You’ll notice a new trade menu design now live on the platform. It features additional information on the various trade generation modes. The new design is in preparation for several new ways to trade options that you’ll see in the coming weeks.

The New Trade Menu

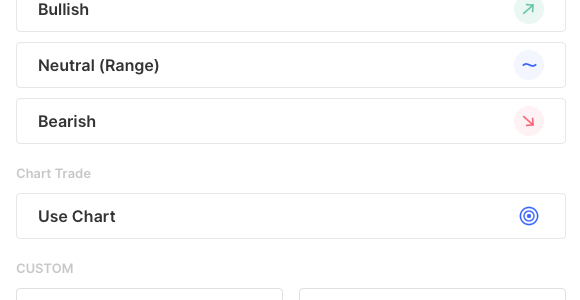

First, a look at the new design, featuring new shortcuts to trade generation modes:

Hover states (on desktop) will reveal trade types that can be accessed via the different modes.

Mode Descriptions

Clicking Learn About Trade Types will reveal descriptions on the various modes and what trades can be accessed (mobile and desktop):

A Preview of What’s to Come.

Custom Trade

You’ll notice that the Custom category is currently inactive. Soon Options AI users will have the ability to select those modes. In the case of Stock, and skip straight to the ticket to buy shares. In the case of Options, skipping to a custom strategy and strike selector. The Custom Options feature is fast and efficient and will feature Options AI unique payout diagrams and trade metrics.

Here’s a sneak peek of the Custom Option screen with selectable Strategy, Strike and Expiration fields that trigger easy to navigate carousels and pickers:

This will allow users to quickly generate a custom trade of their own, seeing the trade’s risk, reward, probability of profit and liquidity of the legs. Upon saving, the user will see their strategy in the context of the Expected Move before proceeding to ticket.

Enhanced Chart Trade

Chart Trade will soon become much more powerful, with the addition of 3 additional modes of trade generation. Here’s a preview:

Set Support / Resistance

Credit Spreads, Covered Calls & Cash Secured Puts to profit if a stock stays above or below your level

Set a Range

Iron Condors & Flies to profit if a stock stays between your levels

Set a Target

Debit Spreads to profit from a stock move to your target

Set Breakout / Breakdown (hedges)

Out-the-money Calls, Puts and Spreads to profit or protect from outsized moves up or down

And a sneak peek of the interface:

Go Commission Free on Options AI

Do you like Options AI? Do you like commission-free trading? Use the referral link to share Options AI with others and get free commissions when they open and fund accounts. Find your unique referral code at the bottom of the main menu (Go Commission Free).