Good morning!

Futures are higher to start the 4 day week, with the S&P indicated up 0.5% and the Nasdaq up 1.3%. Nvidia’s surge continues following earnings last week with the stock up about 4%. Tesla is also helping, up more than 4% as well. The SPY was essentially unchanged once again last week, but there was more than meets the eye as it rallied almost 2.5% from its intra-week lows. IV also saw a decent range, closing the week near 17 but seeing a high near 21 on Wednesday. Although the SPY has been relatively quiet in May, up about 1%, the Nasdaq has been the story, now up nearly 10% on the month. This week features nonfarm payrolls on Friday. Earnings highlights this week include Salesforce and Crowdstrike Wednesday, with Broadcom and Lululemon Thursday.

Pre-Market Movers:

- Palantir Technologies Inc Cl A (PLTR) +7.33%

- Tesla Inc (TSLA) +4.12%

- C3.Ai Inc Cl A (AI) +12.14%

- Nvidia Corp (NVDA) +4.70%

- Sofi Technologies Inc (SOFI) +7.39%

- Iovance Biotherapeutics Inc (IOVA) +19.60%

- Equitrans Midstream Corp (ETRN) +38.26%

- Riot Platforms Inc (RIOT) +6.14%

- Chargepoint Hldgs Inc (CHPT) +6.83%

- McDonald’s Corp (MCD) -0.36%

Today’s Earnings Highlights:

- VMware, Inc. (VMW) Expected Move: 5.60%

- HP Inc. (HPQ) Expected Move: 5.39%

- Hewlett Packard Enterprise Company (HPE) Expected Move: 7.05%

- U-Haul Holding Company (UHAL) Expected Move: 7.70%

- Box, Inc. (BOX) Expected Move: 6.94%

- Ambarella, Inc. (AMBA) Expected Move: 10.25%

Full list here: Options AI Earnings Calendar.

Economic Calendar:

- At 09:00 AM (EST) S&P/Case-Shiller Home Price MoM (Mar) Estimates: 0.4%, Prior: 0.2%

- At 09:00 AM (EST) S&P/Case-Shiller Home Price YoY (Mar) Estimates: -1.6%, Prior: 0.4%

- At 10:30 AM (EST) Dallas Fed Manufacturing Index (May) Estimates: -25%, Prior: -23.4%

- At 01:00 PM (EST) Fed Barkin Speech Impact: Medium

- At 08:50 AM (EST) Fed Bowman Speech Impact: Medium

- At 09:45 AM (EST) Chicago PMI (May) Estimates: 47%, Prior: 48.6%

- At 12:30 PM (EST) Fed Harker Speech Impact: Medium

- At 01:30 PM (EST) Fed Jefferson Speech Impact: Medium

Options AI Scanner Highlights:

- Overbought (RSI): MRVL (89), AVGO (87), NVDA (84), AMD (83), PLTR (82), XP (80), META (79), TSM (78)

- Oversold (RSI): VRAY (17), BTU (23), FL (23), KO (23), AMGN (23), ABBV (24), NKE (25)

- High IV: BTG (+447%), MMAT (+417%), IEP (+290%), SAN (+245%), LU (+243%), OZK (+145%)

- Unusual Options Volume: MRVL (+1005%), AVGO (+861%), SMH (+821%), COST (+784%), ADBE (+574%), MU (+567%), QQQ (+493%), SQQQ (+491%)

Full lists here: Options AI Free Tools.

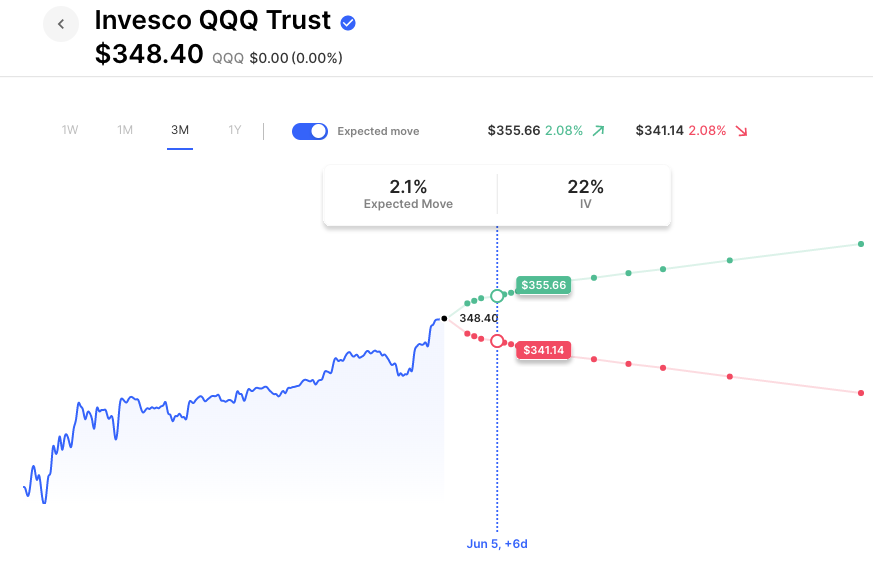

Chart of the Day:

QQQ options are pricing about a 2% move for the week. It’s higher by about 1.3% pre-market.

That’s all for now. Have a great day!

The Options AI Team

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.