Good morning!

Futures are indicating an up opening, reversing higher after a cooler-than-expected CPI print. the CPI came in at 4.9%, slightly lower than the 5% estimates. The VIX is indicated below 16.50. It’s worth keeping an eye on the VIX as now that the FOMC and CPI are out of the way the the debt ceiling negotiations will garner headlines. As mentioned, the options market isn’t showing much concern yet on that front. Therefore, with most economic news and most earnings now in the past, it’s really the banks driving market vol. If the market finds some stability we could see some of the lowest IV in years.

Disney, TradeDesk, Beyond Meat and Robinhood highlight reports after the close.

Pre-Market Movers:

- Cti Biopharm Corp (CTIC) +84.85%

- Rivian Automotive Inc Cl A (RIVN) +7.07%

- Airbnb Inc Cl A (ABNB) -15.20%

- Roblox Corp Cl A (RBLX) -8.48%

- Teva Pharmaceutical Industries ADR (TEVA) -6.92%

- Palantir Technologies Inc Cl A (PLTR) -0.10%

- Livent Corp (LTHM) +0.29%

- Nio Inc ADR (NIO) +1.10%

- Twilio (TWLO) -18.21%

- Tesla Inc (TSLA) -0.12%

- Pacwest Bancorp (PACW) -0.68%

- Paypal Holdings (PYPL) +0.15%

- Plug Power Inc (PLUG) +0.52%

- Sofi Technologies Inc (SOFI) +0.55%

- Xpeng Inc ADR (XPEV) +1.19%

- Lucid Group Inc (LCID) -0.69%

- Carvana Company Cl A (CVNA) -3.12%

- Carnival Corp (CCL) -0.28%

Today’s Earnings Highlights:

- Toyota Motor Corporation (TM) Expected Move: 2.69%

- The Walt Disney Company (DIS) Expected Move: 5.14%

- The Trade Desk, Inc. (TTD) Expected Move: 11.19%

- Roblox Corporation (RBLX) Expected Move: 9.52%

- Unity Software Inc. (U) Expected Move: 12.45%

- Teva Pharmaceutical Industries Limited (TEVA) Expected Move: 7.39%

- Robinhood Markets, Inc. (HOOD) Expected Move: 7.92%

- Ziff Davis, Inc. (ZD) Expected Move: 6.50%

- Ferroglobe PLC (GSM) Expected Move: 10.33%

- Beyond Meat, Inc. (BYND) Expected Move: 14.85%

Full list here: Options AI Earnings Calendar.

Economic Calendar:

- At 07:00 AM (EST) MBA 30-Year Mortgage Rate (May/05) Impact: Medium

- At 08:30 AM (EST) CPI (Apr) Estimates: 303.532, Prior: 301.836

- At 08:30 AM (EST) Initial Jobless Claims (May/06) Estimates: 245, Prior: 242

- At 10:15 AM (EST) Fed Waller Speech Impact: Medium

Options AI Scanner Highlights:

- Overbought (RSI): IMGN (92), SHOP (79), PEP (77), MNST (72), CVNA (72), UBER (72), MCD (70), DKNG (69), OPEN (69), SNOW (67)

- Oversold (RSI): CGC (6), SAVE (27), QCOM (28), BYND (28), PINS (29), IBM (29), TRIP (32), NRG (33), T (33), ABBV (33)

- High IV: XELA (+458%), OZK (+211%), PACW (+200%), ZION (+196%), NKLA (+168%), KRE (+160%), SPCE (+152%), GPS (+129%), BYND (+121%)

- Unusual Options Volume: EWC (+2121%), PLTR (+1183%), NVAX (+1016%), PYPL (+999%), IAG (+986%), TWLO (+949%), AFRM (+905%), ABNB (+867%), CVNA (+755%), RIVN (+627%), HOOD (+560%), PENN (+542%), BYND (+532%)

Full lists here: Options AI Free Tools.

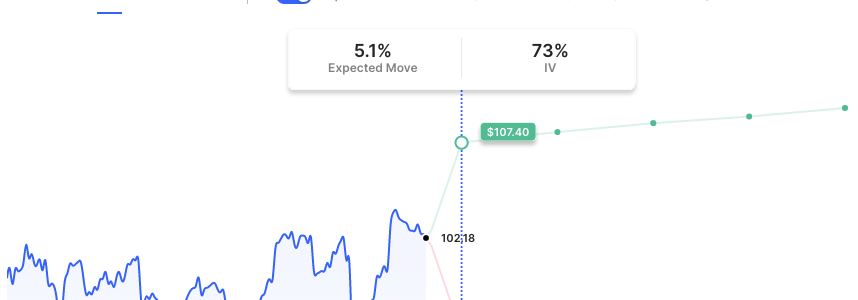

Chart of the Day:

Disney options are pricing about a 5% move on earnings.

That’s all for now. Have a great day!

The Options AI Team

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.