The Broader Markets

Last Week – SPY was lower by about 0.5%, inside the 0.7% expected move options were pricing. However, the market was lower mid-week.

This Week – SPY options are pricing a 1% move (in either direction) for the upcoming week. With the SPY around $444 that corresponds to about $439 as a bearish expected move and $448 as a bullish expected move.

Implied Volatility – The VIX was above 23 during the week, but closed around 18.50 on Friday following the market rally that ended the week. That is about in line with its historical average. The futures curve is upward sloping with December VIX futures around 23, up from 22 last week.

Expected Moves for This Week via Options AI:

The market ETFs are all pricing larger moves this week than last week:

- SPY 1%

- QQQ 1.3%

- IWM 2.1%

- DIA 1.3%

In the News

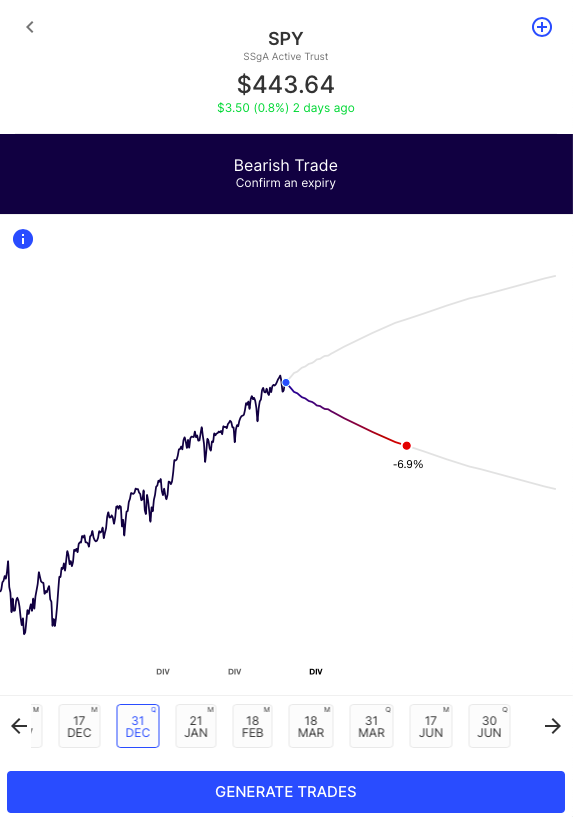

The market’s move lower last week saw some demand for option volatility as the VIX quickly spiked towards the mid 20s. With the VIX now back in the teens and VIX December futures near 23, options are pricing about a 7% move by year end:

A Debit Put Spread to that level, buying the at-the-money 443 puts and selling a put at the Bearish Expected Move of 413 costs about 8.00 and breaks-even at about 435. It costs about 1.8% of the underlying but protects against about 5% of the 7% move options are currently pricing. For those looking for portfolio protection, those ratios and breakevens are one way to analyze potential hedges:

Expected Moves for Companies Reporting Earnings

The Options AI Earnings Calendar is a free resource to keep up to date on upcoming earnings, how options are pricing potential moves, and how that compares to actual moves from prior earnings (starting with most recent).

Options AI puts the expected move at the heart of its trading experience. Traders are able to quickly generate trades based on the move, or to place their own price target in context of the expected move. More education on expected moves and spread trading can be found at Learn / Options AI.

Some earnings of note this week include Salesforce, Snowflake, Palo Alto Networks, and Peloton.

Monday

JD.com JD / Expected Move: 6.2% / Recent moves: -5%, +1%, +1%

Palo Alto Networks PANW / Expected Move: 6.2% / Recent moves: +6%, -2%, +8%

Tuesday

Best Buy BBY / Expected Move: 5.3% / Recent moves: +1%, -9%, -7%

Wednesday

Salesforce CRM / Expected Move: 5.2% / Recent moves: +5%, -6%, -9%

Snowflake SNOW / Expected Move: 7.9% / Recent moves: +4%, +1%, +16%

Autodesk ADSK / Expected Move: 4.7% / Recent moves: 0%, -3%, +5%

Splunk SPLK / Expected Move: 7.1% / Recent moves: -10%, -3%, -23%

Thursday

Peloton PTON / Expected Move: 8.1% / Recent moves: 0%, -6%, -1%

Workday WDAY / Expected Move: 5.2% / Recent moves: -3%, -2%, -9%

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC a registered broker-dealer.