Hello! This morning we look at the expected moves #0DTE and for the shortened holiday week at a low vol level in $SPX $SPY and $QQQ. Also, did the 4500 $SPX gamma from...

Author - The Options AI Team

Hello! Stocks had another strong week, finishing higher by about 2.3% Both SPX and SPY got stuck in the mud for the final 3 days of last week as they reached a heavy...

Hello! Stocks were in the green into the open but quickly found sellers back down to the 4500 level in SPX. As mentioned, there is a lot of stock being sold above that...

Hello! The indices are unchanged to slightly red this morning. They were more red overnight but as has often been the case the past 2 weeks during this rally dips have...

Hello! A look at year-end debit spreads in $SPY in a low IV environment. Establishing breakevens close to the money for either an outright pullback or as a hedge to the...

Hello! The CPI came in cooler than expected and futures are sharply higher to start the day. This number completes the picture traders and investors were hoping and...

Hello! Income from Options Weekly, Low IV and strike selection on a week with CPI, PPI, retail sales, and continued earnings reports. Plus, slow grind conditions, upper...

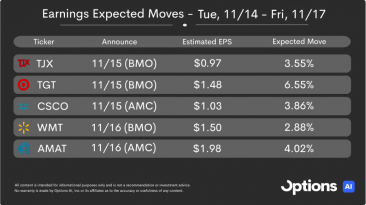

Hello! Last week saw mostly sideways action until Friday’s strong rally took the SPY up 1.2% for the week, about in line with the expected move. This coming week...

Hello! Futures are higher this morning following yesterday’s Powell (and yields) induced pullback. As we’ve been mentioning all week the market is taking a...

Hello! Lower vol, tighter levels. A look at today’s 0DTE setup, a discussion on expectations during a clear market trend and some talk about legging into condors...

Hello! As mentioned on recent Orbit videos (and on twitter) traders can be on the lookout for a few signs this week that the vega/gamma backdrop of the market has...

Stay in the loop

Be the first to hear product announcements and get daily market content from The Orbit.