Hello!

Recent volatility

As I’ve mentioned a ton lately, some dynamics of the market have changed recently, making it a bit easier for stocks and the market to make large daily moves. From August to September, much of the gamma that had been holding the market in tight ranges expired, while net dealer gamma went from long to short. When the market is loaded with gamma it puts a governor on moves, when the market is short gamma it exacerbates moves. That, combined with a number of economic worries, but most importantly an extremely volatile bond market has investors worried and selling stocks and the market making larger moves than we’ve seen since early 2023. But here’s where the vol hangover comes in. The VIX, at 18 and change is not high. In fact, it’s about at its historical mean. And the realized vol, how much the market is actually moving, isn’t that volatile yet. The 30-day realized vol in SPY is just 13 right now. That’s less than the 17 realized over the past year.

It feels like the market is super volatile because most of the moves have been lower, and in a row. Something we haven’t seen in a while. But the moves themselves, (like yesterday’s -1.5% decline) have not been massive. When the market was going higher, in Spring or Summer it wasn’t uncommon to see a 2.5% rally in a day. But the VIX generally got slammed on those days. The VIX now is nearing 19, but it’s been a slow rollover in stocks to this point. Not a ton of panic, and fairly orderly. If things get wild you’d see a much steeper decline intraday, and a pop in the VIX to at least the mid 20’s. That’s the sort of pop in IV that would signal at least some fear, and possibly be a contrarian signal of a potential bounce.

The Market’s Hottest Club is Weeklies and 0DTE

For now, the story of an IV pop may actually be most interesting in the 0DTE-Weekly vol. The at the money IV in SPY options expiring today is above 30, and Friday’s options are 24. It wasn’t uncommon to see 0DTE and weekly vol in the single digits in August. So what’s that mean for 0DTE moves? This summer 0DTE moves were often below a half a percent. Now, options are pricing moves of 0.7% – 0.8%, and nearing 1% a day expected moves.

Backwardation/Contango

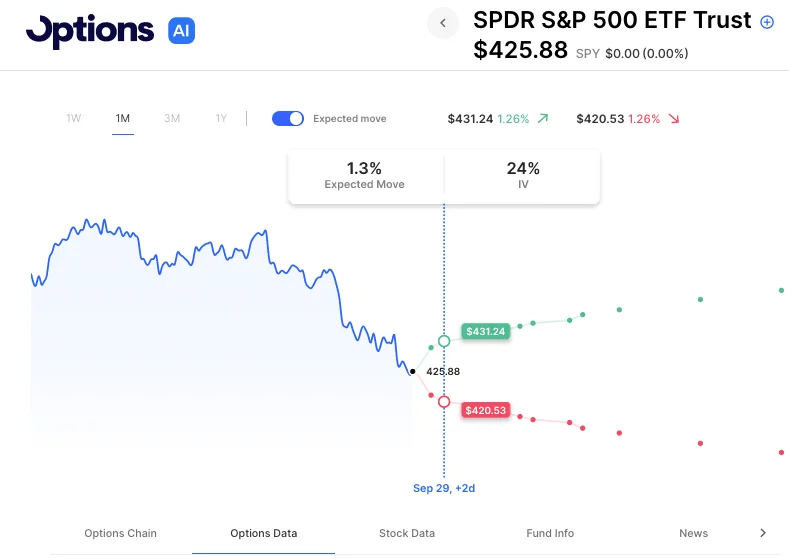

The SPY is pricing in about a 0.7% move today, and a 1.3% move into Friday’s close. The IV in the 20’s and 30s is substantially higher than the 17 IV out 1 month, creating a situation where 0DTE vol is consistently higher than outer month for the first time since Spring. That mini backwardation is not the same thing as backwardation in the VIX futures. That curve, remains in contango, but its flattening. Something of interest to those that trade the long and short VIX etfs as their largest factor is often the headwind or tailwind provided by the VIX futures curve.

- Oct VIX: 18.70

- Jan VIX: 19.50

Micron Earnings Today

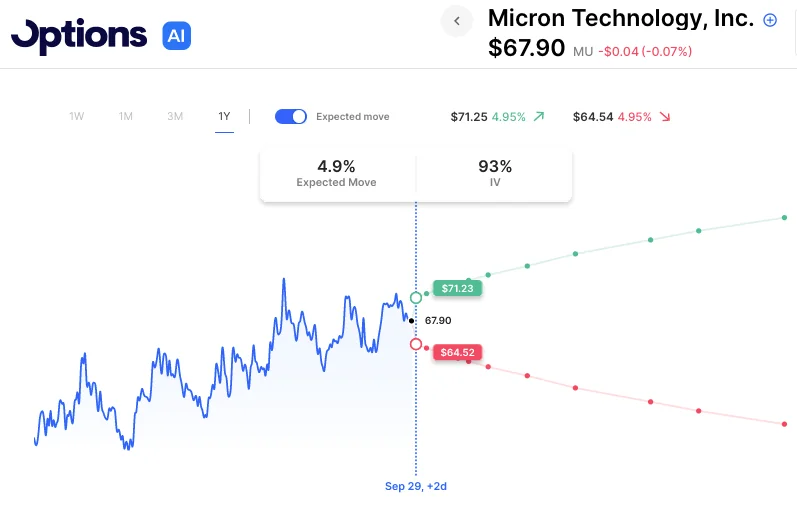

Micron MU options are pricing about a 5% move for earnings. That’s on the high side of recent actual earnings moves of -4%, -1%, -3%, and 0% (see more on Micron here)

The current expected move matches the most recent two highs. The lower expected move is positioned just above the most recent low. Something to keep in mind on strike selection from both the debit spread or credit spread side of things.

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.