Good morning!

Options AI mobile is now available in the Apple app store! Go find it here.

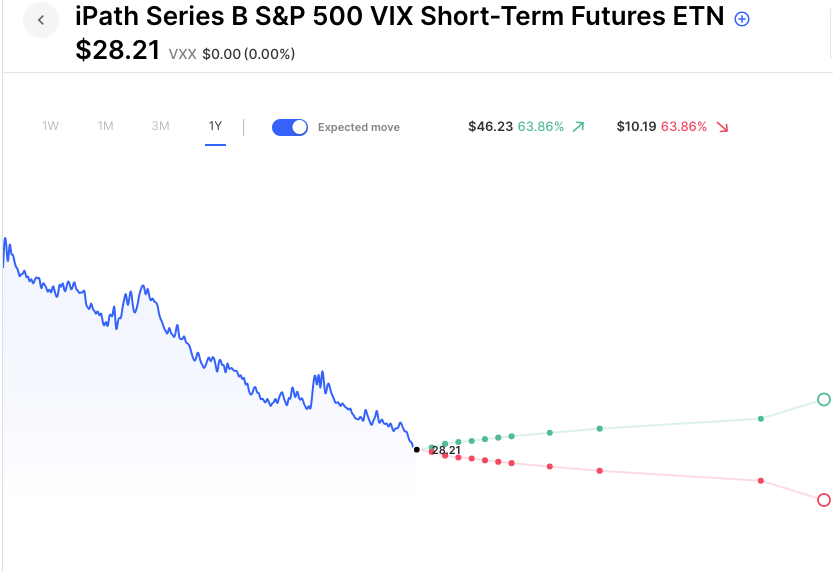

Futures are flat once again. With yesterday’s move higher the SPY is now up 0.3% on the week, well inside its expected move and more or less unchanged. The VIX is now 13.65, its lowest level in years. VIX futures are steeply curved with front month vol so low. For instance, there’s a 13% difference between this month’s VIX futures and next month’s. Looking out to December, there’s a more than 30% difference. Where that steep curve has the biggest impact is in the long-vol ETFs like VXX, UVXY etc., which are in a massive contango drag right now.

Here’s an overly simplified explanation of how these products work. The long vix ETFs attempt to track 1 month futures in VIX. That means each trading day of the month (~20), it needs to sell 1/20th of its front-month position and add 1/20th of the next month’s futures, to its holding at a higher price. (the roll is done in order to keep a mix of futures averaging one month out from today.) With the difference between those two months currently 13%, that means that each day, roughly speaking, these funds are losing 13% on 1/20th of their holdings, over and over. These products are as much a contango/backwardation product as they are a VIX tracking product, and that contango factor is large at the moment.

It’s light on the economic calendar today, as well as on earnings. Some drama is possible next week as we get this month’s CPI, as well as a Fed meeting.

Pre-Market Movers:

- Tesla Inc (TSLA) +6.29%

- Sientra Inc (SIEN) +83.43%

- Medigus Ltd ADR (MDGS) +22.69%

- Nvidia Corp (NVDA) +1.06%

- Docusign Inc (DOCU) +7.22%

- Chargepoint Hldgs Inc (CHPT) -5.20%

- Alibaba Group Holding ADR (BABA) -0.24%

- Baosheng Media Group Holdings Ltd (BAOS) -21.72%

Today’s Earnings Highlights:

- NIO Inc. (NIO) Expected Move: 10.30%

- Tuniu Corporation (TOUR) Expected Move: 52.72%

- Anixa Biosciences, Inc. (ANIX) Expected Move: 26.70%

- Enlivex Therapeutics Ltd. (ENLV) Expected Move: 12.41%

- Organovo Holdings, Inc. (ONVO) Expected Move: 45.37%

Full list here: Options AI Earnings Calendar.

Economic Calendar:

- none

Options AI Scanner Highlights:

- Overbought (RSI): MVIS (91), ETRN (89), NU (84), RCL (81), TSLA (80), PSTG (79), SOFI (78), NCLH (77), COF (76), CCL (76), MDB (75)

- Oversold (RSI): CGC (6), AAP (11), MULN (22), TGT (24), TMUS (28), PEP (31), TLRY (31)

- High IV: MVIS (+212%), NKLA (+205%), VRAY (+205%), FFIE (+203%), MANU (+195%), GOEV (+194%), TELL (+194%)

- Unusual Options Volume: BTG (+1835%), IAG (+1559%), AGI (+1325%), MVIS (+1234%), SPG (+1214%), KGC (+1180%), ROKU (+912%), GME (+870%), SFIX (+863%), FCEL (+852%)

Full lists here: Options AI Free Tools.

Chart of the Day:

Long vol ETFs like VXX are under added pressure due to steep VIX futures contango.

That’s all for now. Have a great day!

The Options AI Team

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.