Good morning!

Core PCE, the Fed’s preferred inflation gauge came in slightly higher than expectations and remains stubbornly sticky. Stubborn inflation has become a theme recently and one can see in short-term yields how much has changed since the SVB collapse, where expectations of a dovish Fed to battle either recession or a potential banking collapse have vanished. For instance, the 1-year yield is back to where it was before the regional bank crisis. It’s unlikely that the Fed suddenly turns aggressive and harms stocks, but the bullish for stocks case of rate cust potentially coming late 2023 seems to have vanished. This type of stalemate may be contributing to the sideways action in the market.

Futures are pointing to an unchanged opened more or less. Currently, the SPY is down about 1% on the week, following a move slightly higher last week. Again, mostly sideways action with the market in standby mode. With the 3-day weekend ahead SPY IV expiring Tuesday is just 12, with next Friday about 15. Looking out 3 months, at the money IV is mostly in the 15-16 range, quite low historically. The VIX is 19, about its historical average, and has high skew, with downside puts much higher IV than upside calls on a percentage basis.

Pre-Market Movers:

- Elevation Oncology Inc (ELEV) +49.83%

- Pdd Holdings Inc (PDD) +13.81%

- Quhuo Ltd ADR (QH) +38.69%

- Marvell Technology Inc (MRVL) +17.08%

- Adv Micro Devices (AMD) +2.09%

- Tingo Group Inc (TIO) -6.84%

- Big Lots (BIG) -11.93%

- Gap Inc (GPS) +10.65%

Today’s Earnings Highlights:

- PDD Holdings Inc. (PDD) Expected Move: 13.01%

- VMware, Inc. (VMW) Expected Move: 4.43%

- Booz Allen Hamilton Holding Corporation (BAH) Expected Move: 6.29%

- Big Lots, Inc. (BIG) Expected Move: 34.33%

- Azure Power Global Limited (AZRE) Expected Move: 18.40%

- Camber Energy, Inc. (CEI) Expected Move: 8.33%

Full list here: Options AI Earnings Calendar.

Economic Calendar:

- At 08:30 AM (EST) Durable Goods Orders MoM (Apr) Estimates: -1%, Prior: 3.2%

- At 08:30 AM (EST) Core PCE Price Index MoM (Apr) Estimates: 0.3%, Prior: 0.3%

- At 08:30 AM (EST) Wholesale Inventories MoM (Apr) Estimates: 0%, Prior: 0%

- At 10:00 AM (EST) Michigan Consumer Sentiment (May) Estimates: 57.7%, Prior: 63.5%

Options AI Scanner Highlights:

- Overbought (RSI): NU (83), NVDA (82), AMD (80), PLTR (79), AVGO (78), XP (78), TSM (76), MRVL (76)

- Oversold (RSI): CGC (6), VRAY (17), SRPT (19), T (19), IEP (21), FYBR (21)

- High IV: MMAT (+416%), BTG (+413%), IEP (+290%), FFIE (+238%), RYAM (+210%), AIV (+201%), SAN (+191%), NKLA (+186%)

- Unusual Options Volume: CPNG (+1238%), IAU (+1048%), TSM (+1005%), DLTR (+985%), NVDA (+982%), SNOW (+977%), GPS (+957%), COST (+904%), SMH (+898%), MRVL (+837%), AVGO (+729%)

Full lists here: Options AI Free Tools.

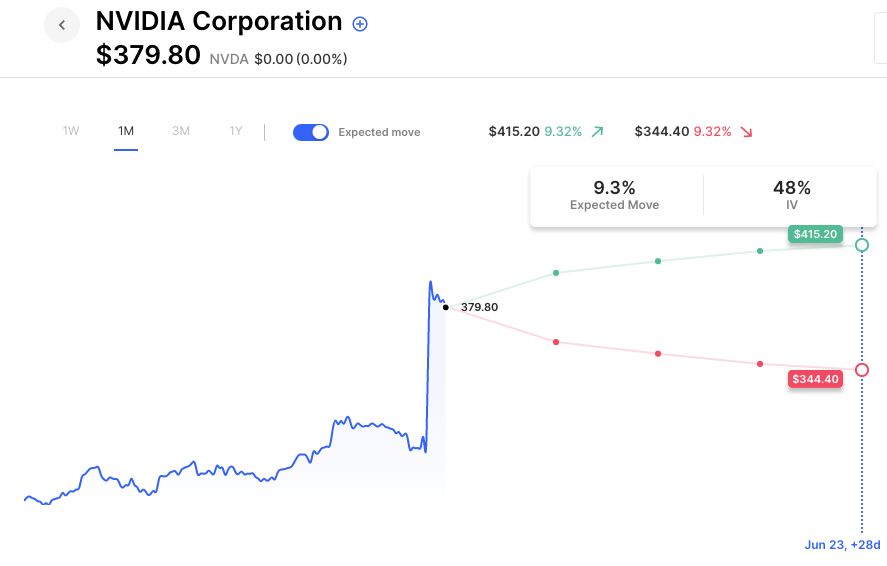

Chart of the Day:

Following a 25% move higher on earnings, Nvidia options are now pricing in about a 10% move for the next month.

That’s all for now. Have a great day!

The Options AI Team

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.