The Markets

Implied volatility in options spiked last week, with the VIX briefly approaching 30 into the special election in Georgia but closed the week in the low 20’s with stocks at or near all time highs.

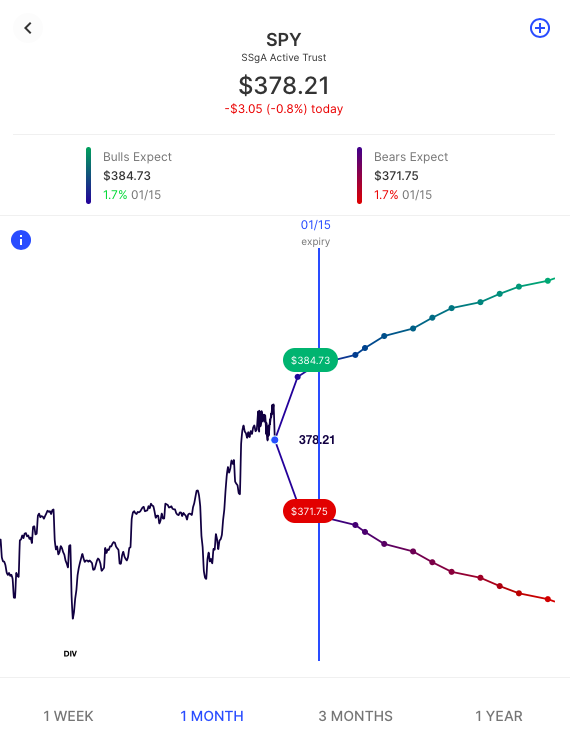

SPY options are pricing in about a 1.7% expected move for the balance of this week, corresponding to about $385 on the downside and $372 on the upside:

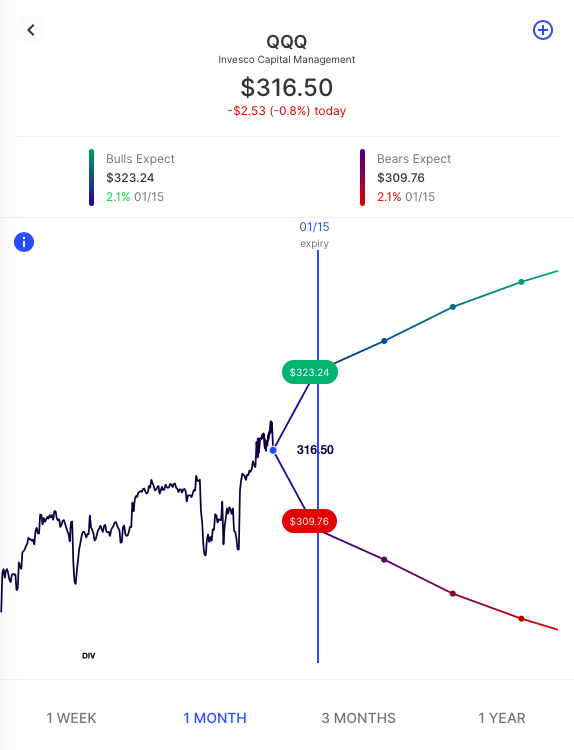

QQQ options are pricing in a 2.1% expected move this week, corresponding to about $305 on the downside and $317 on the upside:

In the News

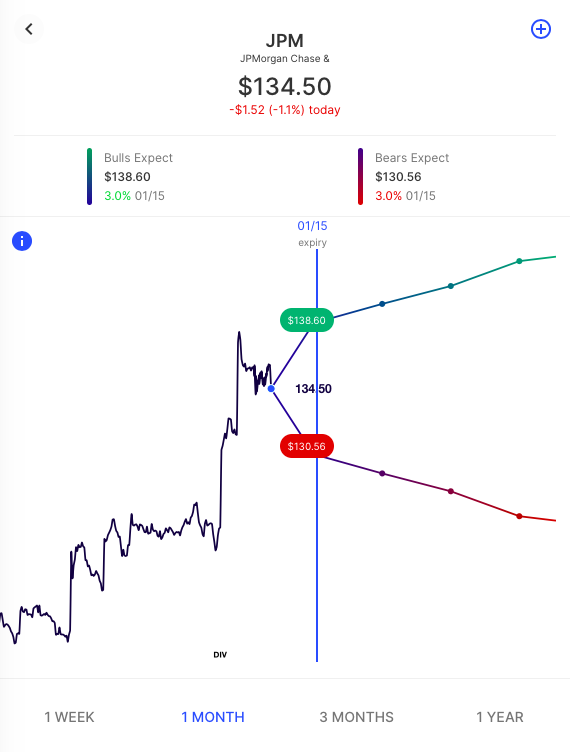

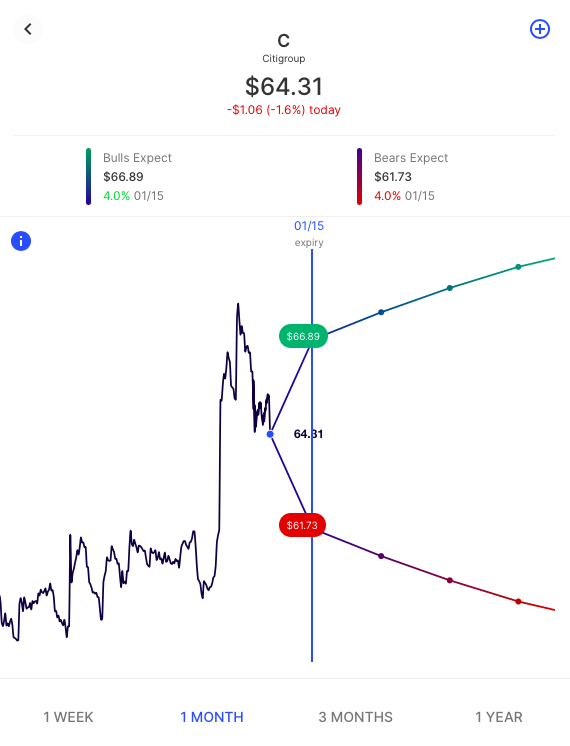

Markets get their first look at results from the banking sector on Friday as Citi, Wells Fargo and JP Morgan report. Here’s the expected move for banking etf XLF for this Friday’s expiration:

And an expected move comparison (via the calculator) that includes Bank of America, Goldman Sachs and Morgan Stanley:

Earnings of Note This Week

(links to Earnings Calendar with historical earnings moves)

Tuesday after hours / KB Homes / KBH 6.6.%

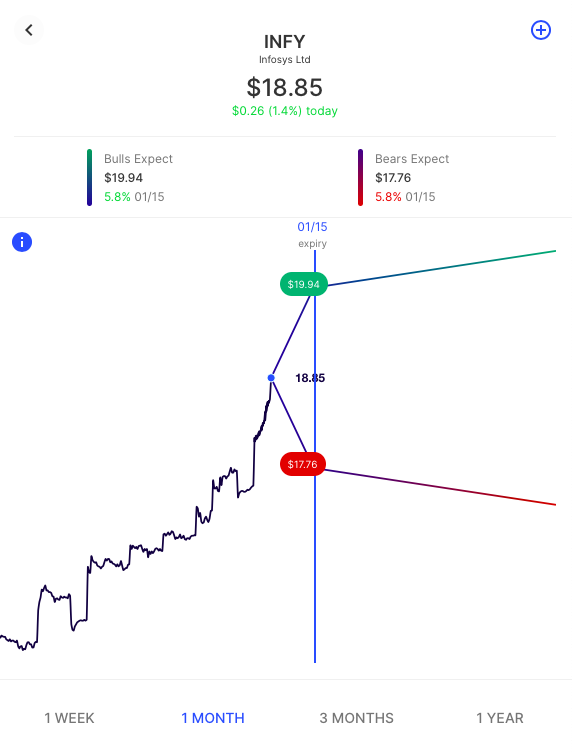

Wednesday before / Infosys / INFY 5.8%

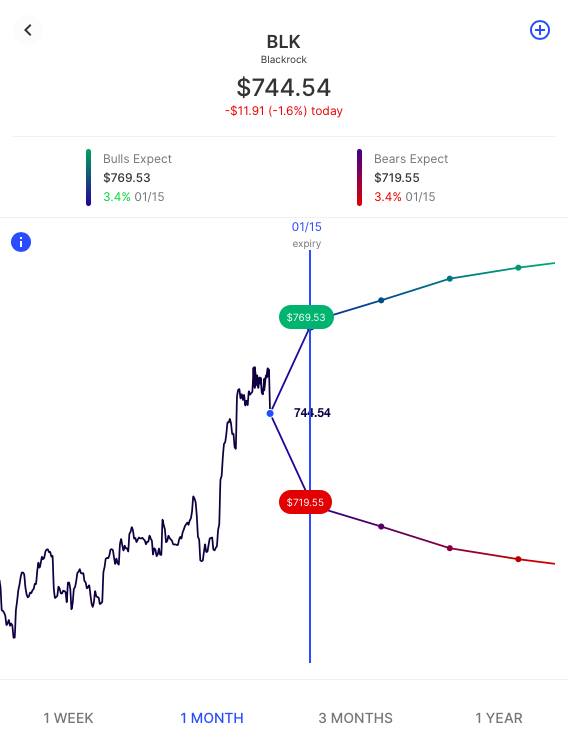

Thursday before / Blackrock / BLK 3.4%

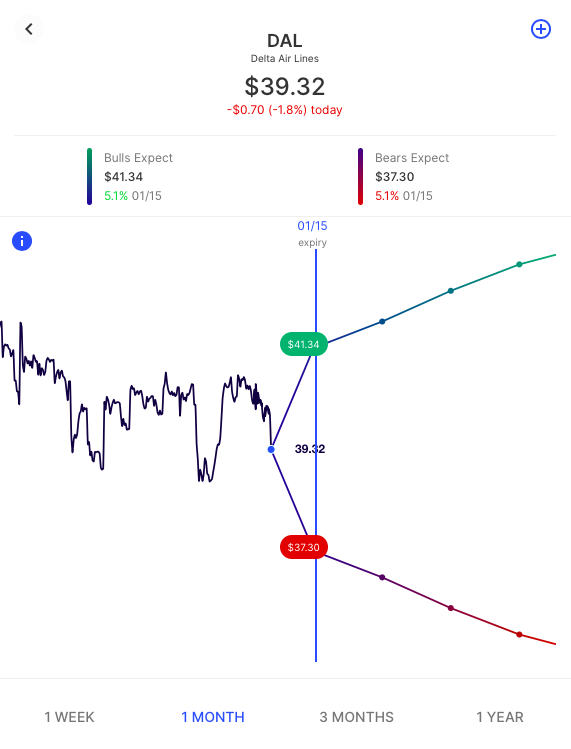

Thursday before / Delta Airlines / DAL 5.1%

Thursday before / Taiwan Semiconductor / TSM 4.3%

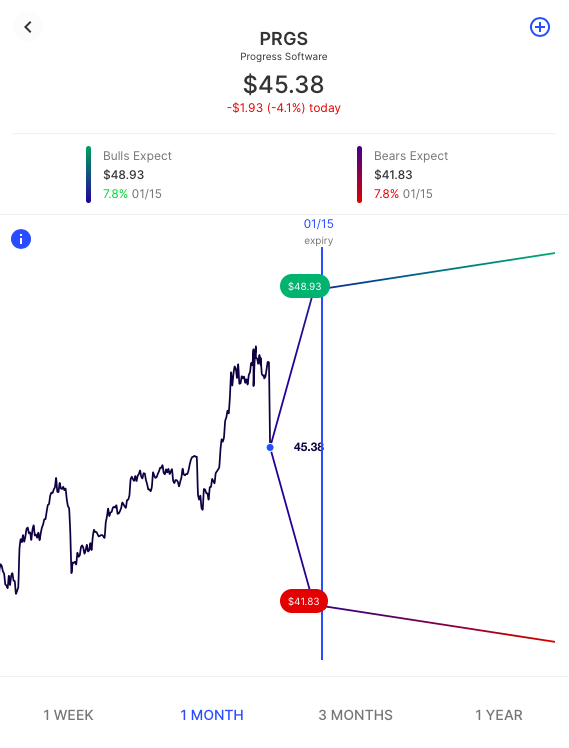

Thursday after hours / Progress Software / PRGS 7.8%

Friday before / JP Morgan / JPM 3.8%

Friday before / Citigroup / C 4.0%

Friday before / Wells Fargo / WFC 4.4%