Good morning!

Options AI mobile is now available in the Apple app store! Go find it here.

Futures are slightly higher into the CPI release. Here’s a quick note from Goldman on how the market would be likely to react, their estimate is 0.44:

Core MoM < 0.3% = S&P 500 up 2%

Core MoM 0.3%-0.35% = S&P 500 up 1%

Core MoM 0.35%-0.45% = S&P up or down 0.5%

Core MoM 0.5 to 0.55% = S&P 500 down 1.5%

Core MoM > 0.55% = S&P down 2.5%

(h/t markets and mayhem)

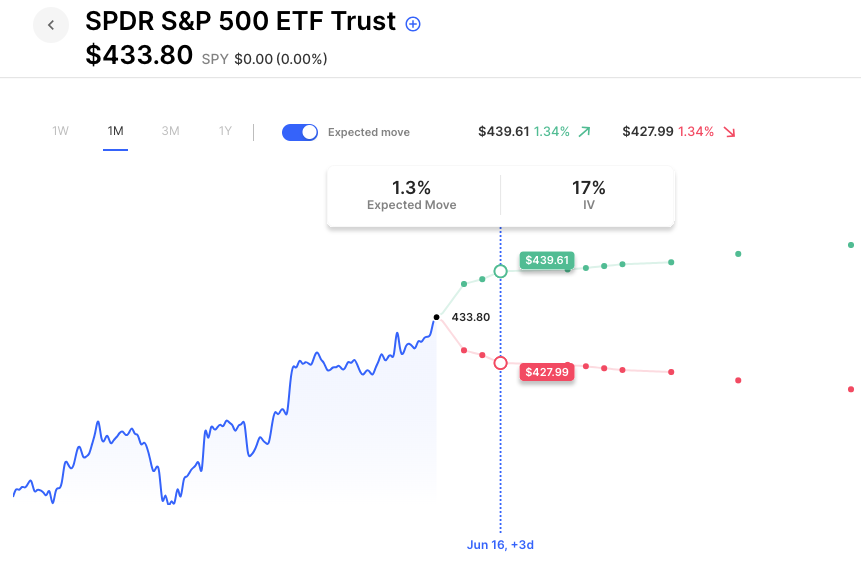

Between this morning’s CPI and the FOMC the options market is pricing about a 1.3% move for the week.

Pre-Market Movers:

- First Wave Biopharma Inc (FWBI) +86.84%

- Millennium Group International Holdings Limited (MGIH) +50.00%

- Manchester United Ltd (MANU) +14.26%

- Sofi Technologies Inc (SOFI) +4.80%

- Adv Micro Devices (AMD) +1.80%

- Apple Inc (AAPL) -0.75%

- Oracle Corp (ORCL) +5.10%

- Suncar Technology Group Inc (SDA) +8.06%

Today’s Earnings Highlights:

- Motorcar Parts of America, Inc. (MPAA) Expected Move: 9.07%

Full list here: Options AI Earnings Calendar.

Economic Calendar:

- At 08:30 AM (EST) Core Inflation Rate MoM (May) Estimates: 0.4%, Prior: 0.4%

- At 08:30 AM (EST) Inflation Rate MoM (May) Estimates: 0.2%, Prior: 0.4%

- At 08:30 AM (EST) Core Inflation Rate YoY (May) Estimates: 5.3%, Prior: 5.5%

- At 08:30 AM (EST) Inflation Rate YoY (May) Estimates: 4.1%, Prior: 4.9%

Options AI Scanner Highlights:

- Overbought (RSI): TSLA (87), SOFI (85), ORCL (81), CCL (81), AVGO (79), DAL (79)

- Oversold (RSI): CGC (6), DG (16), TGT (20), BUD (32), TLRY (33), TEVA (34)

- High IV: FGEN (+508%), BTG (+312%), NKLA (+200%), SIRI (+195%), MULN (+189%)

- Unusual Options Volume: FXI (+1808%), ORCL (+1311%), CCL (+796%), RIVN (+617%), CHPT (+542%), NIO (+485%), INTC (+475%)

Full lists here: Options AI Free Tools.

Chart of the Day:

SPY options are pricing about. 1.3% move for the next 4 trading days

That’s all for now. Have a great day!

The Options AI Team

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.