Palantir hosts their first Demo Day Tuesday, the 26th after the close. The event includes announcements and demonstrations of some of the company’s latest software.

The stock is sharply higher, with increasing day-to-day volatility since the announcement of the event. Palantir will also report earnings in February. So a busy few weeks in the stock.

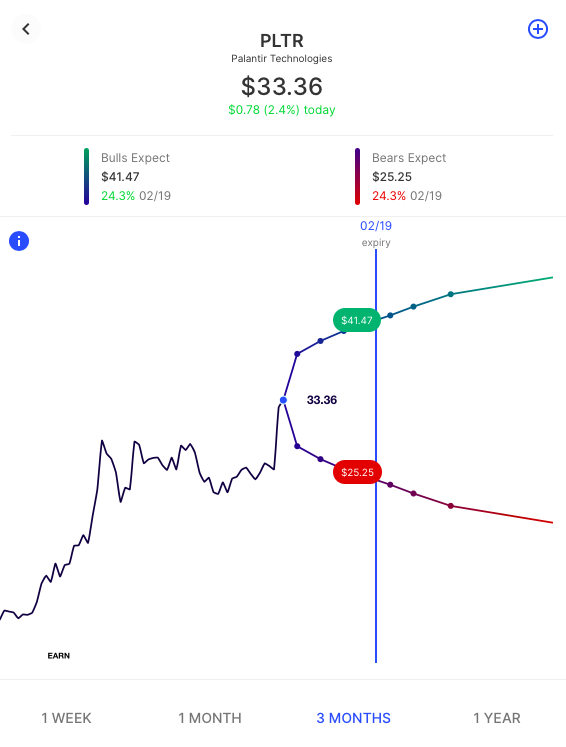

Here’s a look at the recent stock history and how options are pricing the expected move out to mid-February:

Options are pricing about a 25% move in either direction by February 19th expiration, which captures earnings, but with nearly 15% priced in for this week alone, which captures Demo Day.

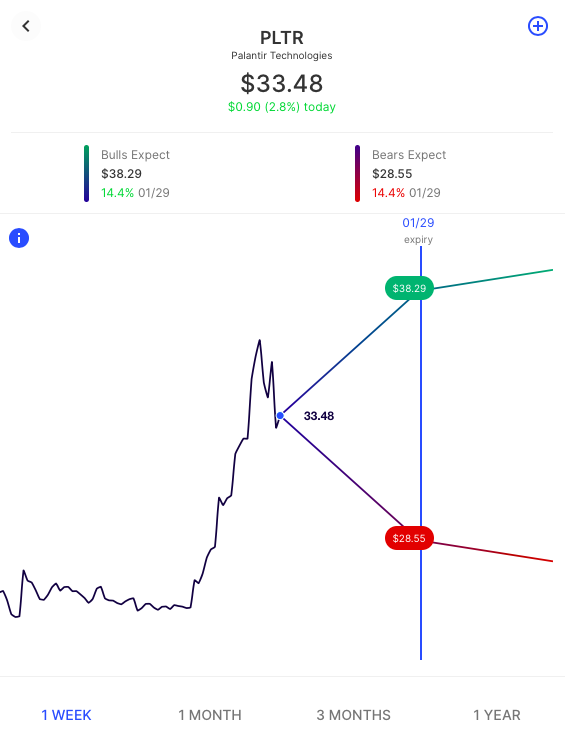

Here’s the look at this week:

For this week, that corresponds to about a $10 range, $28 and $38 in the stock, or about $5 in either direction.

Palantir: Using Option Spreads and the Expected Move

The Options AI expected move chart helps traders visualize just how much volatility option traders are pricing into a stock like PLTR and in what timeframe. And when the expected move is large, it follows that buying options can be expensive.

So, using PLTR as an example, we look at how Spreads can be used to either lower that cost through buying Debit Spreads or generate income through selling Credit Spreads. We also look at how the expected move can be used to help guide strike selection.

Using the Move for Bullish Strategies

Let’s consider the scenario where as a trader you are bullish and knowing the expected move to your timeframe, you also believe that the options market is generally correct in its bullish consensus. In other words, the stock is going up, but its likely not going beyond where the market has priced a potential move.

In this scenario, rather than simply buying a call option, you might choose to simultaneously sell a higher strike call at the expected move level, creating a Debit Call Spread. This lowers the overall cost (thereby also lowering the breakeven level and increasing probability of profit) in exchange for capping potential upside (beyond where the market has priced the move).

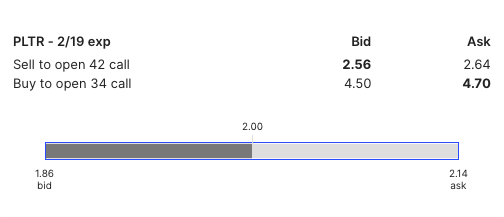

Let’s look at an example as applied to PLTR. Below is a +34/-42 debit call spread for February 19th, capturing both Demo Day, and earnings, with a breakeven in the stock near $36, and max profit above $42:

Looking at the prices of the two calls involved, we can see that the call spread, with a price just over $2 costs less than buying the 42 call outright:

Now let’s look at an alternative bullish strategy that seeks not to lower cost, but rather to capitalize on higher option prices and generate income by ‘selling to the bears’.

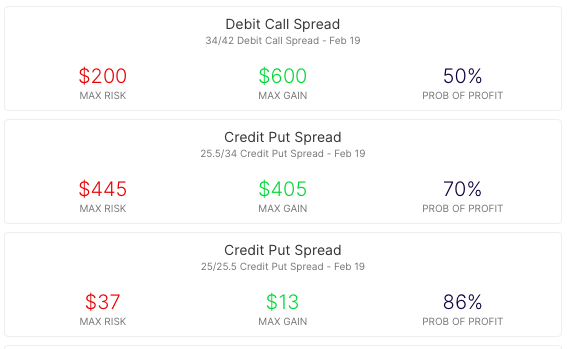

Below, we see two potential alternatives. The first Credit Put Spread could be viewed as essentially ‘mirroring’ the Debit Call Spread – in this case selling an at-the-money Put option and simultaneously buying a Put option at the expected move level (thereby limiting potential downside and defining risk). And also for comparison, we see a second, out-the-money Credit Put Spread, that uses the expected move to guide the initial short strike.

Note that a far out-the-money Credit Put Spread (the last trade shown) has the highest Probability of Profit (likelihood of the stock expiring higher than the breakeven level) but it also presents a relatively high risk to reward ratio (nearly 4 to 1). It can be thought of as selling to those that are extremely bearish.

Whether a trader chooses a Debit or a Credit Spread might depend on their own level of bullishness, compared to the crowd.

Beyond the Expected Move

But what about expectations outside the expected move? If one thinks the crowd is underpricing a potential move? Here’s an example, using a price target beyond the bullish consensus, for February 19th expiry:

A $50 price target is obviously very bullish. But again, by creating a Spread, rather than buying only an out-the-money call, cost is lowered (and therefore breakeven is lowered and probability of profit increased) in return for capping potential upside:

Using the Move for Bearish Strategies

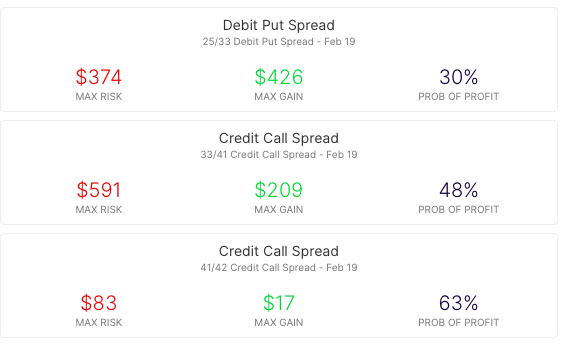

The same concepts apply to Spreads with a bearish view, with Debit Spreads to the expected move helping lower costs and lower break-evens:

Using the Move for Income Generating Strategies

Finally, let’s consider the scenario where you believe that the options market has overpriced the move and believe that the stock will stay within the expected move on a given timeframe.

When ‘selling the move’, Premium (or income) received from selling options is kept if the stock stays within a specific range. Here’s a look at an Iron Condor for this week’s expiration as an example of a neutral strategy that seeks to collect premium (income) if a stock stays within the expected move.

In this example, the +28p/-29p/-38c/+39c Iron Condor establishes a range of max gain for the trade if PLTR stock closes anywhere between 29 and 39 on Friday’s expiry

While by no means the only basis for strike selection, setting Condor strikes at the expected move is essentially taking the other side of option market consensus, while retaining the benefits of defined risk/reward. If the stock moves beyond $28 or $39, the trade results in a max loss.

Summary

Remember, the above are just examples of the many ways a trader might express a view using option spreads. They are intended solely to demonstrate how the expected move can provide actionable insight to consider before making any trade, particularly into an uncertain event. Whether gut-checking your own expectations versus the options crowd, generating trade ideas from option market signals, or for more informed strike selection. That’s why Options AI puts the expected move at the heart of its chart-based platform. Learn / Options AI has a couple of free tools as well as education on expected moves and spread trading. The concepts shown in Palantir can apply to any stock and it is simply used here for illustrative purposes.

[…] post Palantir Demo Day and Using Spreads to Lower Costs when Trading Volatile Stocks appeared first on Options AI: […]