The Broader Markets

Last Week – SPY was unchanged on the week vs. the 1% expected move options were pricing.

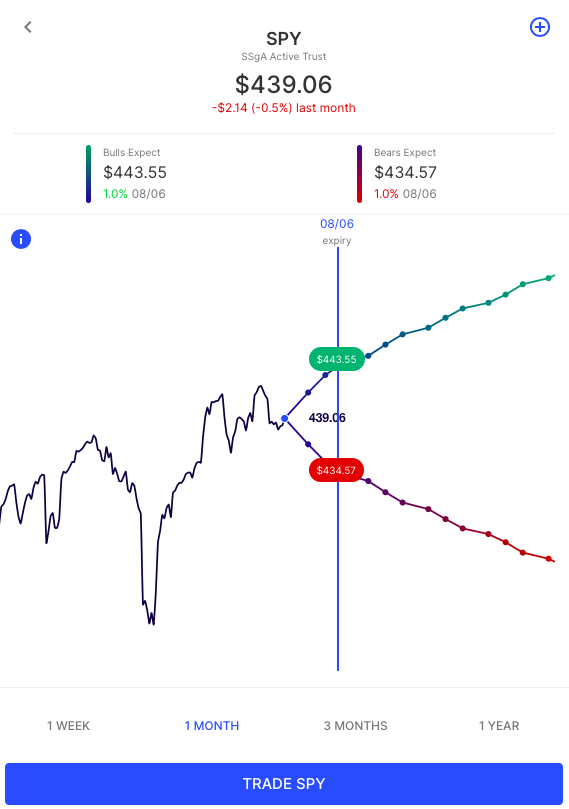

This Week – SPY options are again pricing about a 1% move (in either direction) for the upcoming week. That corresponds to about $434 as a bearish expected move and $444 as a bullish expected move.

Implied Volatility – The VIX pulled spent most of the week between 17 and 20, ending the week just above 18, near its historical average.

Expected Moves for This Week via Options AI:

- SPY 1% (same as last week)

- QQQ 1.4% (same as last week)

- IWM 2.1% (0.1% less than last week)

- DIA 1.2% (0.1% less than last week)

In the News

Last week saw earnings from some of the largest tech companies in the world including Tesla, Apple, Microsoft, Facebook, Alphabet and Amazon. Most of the stocks moved inside or roughly inline with their expected moves. Amazon was a bit of an outlier. Its options were only pricing about a 4% move into earnings yet the stock was down more than 7% on Friday and nearly 10% on the week. Amazon options are pricing about a 2.5% move for the next week.

Expected Moves for Companies Reporting Earnings

The Options AI Earnings Calendar is a free resource to keep up to date on upcoming earnings, how options are pricing potential moves, and how that compares to actual moves from prior earnings (starting with most recent).

Options AI puts the expected move at the heart of its trading experience. Traders are able to quickly generate trades based on the move, or to place their own price target in context of the expected move. More education on expected moves and spread trading can be found at Learn / Options AI.

Some earnings of note this week include Alibaba, Uber, Roku, Moderna, Square and Draftkings.

Tuesday

Alibaba BABA / Expected Move: 4.4% / Recent moves: -6%, -4%, -3%

Nikola NKLA / Expected Move: 12% / Recent moves: -2%, -8%, -3%

Activision Blizzard ATVI / Expected Move: 4.5% / Recent moves: +2%, +10%, -3%

Wednesday

Roku ROKU / Expected Move: 8.1% / Recent moves: +12%, +3%, +13%

Uber UBER / Expected Move: 6.6% / Recent moves: -9%, -4%, +7%

Etsy ETSY / Expected Move: 8.5% / Recent moves: -15%, +11%, -5%

Fastly FSLY / Expected Move: 10.2% / Recent moves: -15%, -5%, -18%

Wynn WYNN / Expected Move: 5.3% / Recent moves: -1%, +8%, 0%

Thursday

Moderna MRNA / Expected Move: 6.6% / Recent moves: +4%, +2%, +8%

Square SQ / Expected Move: 6.1% / Recent moves: 0%, -8%, +13%

Virgin Galactic SPCE/ Expected Move: 8.6% / Recent moves: +1%, -4%, -12%

Beyond Meat BYND / Expected Move: 8,7% / Recent moves: -7%, +1%, -17%

Zillow Z / Expected Move: 8.4% / Recent moves: -6%, +18%, +14%

Friday

Draftkings DKNG / Expected Move: 6.6% / Recent moves: +6%, +4%, -6%

Canopy Growth CGC / Expected Move: 11.1% / Recent moves: -7%, +12%, +5%

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC a registered broker-dealer.