Hello!

Last week saw mostly sideways action until Friday’s strong rally took the SPY up 1.2% for the week, about in line with the expected move. This coming week sees a potential market-moving CPI and Retail Sales numbers as well as earnings from some of the big retailers themselves. The VIX closed last week near 14, its lowest level since the sell-off began in mid-September. The SPY is now up more than 7% in the past two weeks and is just 4% or so from the Summer highs. With IV this low the expected move for SPY/SPX is just 3.5% into year end. Expected moves for 0DTE in SPY are just 0.6% a day with at the money vol this week about 14 to 15, and beyond that into year-end as low as 12 to 13.

Weekly Expected Moves

- SPY/SPX 1.2%

- QQQ 1.7%

- IWM 1.9%

ODTE expected moves

- SPY/SPX: 0.6%

- QQQ: 0.7%

Economic calendar

- Tuesday – Fed speeches Williams/Jefferson, CPI

- Wednesday – PPI, Retail Sales

- Thursday – Initial Jobless Claims

- Friday – Housing Starts

Earnings This Week

Monday

- MNDY monday.com Ltd. 11.7%

Tuesday

- HD The Home Depot, Inc. 3.7%

- SE Sea Limited 15.7%

- TME Tencent Music Entertainment Group 8.1%

- ONON On Holding AG 9.6%

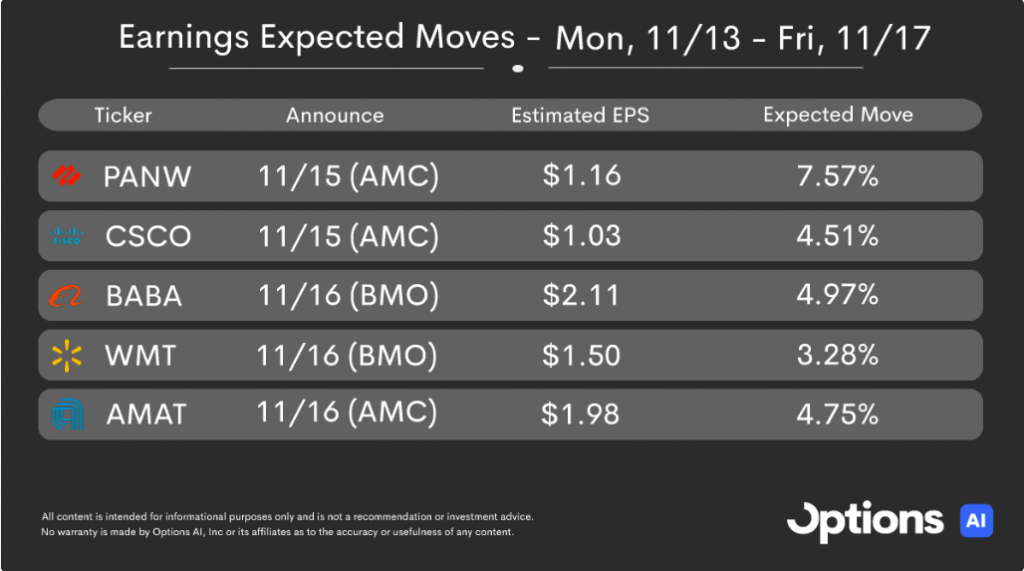

Wednesday

- CSCO Cisco Systems, Inc. 4.3%

- TJX The TJX Companies, Inc. 3.6%

- PANW Palo Alto Networks, Inc. 7.4%

- TGT Target Corporation 7.0%

- XPEV XPeng Inc. 8.3%

Thursday

- BABA Alibaba Group Holding Limited 5.0%

- WMT Walmart 3.2%

- AMAT Applied Materials, Inc. 4.4%

- NTES NetEase, Inc. 4.9%

- ROST Ross Stores, Inc. 4.4%

- WMG Warner Music Group Corp. 6.5%

- NICE NICE Ltd. 8.3%

- WSM Williams-Sonoma, Inc. 5.8%

- M Macy’s, Inc. 12.0%

Friday

- BJ BJ’s Wholesale Club Holdings, Inc. 6.5%

- SPB Spectrum Brands Holdings, Inc. 4.2%

- FL Foot Locker, Inc. 4.9%

Full calendar here Options AI Calendar

Follow The Orbit on Twitter and Youtube

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC