Good morning!

Options AI mobile is now available in the Apple app store! Go find it here.

Futures are lower this morning. That follows a fairly eventful FOMC rate announcement day that saw stocks higher, lower, and finally unchanged. The Fed paused as expected, but indicated that 2 more rate hikes may come this year. Option vol fell further, despite the intraday swings as one more mystery was removed from the market. Today saw a retail sales number that beat expectations, +0.3% vs a forecast of -0.2% m/m. That is lower than the prior reading of +0.4%.

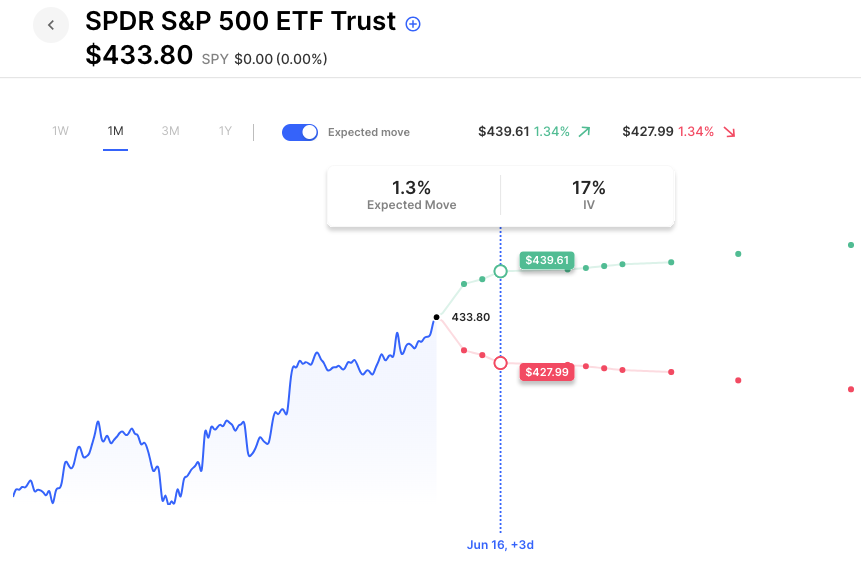

There’s a three-day weekend coming up so it’s a good idea to keep an eye on vol on new trade entries. Typically, IV will fall into the long weekend as market makers protect against getting stuck with a lot of decay over a 3-day span. Something to be aware of as typically the IV will reset higher on Tuesday morning. Of course, overall IV is determined by what happens in the market next.

The VIX is up slightly before the bell on the futures being down but is still just 14.30 or so, indicating very little fear at the moment. SPY at the money IV is just 10-11 for the next few weeks, which is quite low historically. That means SPY options are pricing in just under a 2.5% move for the next month. That’s the type of move options were pricing each week just a few months ago.

Realized vol in SPY for the past month is 11. So options have it priced about right for the moment. But that sort of IV looking out a month essentially requires the SPY to continue to go sideways or grind slowly higher for options to not have been underpriced. If very recent history is any indication, it is capable of doing so. Adobe highlights earnings after the close.

Pre-Market Movers:

- Tesla Inc (TSLA) -3.15%

- Mersana Therapeutics Inc (MRSN) -64.61%

- Dragonfly Energy Hldgs Corp (DFLI) +26.95%

- Leju Holdings Ltd ADR (LEJU) +41.44%

- Sofi Technologies Inc (SOFI) -4.93%

- Palantir Technologies Inc Cl A (PLTR) -2.95%

- Xpeng Inc ADR (XPEV) +2.04%

- Alibaba Group Holding ADR (BABA) +1.54%

- Coinbase Global Inc Cl A (COIN) -5.03%

- Jd.com Inc ADR (JD) +2.17%

Today’s Earnings Highlights:

- Adobe Inc. (ADBE) Expected Move: 6.28%

- The Kroger Co. (KR) Expected Move: 5.07%

- Jabil Inc. (JBL) Expected Move: 4.70%

Full list here: Options AI Earnings Calendar.

Economic Calendar:

- At 08:30 AM (EST) NY Empire State Manufacturing Index (Jun) Estimates: -15.1, Prior: -31.8

- At 08:30 AM (EST) Retail Sales Ex Gas/Autos MoM (May) Estimates: 0.2%, Prior: 0.6%

- At 08:30 AM (EST) Retail Sales YoY (May) Estimates: 1%, Prior: 1.6%

- At 08:30 AM (EST) Retail Sales Ex Autos MoM (May) Estimates: 0.1%, Prior: 0.4%

- At 08:30 AM (EST) Retail Sales MoM (May) Estimates: -0.1%, Prior: 0.4%

Options AI Scanner Highlights:

- Overbought (RSI): SOFI (87), TSLA (86), ORCL (86), DAL (84), NFLX (81), AVGO (81), ADBE (79)

- Oversold (RSI): CGC (6), TMUS (35), MO (37), TGT (37), MRK (37), FL (38), ZIM (38)

- High IV: FGEN (+533%), VRAY (+269%), MANU (+222%), NKLA (+183%), VMW (+174%), MVIS (+158%), RAD (+153%), BYND (+151%)

- Unusual Options Volume: AIG (+1367%), UNH (+763%), UUP (+656%), JETS (+631%), DKS (+606%), TGT (+515%), ORCL (+475%), NVDA (+445%), HOOD (+443%), SOFI (+436%), UPS (+374%)

Full lists here: Options AI Free Tools.

Chart of the Day:

SPY options are pricing about. 1.3% move for the next 4 trading days

That’s all for now. Have a great day!

The Options AI Team

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.