Good morning!

Futures are lower this morning following a reversal yesterday that saw stocks gap higher on the open but then give up those gains as the day progressed. IV remains subdued, with SPY weekly vol around 14 (that includes an NFP job number on Friday) and then 12-14 vol for the next several weeks. Earnings after the bell include Salesforce, Crowdstrike, AI, and Nordstrom.

Pre-Market Movers:

- Wang & Lee Group Inc (WLGS) +55.40%

- C3.Ai Inc Cl A (AI) -5.85%

- Sofi Technologies Inc (SOFI) +4.15%

- American Airlines Gp (AAL) +2.05%

- Advance Auto Parts Inc (AAP) -28.70%

- Alibaba Group Holding ADR (BABA) +0.67%

- Trip.com Group Ltd ADR (TCOM) +1.82%

- Carvana Company Cl A (CVNA) -4.66%

- LL Flooring Hldgs Inc (LL) +21.26%

Today’s Earnings Highlights:

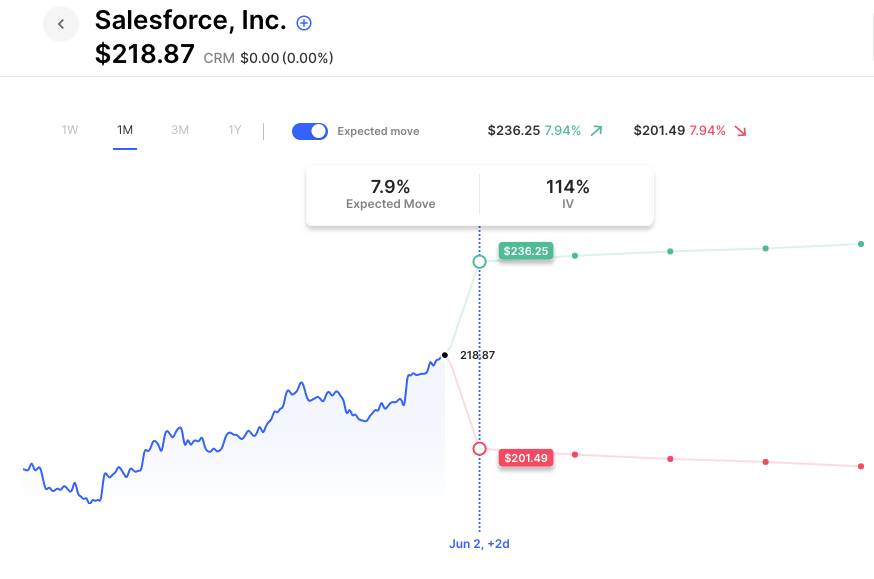

- Salesforce, Inc. (CRM) Expected Move: 7.92%

- AutoZone, Inc. (AZO) Expected Move: 6.70%

- CrowdStrike Holdings, Inc. (CRWD) Expected Move: 9.33%

- NetApp, Inc. (NTAP) Expected Move: 5.40%

- Okta, Inc. (OKTA) Expected Move: 10.37%

- Advance Auto Parts, Inc. (AAP) Expected Move: 33.03%

- Nordstrom, Inc. (JWN) Expected Move: 11.15%

- American Superconductor Corporation (AMSC) Expected Move: 19.87%

Full list here: Options AI Earnings Calendar.

Economic Calendar:

- At 08:50 AM (EST) Fed Bowman Speech Impact: Medium

- At 09:45 AM (EST) Chicago PMI (May) Estimates: 47%, Prior: 48.6%

- At 01:30 PM (EST) Fed Jefferson Speech Impact: Medium

- At 09:45 AM (EST) S&P Global Manufacturing PMI (May) Impact: High

- At 10:00 AM (EST) ISM Manufacturing PMI (May) Estimates: 47%, Prior: 47.1%

- At 12:30 PM (EST) Fed Harker Speech Impact: Medium

Options AI Scanner Highlights:

- Overbought (RSI): ETRN (89), NVDA (85), PLTR (85), AI (85), AVGO (83), MRVL (83), META (80)

- Oversold (RSI): CGC (6), SRPT (17), KO (21), BUD (21), TGT (22), BTU (22)

- High IV: SAN (+243%), HPE (+224%), NKLA (+188%), VMW (+179%)

- Unusual Options Volume: HPE (+1834%), HPQ (+1196%), AI (+1101%), QCOM (+1017%), SPWR (+951%), AVGO (+833%), CVNA (+795%), GS (+701%), TGT (+698%), CRM (+681%)

Full lists here: Options AI Free Tools.

Chart of the Day:

Salesforce options are pricing about an 8$ move for earnings.

That’s all for now. Have a great day!

The Options AI Team

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.