Good morning!

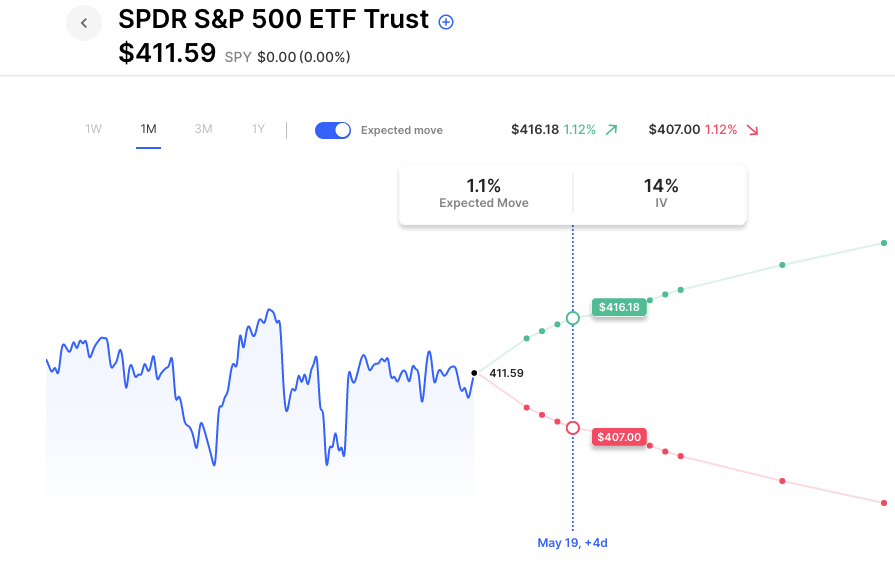

The market was essentially unchanged last week, with the SPY down 0.25%, well inside what options were pricing. Futures are implying a green open, but only by about 0.25%. So we begin this week in very similar fashion to last week’s action. The VIX sits at about 17.50. SPY option IV for this week is lower than that, about 15. That implies a 1.1% move. A couple of things going on on the economic calendar. The first is Fed Speeches galore, lasting all week.14 Federal Reserve governors and presidents will deliver speeches this week, with Fed chair Powell on Friday. The other important part of the calendar is retail sales, on Tuesday. On the earnings front, we hear from Home Depot Tuesday morning, Target ad Cisco Wednesday, Alibaba, Walmart and Applied Materials on Friday.

Pre-Market Movers:

- Gsi Technology Inc (GSIT) -4.91%

- Wisa Technologies Inc (WISA) +37.97%

- Intel Corp (INTC) +0.28%

- Sofi Technologies Inc (SOFI) -6.57%

- Boston Scientific Corp (BSX) +1.05%

- Tesla Inc (TSLA) -0.14%

- Palantir Technologies Inc Cl A (PLTR) -2.42%

- CVS Corp (CVS) +0.16%

- Nio Inc ADR (NIO) +0.75%

- Marathon Digital Hldgs Inc (MARA) +3.92%

- Sarepta Therapeutics (SRPT) +26.66%

- Alibaba Group Holding ADR (BABA) +1.84%

- Meta Platforms Inc (META) +1.36%

- McDonald’s Corp (MCD) -0.46%

- Magellan Midstream Partners LP (MMP) +15.77%

- Jd.com Inc ADR (JD) +1.76%

- The Charles Schwab Corp (SCHW) +2.55%

Today’s Earnings Highlights:

- Nu Holdings Ltd. (NU) Expected Move: 6.99%

- XP Inc. (XP) Expected Move: 10.02%

- monday.com Ltd. (MNDY) Expected Move: 13.10%

- Rumble Inc. (RUM) Expected Move: 9.98%

- Azul S.A. (AZUL) Expected Move: 10.52%

Full list here: Options AI Earnings Calendar.

Economic Calendar:

- At 08:30 AM (EST) NY Empire State Manufacturing Index (May) Estimates: -3.75, Prior: 10.8

- At 09:15 AM (EST) Fed Kashkari Speech Impact: Medium

- At 12:30 PM (EST) Fed Barkin Speech Impact: Medium

- At 05:00 PM (EST) Fed Cook Speech Impact: Medium

- At 08:15 AM (EST) Fed Mester Speech Impact: Medium

- At 08:30 AM (EST) Retail Sales YoY (Apr) Estimates: 1.4, Prior: 2.9

- At 08:30 AM (EST) Retail Sales MoM (Apr) Estimates: 0.7, Prior: -0.6

- At 09:15 AM (EST) Industrial Production YoY (Apr) Estimates: 0.3, Prior: 0.5

- At 09:15 AM (EST) Industrial Production MoM (Apr) Estimates: 0, Prior: 0.4

- At 10:00 AM (EST) Fed Barr Testimony Impact: Medium

- At 10:00 AM (EST) Business Inventories MoM (Mar) Estimates: 0, Prior: 0.2

- At 10:00 AM (EST) NAHB Housing Market Index (May) Estimates: 45, Prior: 45

- At 12:15 PM (EST) Fed Williams Speech Impact: Medium

- At 03:15 PM (EST) Fed Logan Speech Impact: Medium

- At 04:30 PM (EST) API Crude Oil Stock Change (May/12) Impact: Medium

Options AI Scanner Highlights:

- Overbought (RSI): PEP (81), LLY (77), GOOGL (75), DDOG (73), UBER (71), SHOP (70), ORCL (68), CLOV (67), BB (67), MCD (66), PLTR (65), SNOW (65), WMT (65), BSX (65)

- Oversold (RSI): SAVE (24), BYND (24), PINS (29), PTON (29), TWLO (30), PYPL (30), TRIP (30)

- High IV: MMAT (+405%), NKLA (+232%), PACW (+218%), CLOV (+197%), ZION (+158%), FCEL (+133%)

- Unusual Options Volume: FSLR (+1204%), TQQQ (+639%), ABNB (+607%), HOOD (+600%), MSTR (+558%), DDOG (+557%), XOM (+531%), PENN (+491%), DIS (+479%), SPY (+461%), PYPL (+461%)

Full lists here: Options AI Free Tools.

Chart of the Day:

SPY options are pricing in about a 1.1% move for this week

That’s all for now. Have a great day!

The Options AI Team

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.