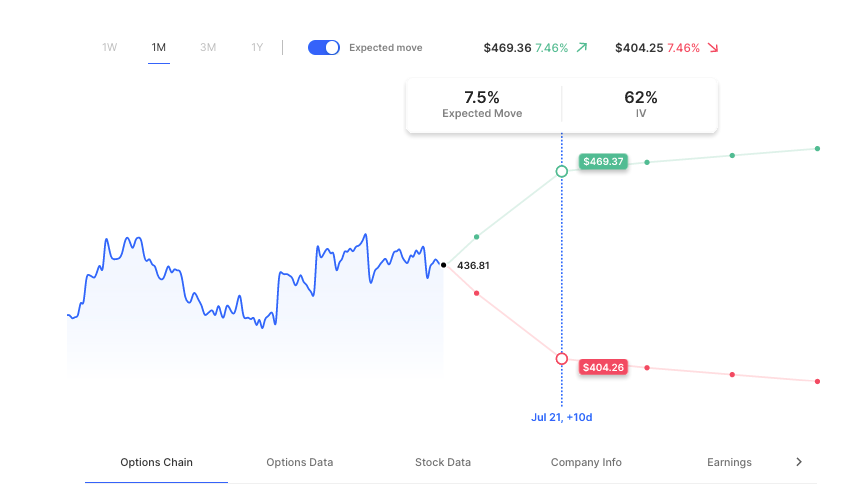

With earnings season approaching, it’s also interesting to look at how low individual stock IV got and how it’s pricing upcoming earnings. Netflix, which reports on the 19th, has 55 IV at the moment for the event, pricing in about an 7.5% move (that includes all the time leading up to the event as well.) For perspective, in Netflix’s last 6 earnings has had greater than 7% moves 5 out of 6 times. In other words, vol is low in most individual stocks as compared o the past 2 years, and with earnings right around the corner, you’ll see much smaller expected moves on average (as of now).

Pre-Market Movers:

- Tesla Inc (TSLA) -0.44%

- Allarity Therapeutics Inc (ALLR) -51.57%

- Bioxcel Therapeutics Inc (BTAI) +23.73%

- Genius Sports Ltd (GENI) +9.12%

- Meta Platforms Inc (META) +1.70%

- Lucid Group Inc (LCID) -1.48%

- Rivian Automotive Inc Cl A (RIVN) +0.29%

- Riot Platforms Inc (RIOT) +3.24%

- Nvidia Corp (NVDA) -0.16%

- Affirm Holdings Inc Cl A (AFRM) -5.06%

- Perion Network Ltd (PERI) +7.22%

Today’s Earnings Highlights:

- Levi Strauss & Co. (LEVI) Expected Move: 7.81%

- Simulations Plus, Inc. (SLP) Expected Move: 8.76%

Full list here: Options AI Earnings Calendar

Economic Calendar:

- At 08:15 AM (EST) ADP Employment Change (Jun) Estimates: 228, Prior: 278

- At 08:30 AM (EST) Initial Jobless Claims (Jul/01) Estimates: 245, Prior: 239

- At 08:45 AM (EST) Fed Logan Speech Impact: Medium

- At 10:00 AM (EST) ISM Services Employment (Jun) Estimates: 49.9, Prior: 49.2

- At 10:00 AM (EST) ISM Services PMI (Jun) Estimates: 51, Prior: 50.3

- At 10:00 AM (EST) JOLTs Job Openings (May) Estimates: 9.9, Prior: 10.103

- At 08:30 AM (EST) Average Hourly Earnings YoY (Jun) Estimates: 4.2, Prior: 4.3

Scanner Highlights:

- Overbought (RSI): DAL (88), JBLU (84), AAL (83), LUV (83), HUT (82), JETS (81), CCL (80), XPEV (79)

- Oversold (RSI): CGC (10), FGEN (14), VRAY (27), VXX (28), RAD (29), SPWR (35), AAP (36), PFE (37)

- High IV: NKLA (+222%), AMC (+185%), RAD (+170%), MVIS (+154%), GRPN (+141%), BYND (+131%), SNDL (+130%), NOK (+129%), TLRY (+126%), VXX (+126%), FCEL (+124%)

Unusual Options Volume: COTY (+1352%), DWAC (+1044%), MULN (+714%), BCS (+690%), PENN (+667%), EQT (+665%), CNK (+640%), UVXY (+626%), META (+583%), INFY (+582%), HOOD (+464%), MSTR (+459%), NFLX (+431%), SQ (+424%), RIVN (+413%)

Full lists here: Options AI Free Tools.

Chart of the Day:

NFLX options are currently pricing about an 8% move between now and the days after its earnings, a move smaller than 6 out of its last 8 actual earnings moves.

That’s all for now. Have a great day!

The Options AI Team

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.