Good morning!

The S&P 500 is essentially in the same place it was 5 weeks ago and has traded in a tight 3% range over that span. Last week continued that trend as the SPY finished the week lower by about 0.7%, inside the move options were pricing. However, in the past 2 weeks, things have begun to open up a bit. Superficially last week was another flat week, but look closer and there was a bit more day-to-day volatility with about a 3% or so range from weekly highs to weekly lows and featuring a quick VIX pop above 20. Of course, last week saw both an FOMC announcement and a Jobs report. After the market stabilized the VIX returned lower and closed the week near 17.50. The next (scheduled) news on the economic front comes Wednesday with the CPI.

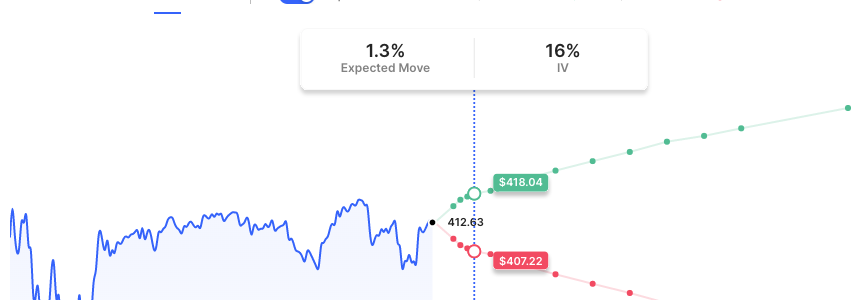

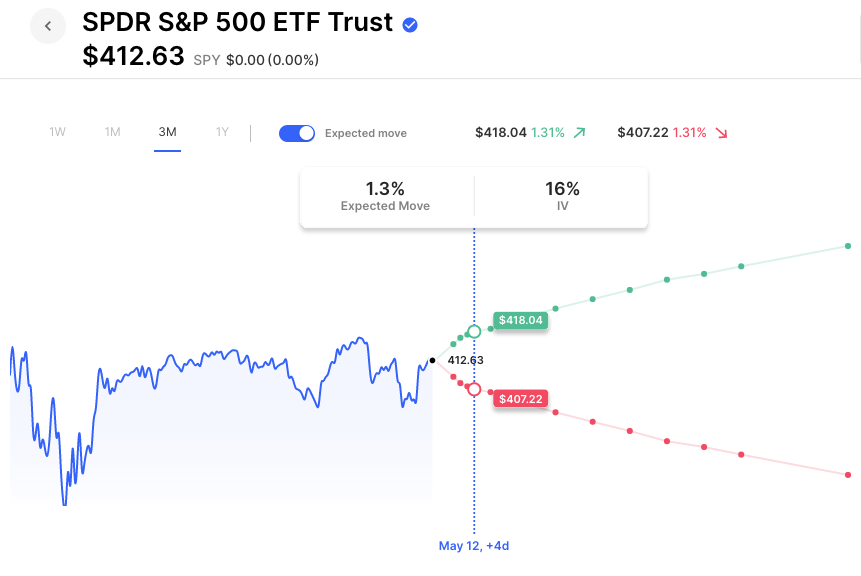

Options are pricing about a 1.3% move for the week, with at-the-money SPY options about 16 IV. For comparison, a CPI week a few months ago may have seen IV near 30 and an expected move approaching 3%. On the earnings front this week we have Palantir and Paypal after the close today, AirBnb and Wynn tomorrow, Disney and Robinhood on Wednesday and many others. We’re well into the second half of earnings season, especially from a market cap perspective but interesting names are still set to report over the next 2-3 weeks.

Pre-Market Movers:

- PacWest Bancorp (PACW) +35.07%

- Tesla Inc (TSLA) +2.24%

- Western Alliance Bancorp (WAL) +11.67%

- Marathon Digital Hldgs Inc (MARA) -5.91%

- Zscaler Inc (ZS) +21.84%

- Carnival Corp (CCL) +0.70%

- Riot Platforms Inc (RIOT) -6.41%

- Sofi Technologies Inc (SOFI) +0.97%

- Coinbase Global Inc Cl A (COIN) -2.91%

- Zions Bancorp (ZION) +6.06%

- Occidental Petroleum Corp (OXY) -0.12%

- Adv Micro Devices (AMD) -0.27%

Today’s Earnings Highlights:

- PayPal Holdings, Inc. (PYPL) Expected Move: 6.32%

- KKR & Co. Inc. (KKR) Expected Move: 5.49%

- Suncor Energy Inc. (SU) Expected Move: 4.04%

- Devon Energy Corporation (DVN) Expected Move: 4.80%

- BioNTech SE (BNTX) Expected Move: 6.60%

- Skyworks Solutions, Inc. (SWKS) Expected Move: 5.20%

- Palantir Technologies Inc. (PLTR) Expected Move: 11.69%

- Lucid Group, Inc. (LCID) Expected Move: 12.42%

- Western Digital Corporation (WDC) Expected Move: 7.43%

Full list here: Options AI Earnings Calendar.

Economic Calendar:

- wholesale inventories, bond auctions

Options AI Scanner Highlights:

- Overbought (RSI): MNST (82), SHOP (79), DKNG (72), LULU (71), MCD (70), MSFT (69), AAPL (68), ORCL (67)

- Oversold (RSI): PINS (25), QCOM (32), GLW (32), SNAP (33)

- High IV: XELA (+616%), DISH (+175%), LUMN (+163%), VXX (+131%), UVXY (+124%), NVAX (+121%), OPEN (+114%), SPWR (+108%), LCID (+106%), HTZ (+106%), MTCH (+105%), RIVN (+105%), WDC (+105%)

- Unusual Options Volume: MULN (+3000%), PACW (+735%), OPEN (+690%), WAL (+685%), PARA (+645%), DKNG (+642%), LYFT (+631%), SHOP (+587%), TQQQ (+452%), COIN (+429%), SQQQ (+428%)

Full lists here: Options AI Free Tools.

Chart of the Day:

SPY options pricing about a 1.3% move for the week that includes a CPI print on Wednesday.

That’s all for now. Have a great day!

The Options AI Team

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.