Good morning!

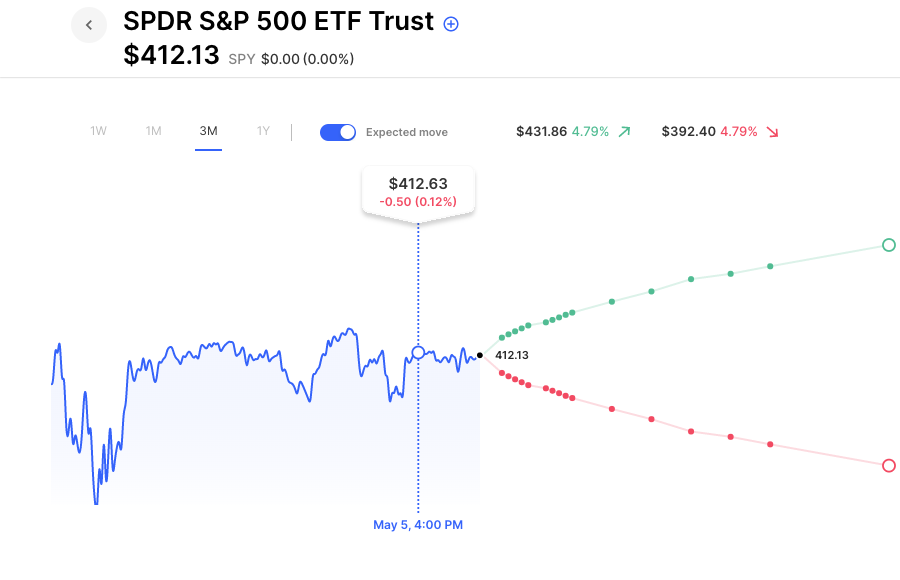

Futures are slightly higher this morning. Tesla stock is helping the futures, up about 2% on the news of a new CEO hire. As of now, it’s looking like the market will once again put in a sideways week. That will continue a trend that’s lasted since the beginning of April. In fact, SPY realized vol (how much the market has actually moved) over the past 30 days is just 13. Compare that to its 1-year realized vol of 22 to see just how much the market moves of the past have come to a screeching halt. And looking forward, as low as IV seems, it’s still slightly overpriced compared to how the market is moving. 30-day IV in SPY is 15 right now. That implies about a 3% move for the market over the next month, a tiny move to be sure, but one that the market has failed to move outside of for the past month and a half. When the sideways action finally breaks remains anyone’s guess.

Pre-Market Movers:

- Dermata Therapeutics Inc (DRMA) +55.44%

- Tesla Inc (TSLA) +2.10%

- Ars Pharmaceuticals Inc (SPRY) +78.76%

- Pacwest Bancorp (PACW) +0.64%

- Hour Loop Inc (HOUR) +27.89%

- Marvell Technology Inc (MRVL) +1.13%

- Sofi Technologies Inc (SOFI) +1.56%

- Marathon Digital Hldgs Inc (MARA) -0.69%

- Palantir Technologies Inc Cl A (PLTR) +0.51%

- Riot Platforms Inc (RIOT) -0.84%

- Xpeng Inc ADR (XPEV) -5.40%

- Electronic Arts Inc (EA) +0.95%

Today’s Earnings Highlights:

- Sumitomo Mitsui Financial Group, Inc. (SMFG) Expected Move: 9.17%

- Sun Life Financial Inc. (SLF) Expected Move: 3.98%

- Crescent Point Energy Corp. (CPG) Expected Move: 9.44%

- Gencor Industries, Inc. (GENC) Expected Move: 24.36%

Full list here: Options AI Earnings Calendar.

Economic Calendar:

- At 03:00 AM (EST) Fed Bowman Speech Impact: Medium

- At 08:30 AM (EST) Import Prices MoM (Apr) Estimates: 0.3%, Prior: -0.8%

- At 08:30 AM (EST) Export Prices MoM (Apr) Estimates: 0.2%, Prior: -0.6%

- At 10:00 AM (EST) Michigan Consumer Sentiment (May) Estimates: 63%, Prior: 63.5%

- At 07:45 PM (EST) Fed Jefferson Speech Impact: Medium

- At 07:45 PM (EST) Fed Bullard Speech Impact: Medium

- At 10:30 AM (EST) Fed Cook Speech Impact: Medium

Options AI Scanner Highlights:

- Overbought (RSI): PEP (79), LLY (79), SHOP (76), GOOGL (73), DDOG (73), BB (72), PLTR (72), UBER (71), SNOW (69), SPOT (69), CVNA (66)

- Oversold (RSI): BYND (20), MOS (24), MET (24), SAVE (25), CHGG (25), PARA (26), QCOM (27), PTON (28), PINS (30), TXN (32), PLUG (32), TWLO (32), PENN (32), HAL (33)

- High IV: NKLA (+182%), OZK (+172%), ZION (+162%), USB (+154%), SPCE (+125%), TLRY (+115%), PNC (+112%), SCHW (+109%), JWN (+109%), HD (+107%), TJX (+104%), BBY (+103%)

- Unusual Options Volume: KBH (+1061%), DIS (+947%), LLY (+941%), RCL (+832%), TTD (+804%), HOOD (+794%), GT (+736%), BYND (+721%), U (+670%), GOOGL (+655%), Z (+606%), IBRX (+575%), NFLX (+518%)

Full lists here: Options AI Free Tools.

Chart of the Day:

SPY actual volatility over the past 30 days has been around 13

That’s all for now. Have a great day!

The Options AI Team

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.