Good morning!

Options AI mobile is now available in the Apple app store! Go find it here.

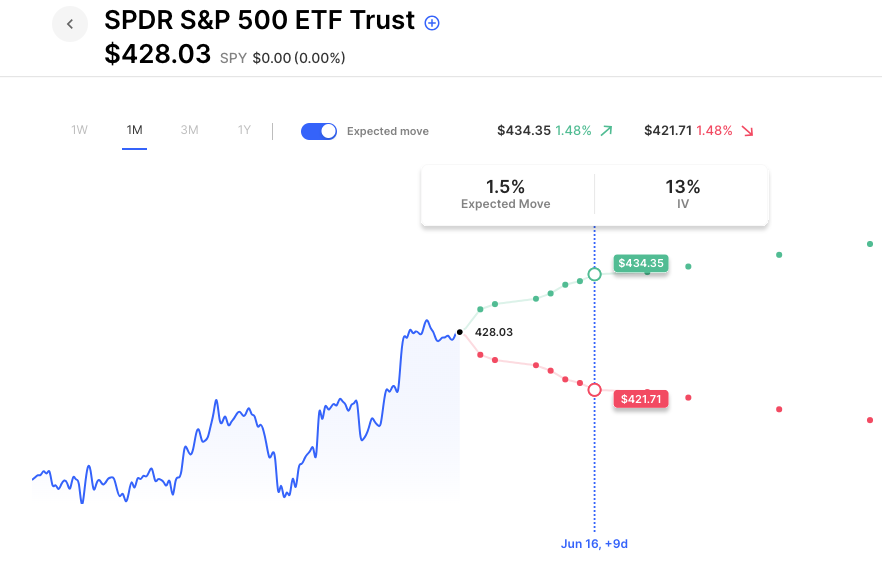

Futures are unchanged this morning, with the SPY unchanged on the week so far. The VIX is around 14, its lowest level since Feb ’22. Weekly IV in SPY is just 10, pricing an expected move for the rest of the week of about 0.7%. So low IV, the lowest we’ve seen in years, but against a backdrop of even lower realized vol (the actual moves SPY is making day to day). IV will likely remain low, (or creep even lower) if the market remains sideways on the week. There is a slight uptick in IV next week, for the FOMC and CPI. IV in SPY next week reaches 13 or so, and then drops back to 11 for the week after (at the moment).

Pre-Market Movers:

- Farmer Brothers (FARM) +75.65%

- Tesla Inc (TSLA) +2.98%

- Palantir Technologies Inc Cl A (PLTR) +2.78%

- Amazon.com Inc (AMZN) -0.51%

- Coinbase Global Inc Cl A (COIN) +2.89%

- Pacwest Bancorp (PACW) +4.75%

- Sofi Technologies Inc (SOFI) +2.61%

- Adv Micro Devices (AMD) +0.38%

- Marathon Digital Hldgs Inc (MARA) -1.98%

- C3.Ai Inc Cl A (AI) +1.41%

- Marvell Technology Inc (MRVL) +6.04%

- Nvidia Corp (NVDA) +0.56%

- Apple Inc (AAPL) -0.04%

- Roblox Corp Cl A (RBLX) -4.43%

- Wayfair Inc (W) +6.92%

- Yext Inc (YEXT) +17.71%

- Riot Platforms Inc (RIOT) -0.92%

- Intel Corp (INTC) +0.03%

- Meta Platforms Inc (META) -0.07%

- Roku Inc (ROKU) +3.21%

- Netflix Inc (NFLX) +3.19%

Today’s Earnings Highlights:

- Campbell Soup Company (CPB) Expected Move: 4.34%

- Smartsheet Inc. (SMAR) Expected Move: 12.67%

- HashiCorp, Inc. (HCP) Expected Move: 11.92%

- Ollie’s Bargain Outlet Holdings, Inc. (OLLI) Expected Move: 9.40%

- United Natural Foods, Inc. (UNFI) Expected Move: 36.91%

- Semtech Corporation (SMTC) Expected Move: 10.31%

- The Lovesac Company (LOVE) Expected Move: 16.06%

- Rent the Runway, Inc. (RENT) Expected Move: 19.19%

Full list here: Options AI Earnings Calendar.

Economic Calendar:

- At 07:00 AM (EST) MBA 30-Year Mortgage Rate (Jun/02) Impact: Medium

- At 08:30 AM (EST) Balance of Trade (Apr) Estimates: -75.2%, Prior: -60.6%

- At 08:30 AM (EST) Exports (Apr) Estimates: 247, Prior: 256.2

- At 08:30 AM (EST) Imports (Apr) Estimates: 325.2, Prior: 320.4

- At 10:30 AM (EST) EIA Crude Oil Stocks Change (Jun/02) Estimates: 1.022, Prior: 4.488

- At 10:30 AM (EST) EIA Gasoline Stocks Change (Jun/02) Estimates: 0.88, Prior: -0.207

- At 08:30 AM (EST) Continuing Jobless Claims (May/27) Estimates: 1800, Prior: 1795

- At 08:30 AM (EST) Initial Jobless Claims (Jun/03) Estimates: 235, Prior: 232

- At 08:30 AM (EST) Jobless Claims 4-week Average (Jun/03) Estimates: 230, Prior: 229.5

Options AI Scanner Highlights:

- Overbought (RSI): PLTR (85), MDB (85), ZS (83), RCL (81), META (81), DDOG (80), TSLA (79), SOFI (77)

- Oversold (RSI): TGT (25), FL (25), TEVA (29), BUD (30), ABBV (31), S (31), NKE (32), PEP (34), VZ (34)

- High IV: VMW (+181%), VOD (+109%), VZ (+107%), OZK (+106%), BB (+106%), TMUS (+105%), TLRY (+105%), BYND (+99%), NIO (+99%), RIOT (+99%), MRK (+98%), DOCU (+98%), KMX (+97%), RIVN (+96%), AMGN (+94%), DNA (+94%)

- Unusual Options Volume: COIN (+908%), EXPE (+611%), KMX (+582%), MSTR (+581%), SHOP (+536%), MARA (+511%), BA (+497%), RIOT (+379%), DASH (+372%), GME (+363%), ORCL (+326%), WYNN (+315%)

Full lists here: Options AI Free Tools.

Chart of the Day:

SPY IV is 10 this week, but has a slight uptick next week for the CPI and FOMC

That’s all for now. Have a great day!

The Options AI Team

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.