Hello!

Futures are higher this morning following yesterday’s Powell (and yields) induced pullback. As we’ve been mentioning all week the market is taking a bit of a breather from the volatility of the past month. Rallies finding sellers and sell-offs finding buyers is a sign of a market loaded with gamma after a rapid decline in the VIX. Keep an eye on those trends. What usually clears those conditions are either a large expiration (Nov monthly expiry is on the 17th) or market-moving news that is enough to send the indices from a heavy gamma area (strikes with lots of open interest) towards areas of either short gamma or low open interest.

Even with the red day yesterday, the VIX is below 15 as we enter Friday. The SPX is essentially unchanged on the week. If this week’s trading action were to carry over into next week the VIX could see low teens. With that low IV comes very tight expected moves day to day so those selling options for income should be aware of where their strikes are in relation to the underlying.

When vol is super low a market (or individual stock) will tend to go outside its expected move more often than when vol is super high. The difference being that when vol is super high it may violate the expected move by a lot more while when vol is low it may just go outside barely. So it often makes sense in low vol environments to go a bit wider from the stock, taking in less premium but giving enough room for those slight violations of the expected move to not be a big loser.

0DTE Expected Moves

- SPY: 0.6% (up 0.4% pre)

- QQQ: 0.75% (up 0.4% pre)

Pre-Market Movers:

Plug Power Inc (PLUG) -36.76%

Trade Desk Inc (TTD) -23.71%

Unity Software Inc (U) -13.55%

Marathon Digital Hldgs Inc (MARA) +3.47%

Riot Platforms Inc (RIOT) +3.14%Groupon Cl A (GRPN) -29.84%

Coinbase Global Inc Cl A (COIN) +2.74%

Wynn Resorts Ltd (WYNN) -5.52%

Economic Calendar:

At 10:00 AM (EST) Michigan Consumer Sentiment (Nov) Estimates: 63.7, Prior: 63.8

Unusual Options Volume

BBD (+1180%), APP (+1126%), UMC (+1089%), BILL (+1045%), TTD (+958%), ARM (+885%), CPNG (+818%), AMC (+797%), COIN (+773%), SPCE (+764%), MSTR (+760%), MARA (+728%), TWLO (+724%), U (+718%), WYNN (+700%), FSR (+520%)

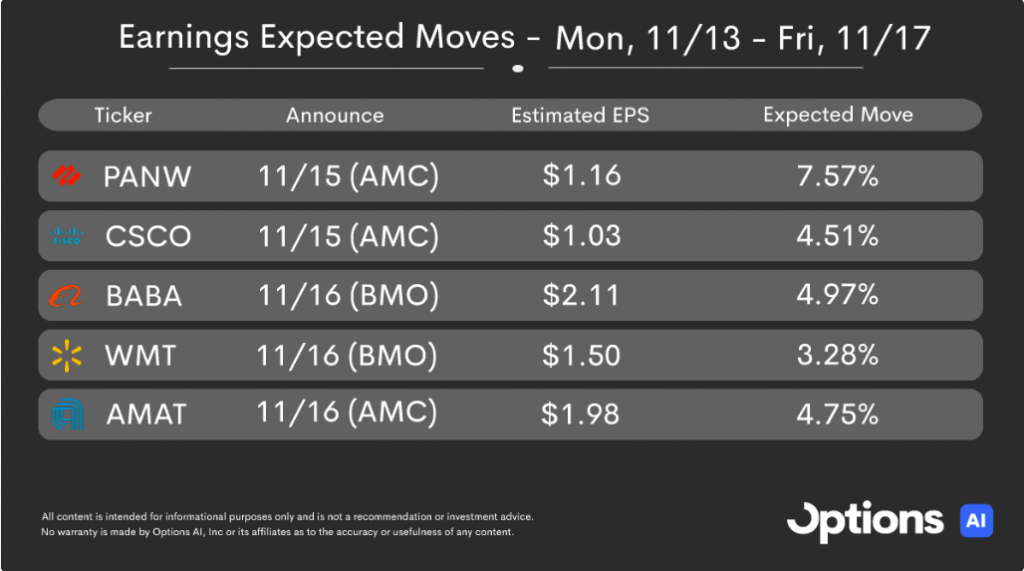

A look ahead at next week’s earnings:

Follow The Orbit on Twitter and Youtube

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC