Options AI mobile is now available in the Apple app store! Go find it here.

Good morning!

Futures are once again bid higher. Stocks were green pre-market even before the PPI release which followed up well to yesterday’s CPI, and was also cooler than expected. Both are encouraging signs about inflation. Earnings season started this morning for all intents and purposes with Pepsi and Delta Airlines being the most interesting names reporting so far. Both stocks are higher, and both have beaten their expected move slightly (so far). This is something to keep an eye on as earnings season kicks off. As mentioned yesterday, IV and expected moves in individual stocks are the lowest they’ve been in years. That does not mean options are completely wrong per se, vol is low for a reason across the market… But what it does mean is that individual stocks are more likely to move beyond their expected move on earnings than on average. Simply because the moves are that much smaller than typical. It also means the vol crushes after earnings are less, which may be helpful in deciding whether or not to hold positions through the event.

It’s also entirely possible that any outsized moves happen more often in one direction than the other, which has more to do with the overall trend in the market. right now that trend is higher as we enter earnings so keep an eye on whether stocks beat expected moves to the upside more than the downside, or vice versa. Tomorrow morning we hear from the first batch of big banks, including JP Morgan and Wells Fargo. Tech reports start to pick up next week with Netflix and Tesla two of the first big names to go.

Pre-Market Movers: Some notable stocks making moves this morning.

- Jiuzi Holdings Inc (JZXN) +71.33%

- Snail Inc Cl A (SNAL) +38.79%

- 60 Degrees Pharmaceuticals Inc (SXTP) +29.27%

- Sofi Technologies Inc (SOFI) -2.83%

- Carvana Company Cl A (CVNA) -7.15%

- Delta Air Lines Inc (DAL) +3.90%

- Tesla Inc (TSLA) +0.76%

- Nvidia Corp (NVDA) +1.05%

- Snap Inc (SNAP) +1.05%

- Walt Disney Company (DIS) +0.44%

- United Airlines Holdings Inc (UAL) +2.73%

- Healthcare Triangle Inc (HCTI) -20.65%

Today’s Earnings Highlights:

- PepsiCo, Inc. (PEP) Expected Move: 2.60%

- Cintas Corporation (CTAS) Expected Move: 4.00%

- Fastenal Company (FAST) Expected Move: 4.03%

- Delta Air Lines, Inc. (DAL) Expected Move: 4.81%

- Conagra Brands, Inc. (CAG) Expected Move: 3.64%

Full list here: Options AI Earnings Calendar

Economic Calendar:

- At 11:30 AM (EST) Continuing Jobless Claims (Jul/01) Estimates: 1723, Prior: 1720

- At 11:30 AM (EST) Jobless Claims 4-week Average (Jul/08) Estimates: 255.39, Prior: 253.25

- At 11:30 AM (EST) Core PPI MoM (Jun) Estimates: 0.2, Prior: 0.2

- At 11:30 AM (EST) Initial Jobless Claims (Jul/08) Estimates: 250, Prior: 248

- At 11:30 AM (EST) PPI MoM (Jun) Estimates: 0.2, Prior: -0.3

- At 06:45 PM (EST) Fed Waller Speech Impact: Medium

A Look ahead to tomorrow’s big bank earnings (before the open):

- JPM: expected move 2.4%

- C: expected move 3.0%

- WFC: expected move 3%

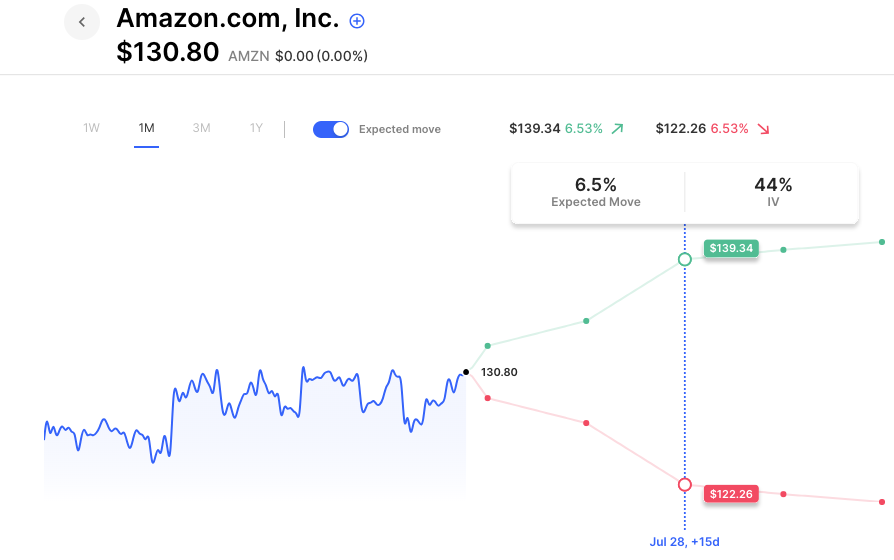

Chart of the Day:

Amazon reports the last week of the month. At the moment options are pricing about a 6.5% move that includes everything leading up to and out of the event. The stock has moved more than 6.5% on the event itself in 6 of its past 8 earnings.

That’s all for now. Have a great day!

The Options AI Team

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.