Good morning!

Nvidia is up an astonishing 30% pre-market. An insane move for a company of that market cap and one where the prior all-time high served as no resistance to the upside. Options weren’t even close to getting the potential move right, pricing in only about a 6% move. NVDA’s move is taking futures higher with it. Nasdaq futures are up about 2.1% and S&P up about 0.7%. What isn’t higher with it are some large chip competitors like Intel and AMD, in fact Intel is lower by nearly 2%. Snowflake also reported and is down 15% pre-market.

After the close today we see earnings from Costco, Workday, Restoration Hardware, Workday, Ulta Beauty, Autodesk and more.

Pre-Market Movers:

- Nvidia Corp (NVDA) +29.11%

- Nano Labs Ltd ADR (NA) +53.79%

- Beamr Imaging Ltd Ordinary Share (BMR) +136.24%

- Adv Micro Devices (AMD) +9.08%

- Qualcomm Inc (QCOM) -1.47%

- Intel Corp (INTC) -2.55%

- Snowflake Inc Cl A (SNOW) -14.28%

- Juniper Networks (JNPR) +0.03%

- Biocept Inc (BIOC) -40.47%

Today’s Earnings Highlights:

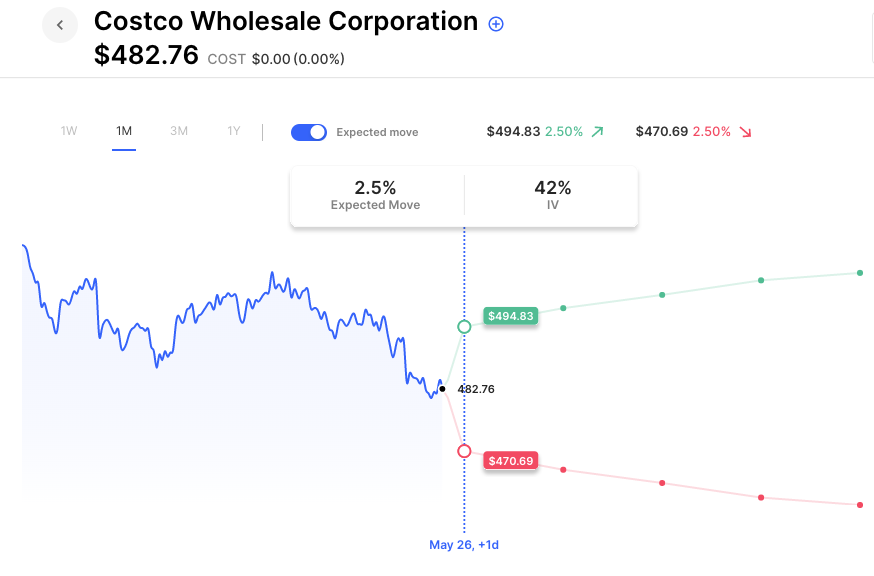

- Costco Wholesale Corporation (COST) Expected Move: 2.56%

- Workday, Inc. (WDAY) Expected Move: 5.08%

- Autodesk, Inc. (ADSK) Expected Move: 5.30%

Full list here: Options AI Earnings Calendar.

Economic Calendar:

- At 08:30 AM (EST) Initial Jobless Claims (May/20) Estimates: 245, Prior: 242

- At 08:30 AM (EST) Jobless Claims 4-week Average (May/20) Estimates: 258.97, Prior: 244.25

- At 08:30 AM (EST) GDP Price Index QoQ (Q1) Estimates: 4%, Prior: 3.9%

- At 08:30 AM (EST) Corporate Profits QoQ (Q1) Estimates: -0.9%, Prior: -2.7%

- At 08:30 AM (EST) GDP Growth Rate QoQ (Q1) Estimates: 1.1%, Prior: 2.6%

- At 10:30 AM (EST) Fed Collins Speech Impact: Medium

- At 08:30 AM (EST) Core PCE Price Index MoM (Apr) Estimates: 0.3%, Prior: 0.3%

- At 08:30 AM (EST) PCE Price Index MoM (Apr) Estimates: 0.2%, Prior: 0.1%

Options AI Scanner Highlights:

- Overbought (RSI): MVIS (86), NU (82), PLTR (76), XP (74), APPS (73), DDOG (72), META (72), AMD (70), UPST (70)

- Oversold (RSI): CGC (6), VRAY (18), SRPT (20), MULN (22), FL (22), FYBR (22), IEP (23), SAVE (24), T (25), NKE (25)

- High IV: BTG (+388%), ACB (+266%), IEP (+265%), MMAT (+256%), FFIE (+228%), AIV (+208%)

- Unusual Options Volume: NU (+1547%), ADI (+1038%), BBY (+894%), PANW (+865%), XHB (+851%), GLW (+787%), CSX (+783%), SPLK (+767%), KSS (+678%), ZM (+629%), SNOW (+580%)

Full lists here: Options AI Free Tools.

Chart of the Day:

Costco options are pricing about a 2.5% move.

That’s all for now. Have a great day!

The Options AI Team

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.