Good morning!

Futures are indicated about 0.5% lower, following yesterday’s 1% selloff. that two-day move essentially erases the gains from the past week or so and again the market remains sideways. The VIX is showing signs of life, now just under 20, its highest level since May 4th and near its historical average. 30 Day At the money SPY IV is about 15, so the VIX is still reflecting heavy skew on the puts side, with traders likely hedging against bad headline risk while options are relatively cheap.

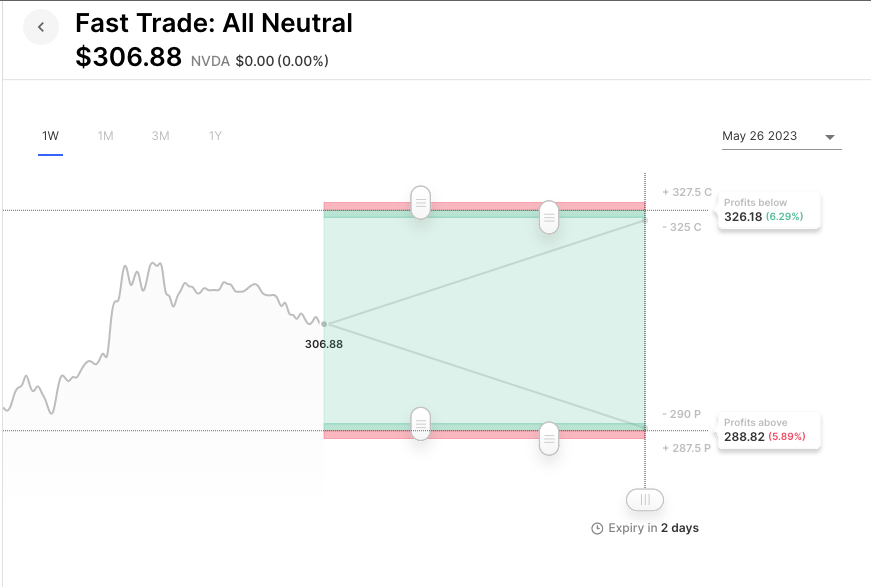

Nvidia leads earnings after the bell of note, Snowflake and Splunk also report. Nvidia options are pricing about a 5.7% move. Prior earnings saw moves of 14.%, -1.5%, 4.%, and 5.2%.

Pre-Market Movers:

- Gigacloud Technology Inc Cl A (GCT) +73.67%

- Tesla Inc (TSLA) -1.73%

- Enveric Biosciences Inc (ENVB) +44.13%

- Kohl’s Corp (KSS) +11.94%

- Zura Bio Ltd (ZURA) +25.24%

- Macy’s Inc (M) +4.15%

- Futu Holdings Ltd ADR (FUTU) +1.63%

- Shopify Inc (SHOP) -1.59%

- Sarepta Therapeutics (SRPT) -14.70%

- Intuit Inc (INTU) -5.51%

- Cohbar Inc (CWBR) -23.55%

Today’s Earnings Highlights:

- NVIDIA Corporation (NVDA) Expected Move: 5.90%

- Analog Devices, Inc. (ADI) Expected Move: 5.62%

- Bank of Montreal (BMO) Expected Move: 4.59%

- Snowflake Inc. (SNOW) Expected Move: 7.90%

- VMware, Inc. (VMW) Expected Move: 5.25%

- Splunk Inc. (SPLK) Expected Move: 7.42%

- Kohl’s Corporation (KSS) Expected Move: 10.90%

- Abercrombie & Fitch Co. (ANF) Expected Move: 13.26%

Full list here: Options AI Earnings Calendar.

Economic Calendar:

- At 10:30 AM (EST) Fed Collins Speech Impact: Medium

- At 02:00 PM (EST) FOMC Minutes Impact: High

Options AI Scanner Highlights:

- Overbought (RSI): MVIS (86), NU (84), PLTR (83), XP (73), ISEE (73), BBD (73), AVGO (72)

- Oversold (RSI): CGC (6), VRAY (18), FL (23), MULN (23), FYBR (24), SAVE (25), NKE (26)

- High IV: MMAT (+390%), BTG (+370%), FFIE (+253%), SAN (+209%), AIV (+209%), ACB (+201%), GOEV (+199%), NKLA (+198%)

- Unusual Options Volume: VMW (+1515%), DNA (+958%), TIP (+819%), ZM (+790%), AVGO (+769%), PFE (+756%), FYBR (+707%), CVNA (+695%), PANW (+671%), PLTR (+627%), DKS (+624%)

Full lists here: Options AI Free Tools.

Chart of the Day:

With Nvidia options pricing about a 6% move, an Iron Condor set at that move, expiring Friday, would need the stock to remain between about $288 and $326:

That’s all for now. Have a great day!

The Options AI Team

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.