Good morning!

SPY finally made a move last week, albeit not a huge one. It got above the very tight range the market had been trading in for the past month and a half, closing up 1.8% on the week, beyond what options were pricing. Because that “outsized” move came to the upside, IV didn’t do much. The VIX dipped below 16 mid-week and closed the week just under 17, essentially the same level as the prior week.

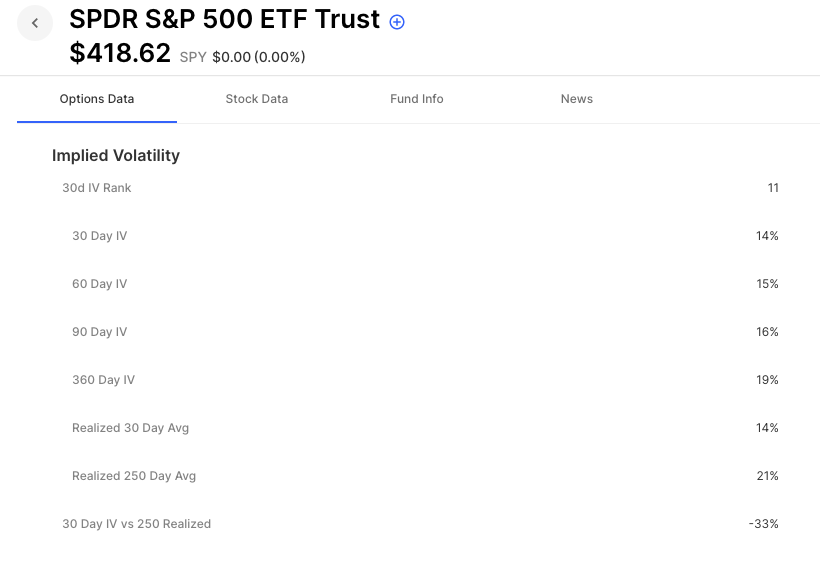

In general in options trading, one wants to sell high IV and buy low IV because if given enough time IV tends to mean revert. However, in the case of a short time frame, say trades with expiries under a month, most trades are not mean reverting IV trades as much as they are an IV vs realized vol trade. Over the past month and a half, IV has continued to go lower, but so has realized vol. For example, if one bought SPY straddles for 16 vol, because that was “low” would soon realize that the actual vol, or realized vol of the SPY over the past month was lower. One place to see that relationship on Options AI is the options data tab on the symbol/company page. One can see current 30-day IV and compare it to the past 30 days of realized vol, as well as the past year. That number of SPY IV vs Realized or actual has consistently meant that IV was actually too high for the past month and a half. Today, however, it’s somewhat aligned. The 30-day IV in SPY currently stands at 14, the 30-day realized (how much SPY has moved in the past 30 days) is also 14. Options have at least gotten the message and are aligned with 30-day realized. Now it’s up to the market to decide what it wants to do next.

This week’s notable earnings include Zoom, Lowes, Palo Alto Networks, Best Buy, Costco and of course Nvidia. On the economic calendar, we have more Fed speeches (all week) but also Fed Minutes on Wednesday and the PCE on Friday.

Pre-Market Movers:

- Immix Biopharma Inc (IMMX) +23.78%

- AT&T Inc (T) +0.25%

- Pacific Gas & Electric Company (PCG) -0.12%

- Micron Technology (MU) -3.92%

- Pacwest Bancorp (PACW) +8.91%

- Plug Power Inc (PLUG) +5.82%

- Zim Integrated Shipping Services Ltd (ZIM) -8.97%

- Apple Inc (AAPL) -0.92%

- Adv Micro Devices (AMD) -0.90%

- Intercept Pharmaceuticals (ICPT) -14.09%

- Nvidia Corp (NVDA) -0.59%

- Amazon.com Inc (AMZN) +0.64%

- Tingo Group Inc (TIO) +4.51%

- Marathon Digital Hldgs Inc (MARA) -0.05%

- Oracle Corp (ORCL) +0.11%

Today’s Earnings Highlights:

- Ryanair Holdings plc (RYAAY) Expected Move: 6.80%

- HEICO Corporation (HEI) Expected Move: 5.00%

- Zoom Video Communications, Inc. (ZM) Expected Move: 10.38%

- Nordson Corporation (NDSN) Expected Move: 5.60%

- Full Truck Alliance Co. Ltd. (YMM) Expected Move: 15.63%

- Global-e Online Ltd. (GLBE) Expected Move: 15.10%

- Sigma Lithium Corporation (SGML) Expected Move: 9.51%

- Lufax Holding Ltd (LU) Expected Move: 22.31%

- ZIM Integrated Shipping Services Ltd. (ZIM) Expected Move: 12.23%

- Nordic American Tankers Limited (NAT) Expected Move: 13.44%

- Capital Southwest Corporation (CSWC) Expected Move: 5.61%

- Niu Technologies (NIU) Expected Move: 23.38%

- PetMed Express, Inc. (PETS) Expected Move: 10.09%

Full list here: Options AI Earnings Calendar.

Economic Calendar:

- At 08:30 AM (EST) Fed Bullard Speech Impact: Medium

- At 10:50 AM (EST) Fed Bostic Speech Impact: Medium

- At 10:50 AM (EST) Fed Barkin Speech Impact: Medium

- At 11:05 AM (EST) Fed Daly Speech Impact: Medium

- At 09:00 AM (EST) Fed Logan Speech Impact: Medium

Options AI Scanner Highlights:

- Overbought (RSI): PLTR (79), ORCL (79), GOOGL (78), XP (74), AVGO (73), QQQ (71), MSFT (71), META (71), UBER (70), OPEN (69), NVDA (69)

- Oversold (RSI): T (28), AMGN (29), PYPL (31), NKE (33), BUD (33), VZ (33)

- High IV: NKLA (+225%), OZK (+158%), PACW (+156%), SPCE (+138%), KSS (+130%), ZION (+126%), SPLK (+98%), PLUG (+98%), BYND (+98%), RIOT (+97%)

- Unusual Options Volume: MQ (+1744%), VMW (+1371%), VOD (+745%), Z (+698%), CHWY (+617%), DKNG (+590%), PLTR (+469%), NKE (+449%), CRWD (+441%), JNJ (+439%), ETSY (+400%), NFLX (+371%), XPEV (+370%), CSCO (+368%), ADBE (+352%)

Full lists here: Options AI Free Tools.

Chart of the Day:

SPY IV vs Realized vol

That’s all for now. Have a great day!

The Options AI Team

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.