Good morning!

Futures are pointing to a lower open. As mentioned yesterday, this is a week where we get some sense of the consumer with several big box stores reporting plus the retail sales number. The retail sales number is out and it was mixed with a slight beat vs estimates but pretty significant downward revisions to prior months. Home Depot reported this morning and had its biggest revenue miss since 2002. The stock was initially down 5% (about the expected move) but has recovered a bit, now down 3%. The retail/consumer theme continues all week as we hear from Target, Walmart and more. There are more Fed member speeches today wth the big one (Powell) coming on Friday. The VIX is up this morning, just under 18.

Pre-Market Movers:

- Gd Culture Group Ltd (GDC) +58.29%

- Futu Holdings Ltd ADR (FUTU) -9.02%

- Horizon Therapeutics (HZNP) -17.29%

- Sea Ltd ADR (SE) -6.62%

- Tesla Inc (TSLA) +0.30%

- Nanobiotix S.A. ADR (NBTX) +16.84%

- Baidu Inc ADR (BIDU) +1.32%

- Sofi Technologies Inc (SOFI) +0.42%

- Pacwest Bancorp (PACW) 0.00%

- Alibaba Group Holding ADR (BABA) -0.93%

- Marathon Digital Hldgs Inc (MARA) -2.52%

- Palantir Technologies Inc Cl A (PLTR) -0.21%

- Nio Inc ADR (NIO) -1.21%

- Amazon.com Inc (AMZN) -0.13%

- Dish Network Corp (DISH) +6.39%

- Bank of America Corp (BAC) +0.47%

- Rio Tinto Plc ADR (RIO) -1.07%

Today’s Earnings Highlights:

- The Home Depot, Inc. (HD) Expected Move: 4.79%

- Sea Limited (SE) Expected Move: 9.75%

- Baidu, Inc. (BIDU) Expected Move: 5.84%

- Vodafone Group Public Limited Company (VOD) Expected Move: 6.56%

- Keysight Technologies, Inc. (KEYS) Expected Move: 4.70%

- Tencent Music Entertainment Group (TME) Expected Move: 7.89%

- On Holding AG (ONON) Expected Move: 11.03%

- Doximity, Inc. (DOCS) Expected Move: 10.90%

- iQIYI, Inc. (IQ) Expected Move: 9.04%

- MINISO Group Holding Limited (MNSO) Expected Move: 8.45%

- Freedom Holding Corp. (FRHC) Expected Move: 7.06%

Full list here: Options AI Earnings Calendar.

Economic Calendar:

- At 08:15 AM (EST) Fed Mester Speech Impact: Medium

- At 10:00 AM (EST) Fed Barr Testimony Impact: Medium

- At 12:15 PM (EST) Fed Williams Speech Impact: Medium

- At 03:15 PM (EST) Fed Logan Speech Impact: Medium

- At 07:00 PM (EST) Fed Bostic Speech Impact: Medium

- At 08:30 AM (EST) Building Permits (Apr) Estimates: 1.437, Prior: 1.43

- At 08:30 AM (EST) Housing Starts (Apr) Estimates: 1.4, Prior: 1.42

- At 08:30 AM (EST) Retail Sales MoM (Apr) Estimates: 0.8%, Prior: -0.6%

- At 10:30 AM (EST) EIA Crude Oil Stocks Change (May/12) Estimates: -1.3%, Prior: 2.951%

Options AI Scanner Highlights:

- Overbought (RSI): IMGN (86), GT (83), NNOX (81), PHM (79), LLY (77), BBD (77), LI (77), ISEE (77), HAS (76), GOOGL (71), SHOP (71), PEP (69), ZS (69), UBER (69), SNOW (68)

- Oversold (RSI): CGC (6), VRAY (17), FHN (21), NWL (22), BYND (27), PENN (31), SAVE (31), PYPL (31), UPS (32), GPS (32)

- High IV: MMAT (+313%), PACW (+177%), NKLA (+176%), DISH (+163%), OZK (+160%), UVXY (+126%), FCEL (+125%), SPCE (+124%), ORCL (+109%), TJX (+108%), LOW (+107%), PNC (+105%)

- Unusual Options Volume: SAVE (+1627%), MAR (+1015%), UPST (+811%), WAL (+682%), PACW (+649%), BIDU (+648%), PENN (+624%), FSLR (+579%), SOFI (+551%), GPS (+548%), TGT (+548%), PANW (+492%), CVNA (+477%)

Full lists here: Options AI Free Tools.

Chart of the Day:

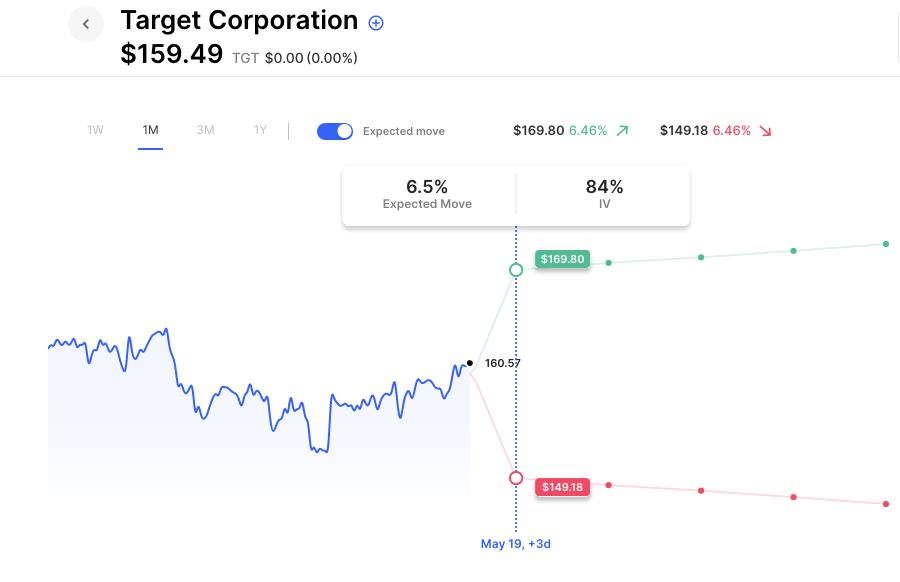

Target reports tomorrow before the open. Options are pricing about a 6.5% move.

That’s all for now. Have a great day!

The Options AI Team

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.