Good morning!

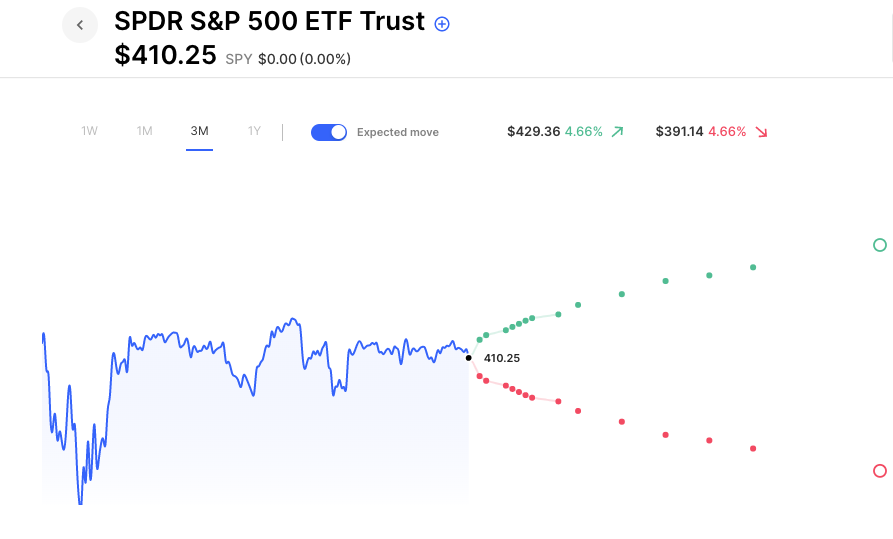

Futures are indicating a bounce from yesterday’s selling, with the SPX up 0.35% pre-market. Yesterday’s selling put the SPY down, 0.35% on the week. The open would mean the SPY is back to unchanged on the week. Speaking of unchanged, Apple finished yesterday exactly unchanged on the day, $0.00, something you don’t see every day. Its range from high to low since reporting earnings on May 4th has been less than $2. The bottom line, the market is still going sideways and has been for a remarkable run. If you had gone to sleep on April 3rd and woken up today, the market would be in the same place, and you would have missed a trading range of about 3%.

The realized Vol (how much it’s actually moved) over the past 30 days in SPY is 13. Meaning the VIX, even as low as 16-18 during this time has been significantly overpriced. Additionally, this type of action can be reinforcing as more and more traders pile into short-term premium selling, like daily and weekly Iron Condors. That loads market makers with gamma, furthering that accordion effect of small moves higher and lower meeting buying and selling.

Pre-Market Movers:

- CSX Corp (CSX) +0.25%

- Applied Digital Corp (APLD) -8.02%

- Pacwest Bancorp (PACW) +12.25%

- Tesla Inc (TSLA) +1.19%

- Nvidia Corp (NVDA) +1.38%

- Marathon Digital Hldgs Inc (MARA) -2.16%

- Virgin Galactic Holdings Inc (SPCE) +4.51%

- Western Alliance Bancorp (WAL) +12.57%

- Jd.com Inc ADR (JD) -2.66%

Today’s Earnings Highlights:

- Cisco Systems, Inc. (CSCO) Expected Move: 4.35%

- The TJX Companies, Inc. (TJX) Expected Move: 4.30%

- Target Corporation (TGT) Expected Move: 6.40%

- Synopsys, Inc. (SNPS) Expected Move: 4.10%

- Copart, Inc. (CPRT) Expected Move: 3.91%

- ZTO Express (Cayman) Inc. (ZTO) Expected Move: 6.58%

- Sociedad Química y Minera de Chile S.A. (SQM) Expected Move: 4.84%

- Take-Two Interactive Software, Inc. (TTWO) Expected Move: 5.85%

- Dynatrace, Inc. (DT) Expected Move: 7.40%

- Wix.com Ltd. (WIX) Expected Move: 8.50%

Full list here: Options AI Earnings Calendar.

Economic Calendar:

- At 08:30 AM (EST) Housing Starts (Apr) Estimates: 1.4%, Prior: 1.371%

- At 08:30 AM (EST) Jobless Claims 4-week Average (May/13) Estimates: 249%, Prior: 245.25%

- At 08:30 AM (EST) Philadelphia Fed Manufacturing Index (May) Estimates: -19.8%, Prior: -31.3%

- At 08:30 AM (EST) Continuing Jobless Claims (May/06) Estimates: 1818%, Prior: 1813%

- At 09:05 AM (EST) Fed Jefferson Speech Impact: Medium

- At 09:30 AM (EST) Fed Barr Testimony Impact: Medium

- At 10:00 AM (EST) Existing Home Sales (Apr) Estimates: 4.3%, Prior: 4.44%

- At 10:00 AM (EST) Fed Logan Speech Impact: Medium

Options AI Scanner Highlights:

- Overbought (RSI): LLY (78), MNST (76), GOOGL (75), DDOG (73), KBH (72)

- Oversold (RSI): BYND (24), PFE (25), SGEN (25), CHGG (26), PENN (26), GPS (28)

- High IV: VRAY (+205%), PACW (+188%), OZK (+168%), NKLA (+139%)

- Unusual Options Volume: XELA (+2551%), TJX (+1275%), HZNP (+1195%), FUTU (+1190%), SE (+1054%), SGEN (+1052%), HD (+965%), VKTX (+902%), TGT (+894%), SMH (+821%), AMD (+752%), COF (+689%), NVDA (+542%), PACW (+525%), MSFT (+510%)

Full lists here: Options AI Free Tools.

Chart of the Day:

The SPY has stayed within a 3% range over the past month and a half, a remarkable sideways run.

That’s all for now. Have a great day!

The Options AI Team

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.