Good morning!

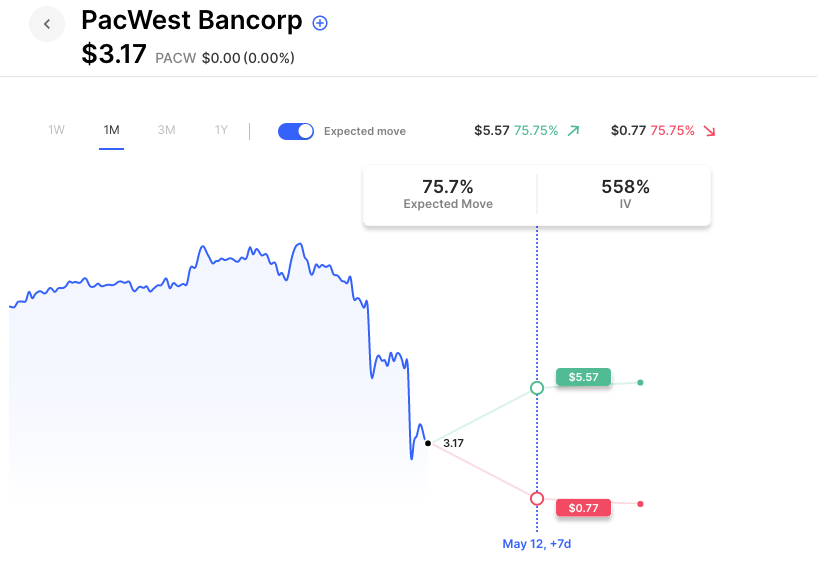

The jobs number came in a little hotter than expected, up 253,000 for the month vs estimates of around +180,000. The unemployment rate is 3.4% (estimate 3.6%), the lowest level since 1969. With that release short-term treasury yields are higher with the 1 year now 4.75 and the 2 year now 3.87. Stock futures are higher, as they have been all morning on the heels of Apple’s earnings. Apple is higher by about 2.6% pre-market. Inside the expected move of about 3.6%. KRE, the regional bank etf is higher by about 3.5%, a bounce after the bloodbath of the past few days. PACW, which has been at the center of attention, is up 25% or so.

Pre-Market Movers:

- Carvana Company Cl A (CVNA) +43.89%

- Agba Group Holding Ltd (AGBA) +32.26%

- Pacwest Bancorp (PACW) +20.19%

- Nanobiotix S.A. ADR (NBTX) +91.62%

- Marvell Technology Inc (MRVL) +0.15%

- Discovery Inc Series A (WBD) -6.65%

- AMC Entertainment Holdings (AMC) +3.38%

- Verizon Communications Inc (VZ) +0.16%

- Apple Inc (AAPL) +2.58%

- CVS Corp (CVS) +0.74%

- Western Alliance Bancorp (WAL) +16.04%

- Zoominfo Technologies Inc Cl A (ZI) +1.12%

- Boston Scientific Corp (BSX) -0.65%

- Lyft Inc Cl A (LYFT) -15.34%

- Adv Micro Devices (AMD) -1.13%

- Zhong Yang Financial Group Limited (TOP) -7.61%

- Tesla Inc (TSLA) +0.90%

- Keycorp (KEY) +11.09%

- Sofi Technologies Inc (SOFI) +1.53%

- Meta Platforms Inc (META) +0.76%

- Draftkings Inc (DKNG) +13.33%

- Shopify Inc (SHOP) -1.82%

- Snap Inc (SNAP) +1.39%

- Ford Motor Company (F) +1.12%

- Bank of America Corp (BAC) +1.37%

Today’s Earnings Highlights:

- Enbridge Inc. (ENB) Expected Move: 3.46%

- Cigna Corporation (CI) Expected Move: 3.64%

- Dominion Energy, Inc. (D) Expected Move: 4.89%

- AMC Entertainment Holdings, Inc. (AMC) Expected Move: 7.48%

Full list here: Options AI Earnings Calendar.

Economic Calendar:

- At 08:30 AM (EST) Non Farm Payrolls (Apr) Estimates: 180, Prior: 165

- At 08:30 AM (EST) Unemployment Rate (Apr) Estimates: 3.6%, Prior: 3.5%

Options AI Scanner Highlights:

- Overbought (RSI): LLY (81), PEP (80), MNST (76), SHOP (74), UBER (73)

- Oversold (RSI): PACW (20), WAL (23), CHGG (23), PINS (23), ZION (24), ATVI (24), QCOM (25), KEY (26), FSLR (27)

- High IV: XELA (+615%), LUMN (+164%), SPCE (+129%), ZION (+127%), FCEL (+124%), FUBO (+123%), RAD (+122%), LCID (+106%), BUD (+106%), ATVI (+106%), HTZ (+106%), PNC (+105%), MTCH (+105%), RIVN (+105%), RIOT (+104%)

- Unusual Options Volume: ET (+1431%), SHOP (+1161%), PARA (+1036%), EXPE (+1006%), WAL (+914%), QCOM (+737%), PACW (+727%), KEY (+683%), KRE (+639%), LYFT (+632%), ZION (+617%), DDOG (+580%), ETSY (+545%), USB (+535%), NRG (+533%), CVNA (+488%), ALLY (+484%), PENN (+475%), AAPL (+459%), SNOW (+456%), COF (+453%), BUD (+441%), ADBE (+427%)

Full lists here: Options AI Free Tools.

Chart of the Day:

PACW weekly vol is near 600

That’s all for now. Have a great day!

The Options AI Team

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.