Good morning!

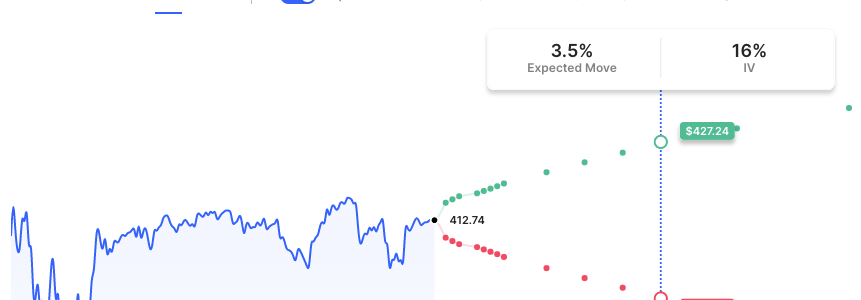

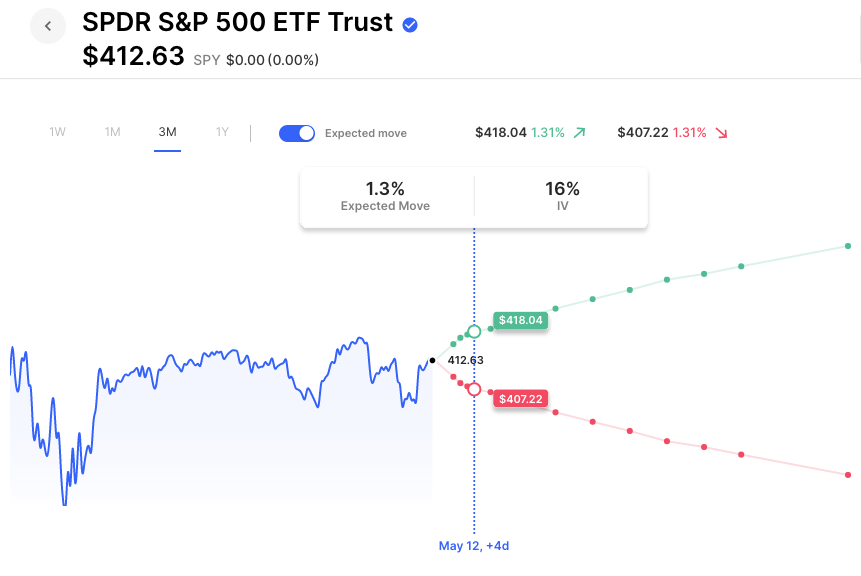

Futures are slightly lower. There’s not much going on on the economic front this morning, the CPI print is tomorrow morning and there’s the backdrop of the debt ceiling negotiations later this week. For context, during the 2011 debt ceiling stunt the SPY peaked at 134 in May. A deal was reached by August, and the SPY finally bottomed at 113 in September. A decline of about 15% or so that included an S&P downgrade on US long-term debt. As of now the options market isn’t indicated much concern, near term IV in SPY options is in the low teens while June is 16. Those options extending into the Summer will be something to watch if the headlines get nastier as they will be indicative of risk, as well as keeping an eye on the bond market.

Airbnb and Occidental are two of the notable companies reporting after the close.

Pre-Market Movers:

- Clearone Inc (CLRO) +67.91%

- Palantir Technologies Inc Cl A (PLTR) +15.50%

- Trevena Inc (TRVN) -10.93%

- Pacwest Bancorp (PACW) -8.54%

- Plug Power Inc (PLUG) -6.67%

- Paypal Holdings (PYPL) -7.10%

- Lucid Group Inc (LCID) -9.86%

- Fisker Inc (FSR) -13.90%

- Tesla Inc (TSLA) -0.98%

- Adv Micro Devices (AMD) +0.24%

- Nio Inc ADR (NIO) -2.18%

- Carvana Company Cl A (CVNA) -4.34%

- Western Alliance Bancorp (WAL) -2.16%

Today’s Earnings Highlights:

- Airbnb, Inc. (ABNB) Expected Move: 7.24%

- Duke Energy Corporation (DUK) Expected Move: 2.75%

- Occidental Petroleum Corporation (OXY) Expected Move: 3.29%

- Wynn Resorts, Limited (WYNN) Expected Move: 3.94%

- Rivian Automotive, Inc. (RIVN) Expected Move: 13.18%

- Twilio Inc. (TWLO) Expected Move: 11.50%

Full list here: Options AI Earnings Calendar.

Economic Calendar:

- At 08:30 AM (EST) Fed Jefferson Speech Impact: Medium

- At 10:00 AM (EST) IBD/TIPP Economic Optimism (May) Estimates: 48.2%, Prior: 47.4%

- At 12:05 PM (EST) Fed Williams Speech Impact: Medium

- At 04:30 PM (EST) API Crude Oil Stock Change (May/05) Estimates: -1.6%, Prior: -3.939%

Options AI Scanner Highlights:

- Overbought (RSI): SHOP (81), UBER (76), DKNG (69), SPOT (68)

- Oversold (RSI): CGC (6), SAVE (28), CS (30), IBM (31), QCOM (31), GLW (32), TRIP (33)

- High IV: PACW (+258%), ZION (+215%), OZK (+205%)

- Unusual Options Volume: GRAB (+1420%), CVNA (+1100%), SMH (+957%), ZS (+751%), PYPL (+722%), LCID (+709%), PLTR (+705%), AMD (+644%), WDC (+623%), ABNB (+616%), SHOP (+591%), PACW (+566%), SPCE (+535%), OPEN (+521%), IBM (+499%)

Full lists here: Options AI Free Tools.

Chart of the Day:

As of now options market are not pricing in much debt ceiling negotiation risk. Future option IV is one way to track potential market reactions in the weeks ahead.

That’s all for now. Have a great day!

The Options AI Team

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.