Good morning!

Futures are slightly lower this morning following a healthy move higher in the markets yesterday. This morning Walmart reported and the stock is up about 2% pre-market, inside the 3% move options were pricing. As has been mentioned in this space for the past several weeks the market is experiencing an uncommonly long sideways move where it has stayed within about a 3% range for over a month and a half. With that lack of action has come lower implied volatility in options. But despite that lower IV, it has generally been overpriced versus actual moves. Looking at the VIX (at about 17 this morning) that is certainly near some of the lowest VIX levels we’ve seen over the past few years, but it is not near washout low levels of the VIX historically. So what’s holding up vol there? Obviously there are some things in the news, with the debt ceiling headlines, inflation, and the recent mid-size banking crisis. That is reflected in the options market mostly at this point via skew.

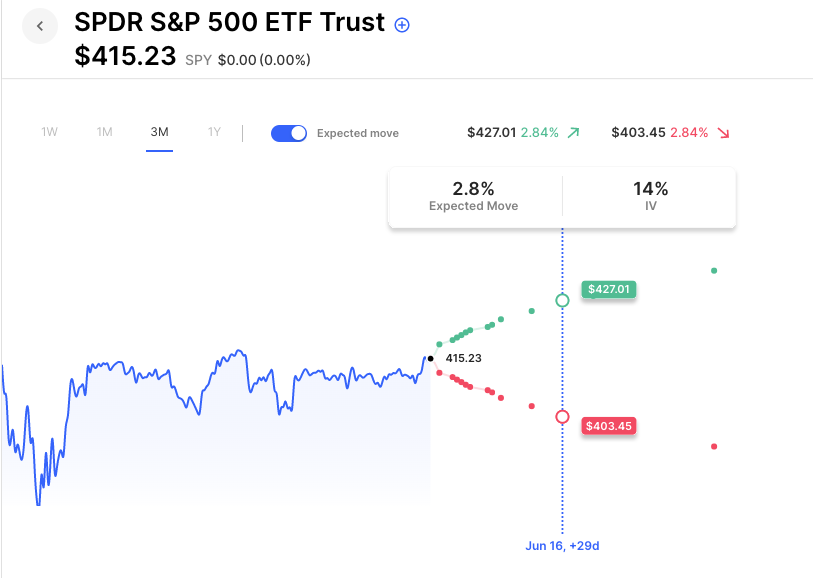

Taking a look at SPY options, there is generally a 6-point difference between upside calls and downside put IV (as measured at the 25 delta levels). That is near a one-year hign in the difference between out-of-the-money put and call IV, but it also is massive from a percentage difference because of IV at being near the lowest levels of the past year. For instance, in May a year ago, the skew difference was slightly higher, around 7 points difference. But that came during a time of volatility in the market when at the money options were 25IV. So to see skew of 6 points then would have looked like 28IV in the puts vs 22IV in the calls. That isn’t as big a percentage difference than right now, when the at-the-money options in SPY are around 14IV, puts 17IV and upside calls 11IV.

To make a long story short, what’s holding up IV and the VIX at this point from being near historical lows? It can be seen in the out-of-the-money puts, where traders still feel like they need protection, even as the market goes sideways for what seems like forever.

Pre-Market Movers:

- Alibaba Group Holding ADR (BABA) +2.83%

- Apple Inc (AAPL) +0.02%

- Pacwest Bancorp (PACW) +6.29%

- Nvidia Corp (NVDA) +1.22%

- Grab Holdings Ltd Cl A (GRAB) -2.42%

- Smart For Life Inc (SMFL) -19.70%

- Opendoor Technologies Inc (OPEN) +5.51%

- TJX Companies (TJX) -0.24%

- Cisco Systems Inc (CSCO) -3.84%

- Jd.com Inc ADR (JD) -0.56%

- Merck & Company (MRK) +0.06%

- Adv Micro Devices (AMD) +0.76%

- Bank of America Corp (BAC) +0.25%

Today’s Earnings Highlights:

- Walmart Inc. (WMT) Expected Move: 3.18%

- Alibaba Group Holding Limited (BABA) Expected Move: 5.17%

- Applied Materials, Inc. (AMAT) Expected Move: 3.40%

- National Grid plc (NGG) Expected Move: 3.40%

- Ross Stores, Inc. (ROST) Expected Move: 5.40%

- KE Holdings Inc. (BEKE) Expected Move: 6.93%

- Grab Holdings Limited (GRAB) Expected Move: 15.70%

- Bath & Body Works, Inc. (BBWI) Expected Move: 10.28%

- Advanced Drainage Systems, Inc. (WMS) Expected Move: 8.34%

- Globant S.A. (GLOB) Expected Move: 6.83%

- Eagle Materials Inc. (EXP) Expected Move: 3.30%

Full list here: Options AI Earnings Calendar.

Economic Calendar:

- At 08:30 AM (EST) Philadelphia Fed Manufacturing Index (May) Estimates: -19.8, Prior: -31.3

- At 08:30 AM (EST) Continuing Jobless Claims (May/06) Estimates: 1818, Prior: 1807

- At 08:30 AM (EST) Initial Jobless Claims (May/13) Estimates: 254, Prior: 264

- At 09:05 AM (EST) Fed Jefferson Speech Impact: Medium

- At 09:30 AM (EST) Fed Barr Testimony Impact: Medium

- At 10:00 AM (EST) Existing Home Sales MoM (Apr) Estimates: -1, Prior: -2.4

- At 10:00 AM (EST) Fed Logan Speech Impact: Medium

- At 10:00 AM (EST) Existing Home Sales (Apr) Estimates: 4.3, Prior: 4.44

- At 08:45 AM (EST) Fed Williams Speech Impact: Medium

- At 09:00 AM (EST) Fed Bowman Speech Impact: Medium

- At 11:00 AM (EST) Fed Chair Powell Speech Impact: High

Options AI Scanner Highlights:

- Overbought (RSI): XELA (81), GOOGL (76), DDOG (76)

- Oversold (RSI): CGC (6), UAA (29), ABBV (29), AMGN (30)

- High IV: NKLA (+193%), PACW (+172%), DISH (+169%), LUMN (+148%), GPS (+141%), OZK (+140%), KSS (+126%), M (+126%)

- Unusual Options Volume: XELA (+1522%), STNE (+1292%), AMGN (+1241%), GSK (+1179%), KNX (+1018%), TTWO (+1012%), EWC (+1000%), ABR (+919%), TJX (+879%), TRIP (+869%), TGT (+817%), WMT (+766%), HZNP (+758%), AI (+695%)

Full lists here: Options AI Free Tools.

Chart of the Day:

A look at the expected move in SPY over the next month at 14 IV:

That’s all for now. Have a great day!

The Options AI Team

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.