Good morning!

Options AI mobile is now available in the Apple app store! Go find it here.

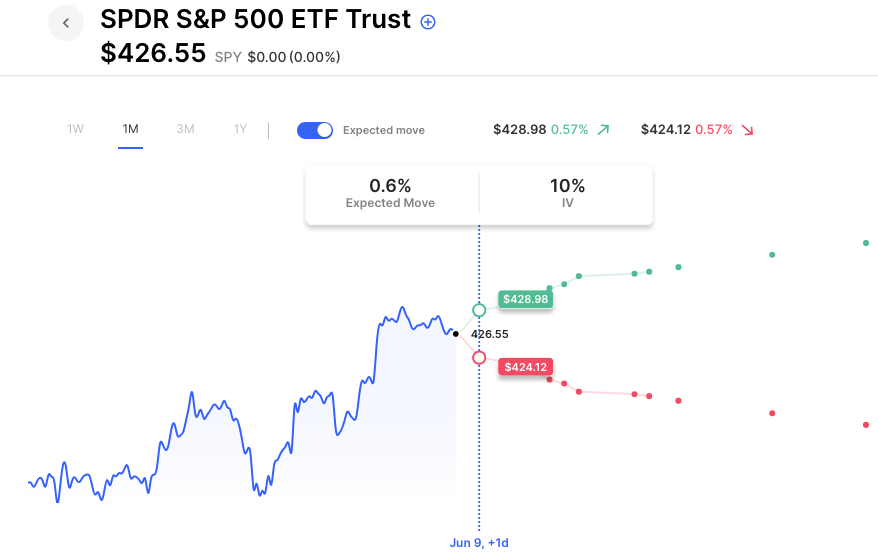

Futures are unchanged once again. The SPY is currently down 0.3% on the week, more or less unchanged. Options are pricing in just a 0.6% change for the balance of the week. Earnings after the close include DocuSign. Big moves this morning include Gamestop. The stock is down 20% following earnings and the firing of their CEO. And on the upside by 23%, Carvana (CVNA) on an updated positive guidance.

Vol went from low to lower yesterday with the VIX closing below 14. Low vol, especially when it follows a period of high vol, can have a dampening effect on stocks as the market gets loaded with long gamma, with traders selling stocks higher and buying lower at increasingly narrowing intervals against decaying long option positions. For option traders, especially those selling credit spreads, one important data point to keep an eye on is realized vs implied vol in near-term options. For instance, SPY IV for Friday’s expiry is just 10. But that’s not crazy considering SPY realized vol for the past month is just 11, and this week so far, even less.

Pre-Market Movers:

- Carvana Company Cl A (CVNA) +27.69%

- Baosheng Media Group Holdings Ltd (BAOS) +90.22%

- Gamestop Corp (GME) -21.98%

- Amazon.com Inc (AMZN) +0.80%

- Atour Lifestyle Holdings ADR (ATAT) -4.34%

- Nvidia Corp (NVDA) +0.28%

- Quantumscape Corp (QS) -9.96%

- Coinbase Global Inc Cl A (COIN) -2.44%

- Apple Inc (AAPL) -0.13%

- Semtech Corp (SMTC) +19.53%

- Hashicorp Inc Cl A (HCP) -22.35%

Today’s Earnings Highlights:

- DocuSign, Inc. (DOCU) Expected Move: 11.40%

- The Toro Company (TTC) Expected Move: 9.70%

- Vail Resorts, Inc. (MTN) Expected Move: 4.80%

- Aegon N.V. (AEG) Expected Move: 5.67%

- Sigma Lithium Corporation (SGML) Expected Move: 5.94%

- Signet Jewelers Limited (SIG) Expected Move: 12.34%

- Manchester United plc (MANU) Expected Move: 14.24%

- FuelCell Energy, Inc. (FCEL) Expected Move: 13.92%

Full list here: Options AI Earnings Calendar.

Economic Calendar:

- At 08:30 AM (EST) Continuing Jobless Claims (May/27) Estimates: 1800, Prior: 1794

- At 08:30 AM (EST) Initial Jobless Claims (Jun/03) Estimates: 235, Prior: 233

- At 08:30 AM (EST) Jobless Claims 4-week Average (Jun/03) Estimates: 230, Prior: 229.75

Options AI Scanner Highlights:

- Overbought (RSI): MVIS (91), ETRN (89), NU (84), RCL (81), TSLA (80), PSTG (79), SOFI (78), NCLH (77), COF (76), CCL (76), MDB (75)

- Oversold (RSI): CGC (6), AAP (11), MULN (22), TGT (24), TMUS (28), PEP (31), TLRY (31)

- High IV: MVIS (+212%), NKLA (+205%), VRAY (+205%), FFIE (+203%), MANU (+195%), GOEV (+194%), TELL (+194%)

- Unusual Options Volume: BTG (+1835%), IAG (+1559%), AGI (+1325%), MVIS (+1234%), SPG (+1214%), KGC (+1180%), ROKU (+912%), GME (+870%), SFIX (+863%), FCEL (+852%)

Full lists here: Options AI Free Tools.

Chart of the Day:

SPY weekly vol sits at 10, with 30 day realized just 11.

That’s all for now. Have a great day!

The Options AI Team

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.