The Broader Markets

Last Week – SPY fell 2.8% last week, in line with the 2.7% move options were pricing. The markets rallied to end the week with a roughly 2.5% move higher from the lows of the week. So once again, the range on the week was wide from highs to lows and back.

This Week – SPY options are pricing about a 2.7% move for the upcoming week (about $11 in either direction). That’s the same as last week’s options.

Implied Volatility / VIX – The VIX closed the week near 29. Roughly where it was last week.

Expected Moves for This Week (via Options AI)

- SPY 2.7% (+/- $11)

- QQQ 3.5% (+/- $10)

- IWM 3.3% (+/- $6)

- DIA 2.4% (+/- $8)

In the News

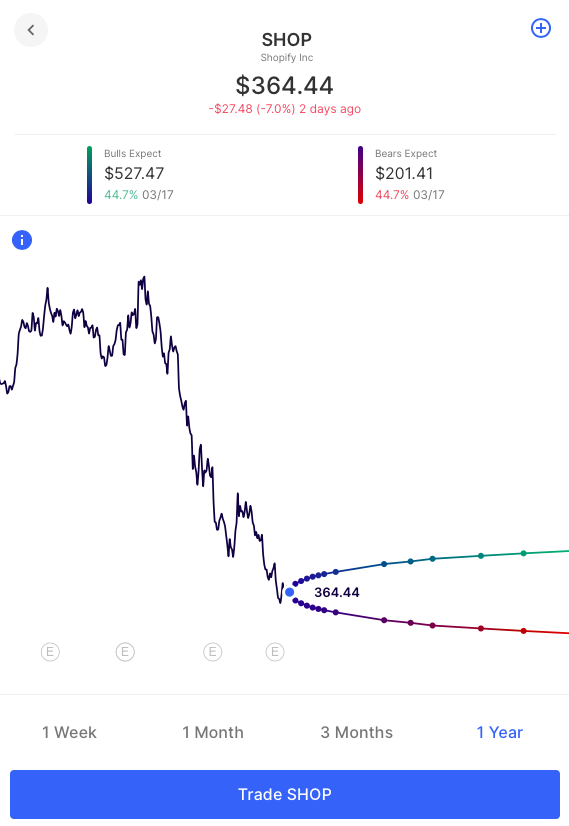

The broader markets hit an official bear market level this past week, with the majority of that selling happening in April and May. SPY was $462 on March 29th, not far from its all-time highs made in the first week of January. However, under the surface many of the hot names from the past few years began their sell-off in the Fall of 2021. Perhaps no name better illustrates that than Shopify SHOP which is now down nearly 80% from its highs made in mid-November ’21. In previous high flying names, implied volatility of options can compress after the market has seemingly given up on the potential for the stock to make large moves higher. In fact, with SHOP now $364 (down from $1700) options are only pricing a potential move higher by year end that would take the stock just above $500. (or a move lower to about $200). In other words, the options market is not even close to pricing anything in these stocks that would look like 2020-2021 era again. (or even the March rally that took the stock up above $700).

That could mean opportunity within options if these stocks ever came back into favor, but for now the options market is not seeing it. And that also helps partially explain the stubbornness of overall market volatility with a fairly consistent 30-ish VIX over the past few weeks. Options are trying to price a fairly consistent sell-off in the broader market. For IV to spike from here, the market would likely need much wider swings higher and lower where both rallies and declines weren’t being properly priced, or an outsized 1-2 day capitulation sell-off where traders reached for puts out of panic.

Earnings

Links below go to the Options AI calendar where you can see the other companies each day and click through to see charts (free to use). Recent earnings moves (actual) start with the most recent:

- Xpeng XPEV / Expected Move: 11.3% / Recent moves: 0%, +8%, -1%

- Zoom ZM / Expected Move: 18.4% / Recent moves: -7%, -15%, -17%

- Best Buy BBY / Expected Move: 12.1% / Recent moves: +9%, -12%, +8%

- Netease NTES / Expected Move: 7.7% / Recent moves: +1%, 0%, +9%

- Intuit INTU / Expected Move: 8.2% / Recent moves: -2%, +10%, 0%

- Nvidia NVDA / Expected Move: 9.6% / Recent moves: -8%, +8%, +4%

- Snowflake SNOW / Expected Move: 16.5% / Recent moves: -16%, +16%, +8%

- Splunk SPLK / Expected Move: 10.3% / Recent moves: +6%, +5%, +1%

- Costco COST / Expected Move: 7.4% / Recent moves: -1%, +7%, +3%

- Alibaba BABA / Expected Move: 8.1% / Recent moves: -11%, -1%, -3%

- Workday WORK / Expected Move: 9.7% / Recent moves: +5%, -4%, -9%

- Baidu BIDU / Expected Move: 8.4% / Recent moves: +7%, -6%, -3%

- Autodesk ADSK / Expected Move: 8.7% / Recent moves: +1%, -15%, -9%

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.