Good morning!

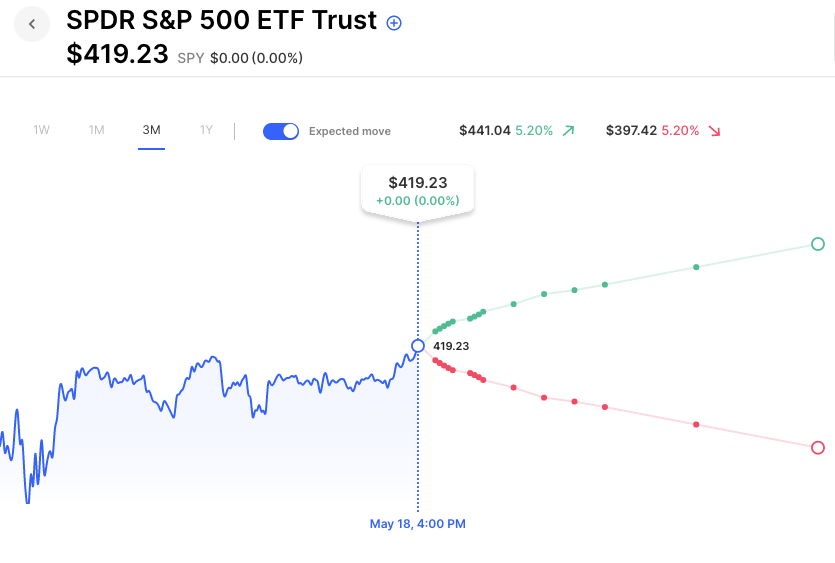

Futures are pointing to a higher open, following up on yesterday’s rally. As of yesterday’s close, the S&P 500 is up 1.8% on the week. The Nasdaq is up 3.3%. This would not only be the best week for stocks since March, but also the first time the market has moved outside the move options were pricing. The prior high of the range SPY has been in since March was around $417. Yesterday’s close of $419.23 was well through that resistance and futures are indicating even further follow-through this morning. That breakout of the recent range to the upside also caused IV to finally break. The VIX is now 16, near its post covid lows of 15.

Fed Chair Powell speaks later today. Short-term treasury yields have been ticking higher of late. The 1-year treasury yield is fast approaching its pre-Silicon Valley Bank collapse levels. Keep an eye on yields for instant market reaction to Powell’s speech but also note the trend lately.

Pre-Market Movers:

- Palantir Technologies Inc Cl A (PLTR) -0.17%

- Farfetch Ltd Cl A (FTCH) +20.28%

- Footlocker Inc (FL) -24.86%

- Suncar Technology Group Inc (SDA) +72.93%

- Tesla Inc (TSLA) +0.46%

- Pacwest Bancorp (PACW) +4.11%

- Alibaba Group Holding ADR (BABA) -1.32%

- Amazon.com Inc (AMZN) +0.24%

- Gsi Technology Inc (GSIT) +2.36%

- Adv Micro Devices (AMD) -0.80%

- Nvidia Corp (NVDA) -0.51%

- Alphabet Cl A (GOOGL) +1.24%

- Apple Inc (AAPL) +0.33%

- Marathon Digital Hldgs Inc (MARA) +1.28%

- Bank of America Corp (BAC) +0.46%

- Alphabet Cl C (GOOG) +1.13%

Today’s Earnings Highlights:

- RBC Bearings Incorporated (RBC) Expected Move: 6.70%

- Catalent, Inc. (CTLT) Expected Move: 13.80%

- Foot Locker, Inc. (FL) Expected Move: 28.83%

Full list here: Options AI Earnings Calendar.

Economic Calendar:

- At 08:45 AM (EST) Fed Williams Speech Impact: Medium

- At 09:00 AM (EST) Fed Bowman Speech Impact: Medium

- At 11:00 AM (EST) Fed Chair Powell Speech Impact: High

- At 08:00 PM (EST) News Conference on Debt Ceiling Impact: Medium

Options AI Scanner Highlights:

- Overbought (RSI): APP (85), PLTR (80), XELA (79), DDOG (79), GOOGL (78), ORCL (78), TTWO (76), AMAT (76), SNOW (75)

- Oversold (RSI): PFE (22), EVGO (26), SRPT (27), BUD (29), PYPL (31), PTON (38), GLD (39), JNJ (39), PLUG (39)

- High IV: MMAT (+260%), VRAY (+217%), FFIE (+209%), PACW (+167%), OZK (+142%), ZM (+121%), ZION (+121%), PANW (+104%), RAD (+103%), PLUG (+102%)

- Unusual Options Volume: CTLP (+1161%), ATUS (+1061%), NFLX (+1031%), LAZR (+1027%), SMH (+1009%), PLTR (+976%), TTWO (+960%), GRAB (+882%), NVDA (+716%), JBLU (+590%)

Full lists here: Options AI Free Tools.

Chart of the Day:

SPY has broken out above the recent range as of yesterday’s close:

That’s all for now. Have a great day!

The Options AI Team

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.