Debit Call Spread

BULLISH DIRECTIONAL STRATEGY, ALSO KNOWN AS A BULL CALL SPREAD

A Debit (Bull) Call Spread is a two-leg options trade where we buy a Call option and simultaneously sell a higher strike Call. The strategy has defined risk and defined reward.

It is commonly used as an alternative to buying an outright Call by investors who are bullish and willing to cap upside profit potential in return for reducing capital outlay (cost).

Watch the 1 minute overview.

Debit Call Spread (vs Long Call)

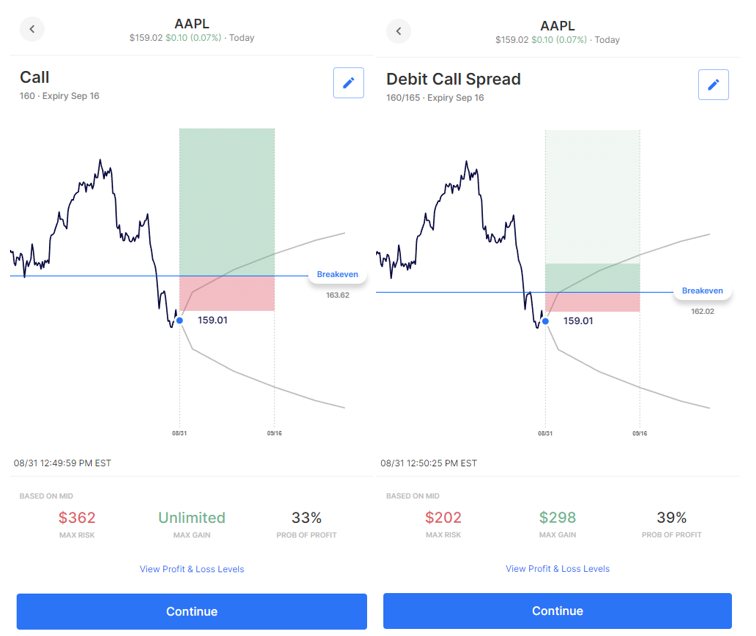

To look more closely at the Debit Call Spread and why it might be used as an alternative to simply buying a Call, let’s look at a hypothetical example using AAPL.

The Setup

Long Call

In this example, we start by taking an at-the-money 160 Call which, let’s assume we can buy for $3.62. Buying 1 Call option contract will therefore cost us around $362 which, will also be our maximum risk on the trade. We have the potential for unlimited gains if the stock moves above our breakeven level of 163.62 (strike + premium paid) at expiration.

Long Call to Debit Call Spread

Now, instead of simply buying the 160 Call, we look at simultaneously selling a higher strike Call to reduce our cost and maximum risk. Since we know that our profit potential is going to be capped at this higher strike level, we decide to use the expected move to help guide strike selection.

In this example, we see an expected move of approximately 3% (up or down) for our expiration date. We do not disagree with this options market consensus and therefore agree to cap our potential gains up around this level.

So, we decide to simultaneously buy the 160 Call (for $3.62) and sell the 165 Call (at $1.60) to setup a 160/165 Call Spread for a net Debit of $2.02 ($3.62 minus $1.60).

Visual Comparison

This visual comparison using the Options AI platform shows that by switching from long Call to Debit Call Spread our cost (or Max Risk) of 1 contract size is reduced from $362 to $202. This has the effect of lowering our breakeven level from 163.62 to 162.02, thereby also increasing our probability of profit. Our trade-off being that with the Debit Call Spread, our zone of increasing potential gains (dark green) becomes capped at our higher strike price of 165.

Summary

In this Debit Call Spread example, we have a defined Max Risk of $202. That’s the most that we can lose if the stock closes below our long 160 Call strike at expiration. We may see gains if the stock rises above the breakeven of 162.02 and we may see a Max Gain of $298 if the stock is above 165 at expiration.

In this example, we have used an at-the-money option for our long Call. We may also set our long Call out-the-money to further reduce our cost (Max Risk). Of course, this will typically also increase our breakeven level and therefore lower our probability profit.

Check out our options trading courses to learn concepts like spreads, covered calls, iron condors and more.